Who is still buying risky biotech stocks?

June 2, 2022

The biotech market has tanked as big investors have shed exposure to risky biotech companies. Which investors are still shedding risk, and who has gone bargain hunting?

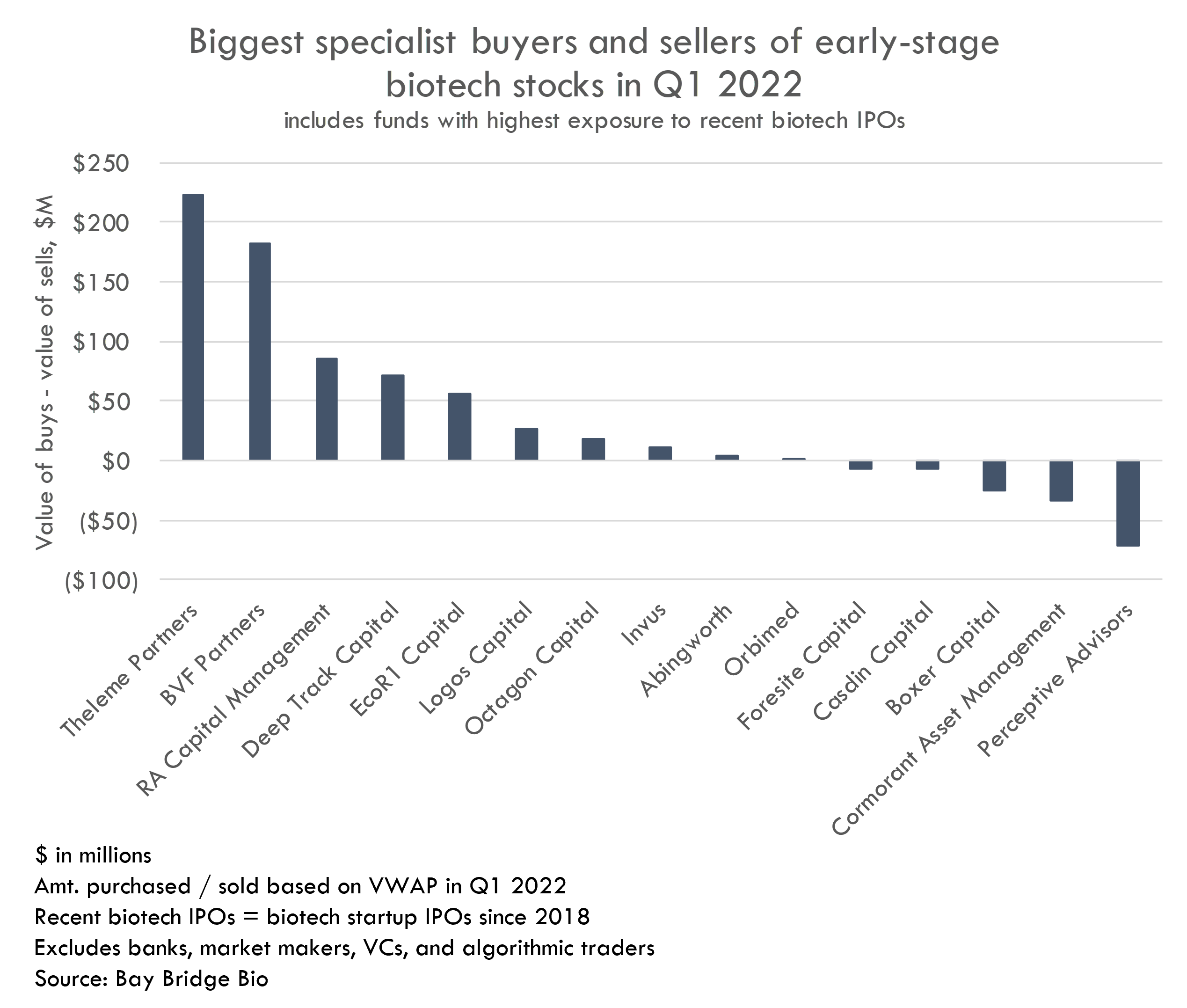

Biggest buyers and sellers

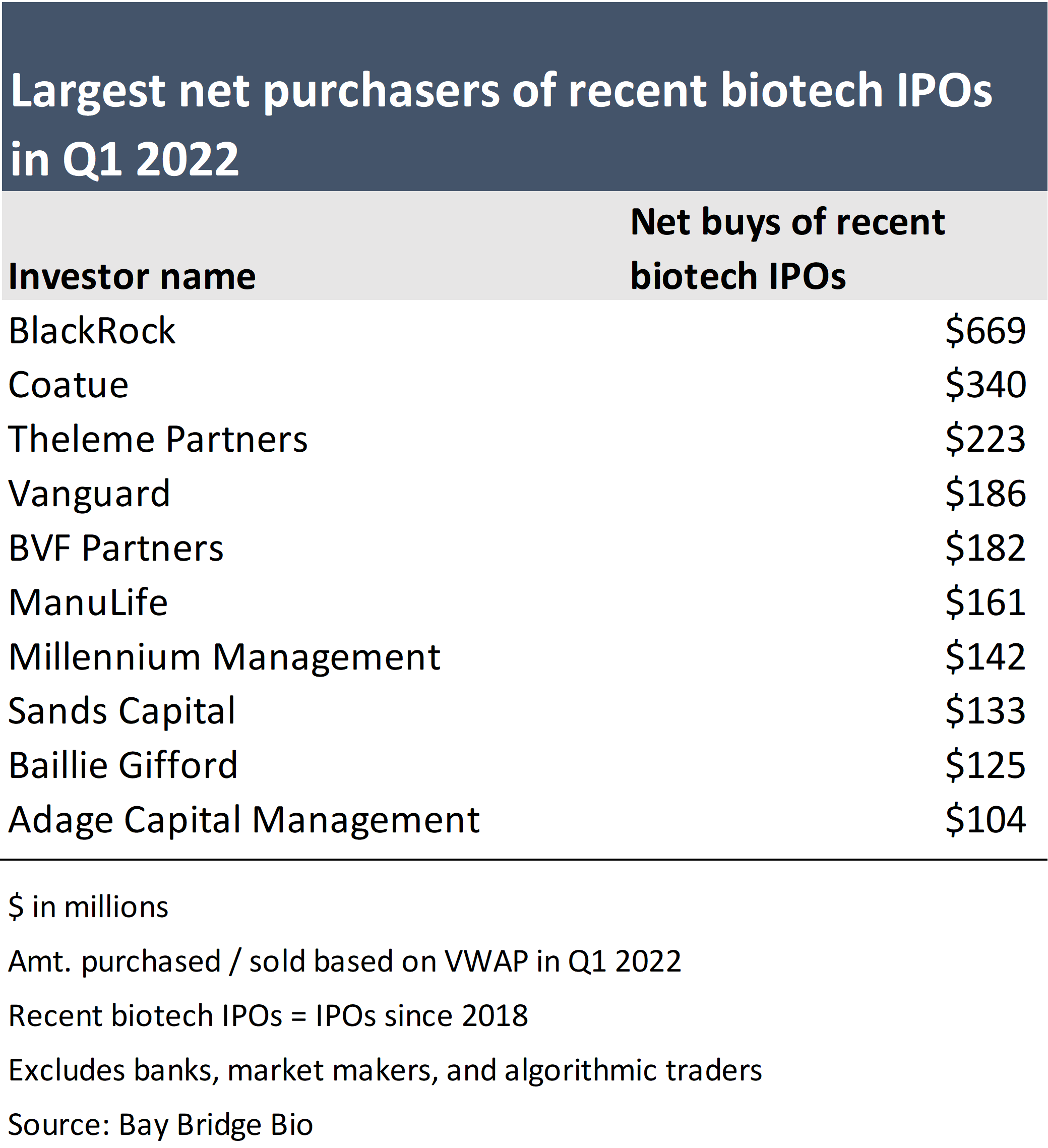

Who were the biggest net buyers of recent biotech startup IPOs in Q1 2022? Here we define recent biotech IPOs as biotech startups that went public since 2018.

All of these major buyers (with the exception of BVF Partners and Theleme) are generalist hedge funds or giant asset managers.

Some of the buyers (BlackRock, Vanguard, Baillie Gifford) were among the biggest supporters of biotech IPO boom. It is encouraging that these groups are net buyers, although the amount purchased is a tiny fraction of their total assets. It is likely that this activity does not signal a new commitment to biotech, but rather buying to maintain a target allocation or other structural factors.

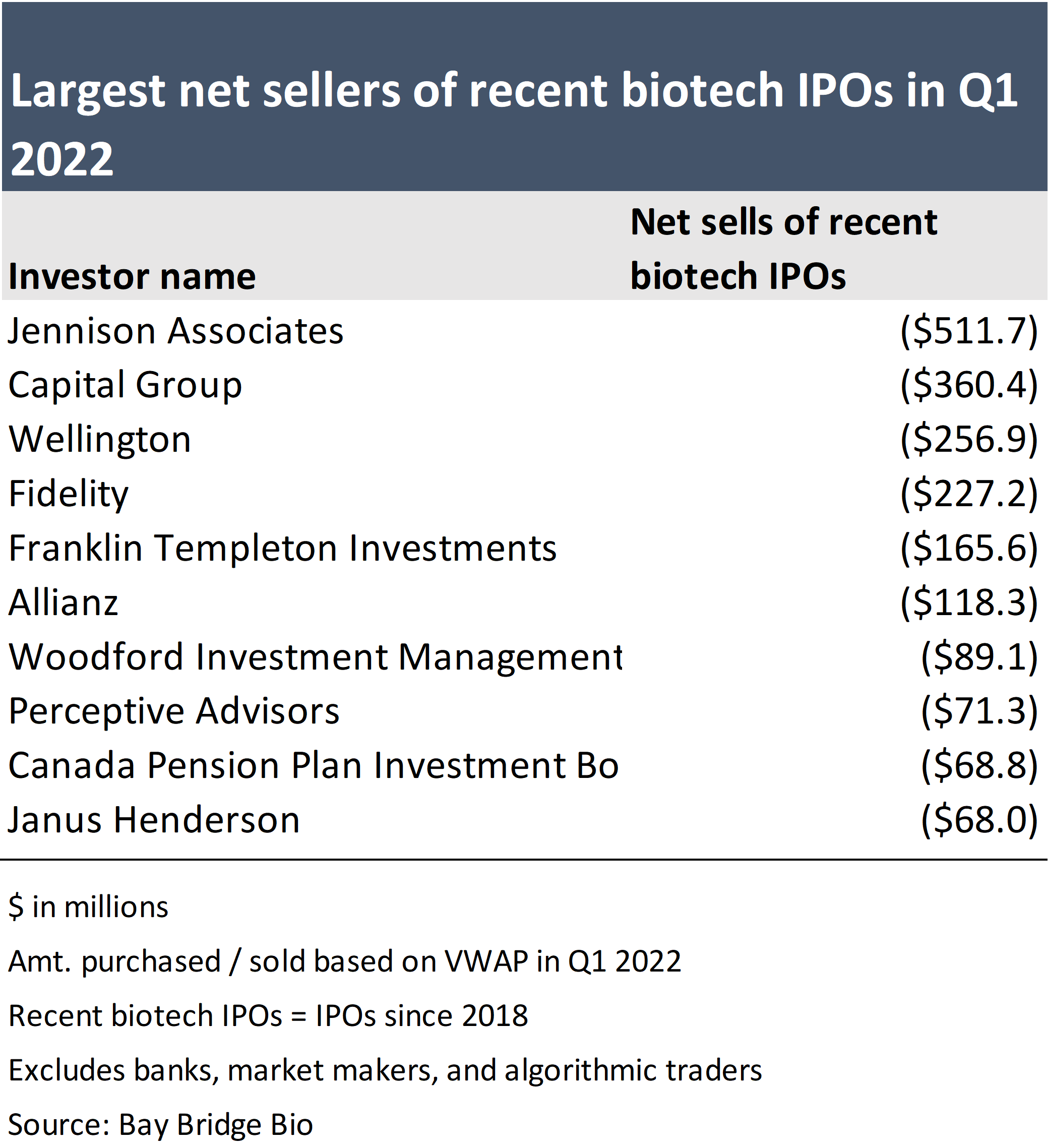

But not all investors are buying. Who is selling?

The biggest net sellers include some major IPO “anchor” investors (Fidelity, Capital Group, Janus Henderson), but again their sells are miniscule in proportion to their total assets. Perceptive Advisors was the biggest net seller among biotech specialist investors.

These lists of top net buyers and sellers are biased towards larger investors: if you have more assets, it is easier to buy or sell a lot of stock in dollar terms. To narrow down on biotech specialist funds, we can look at the activity of funds that have a high portfolio concentration in biotech IPOs.

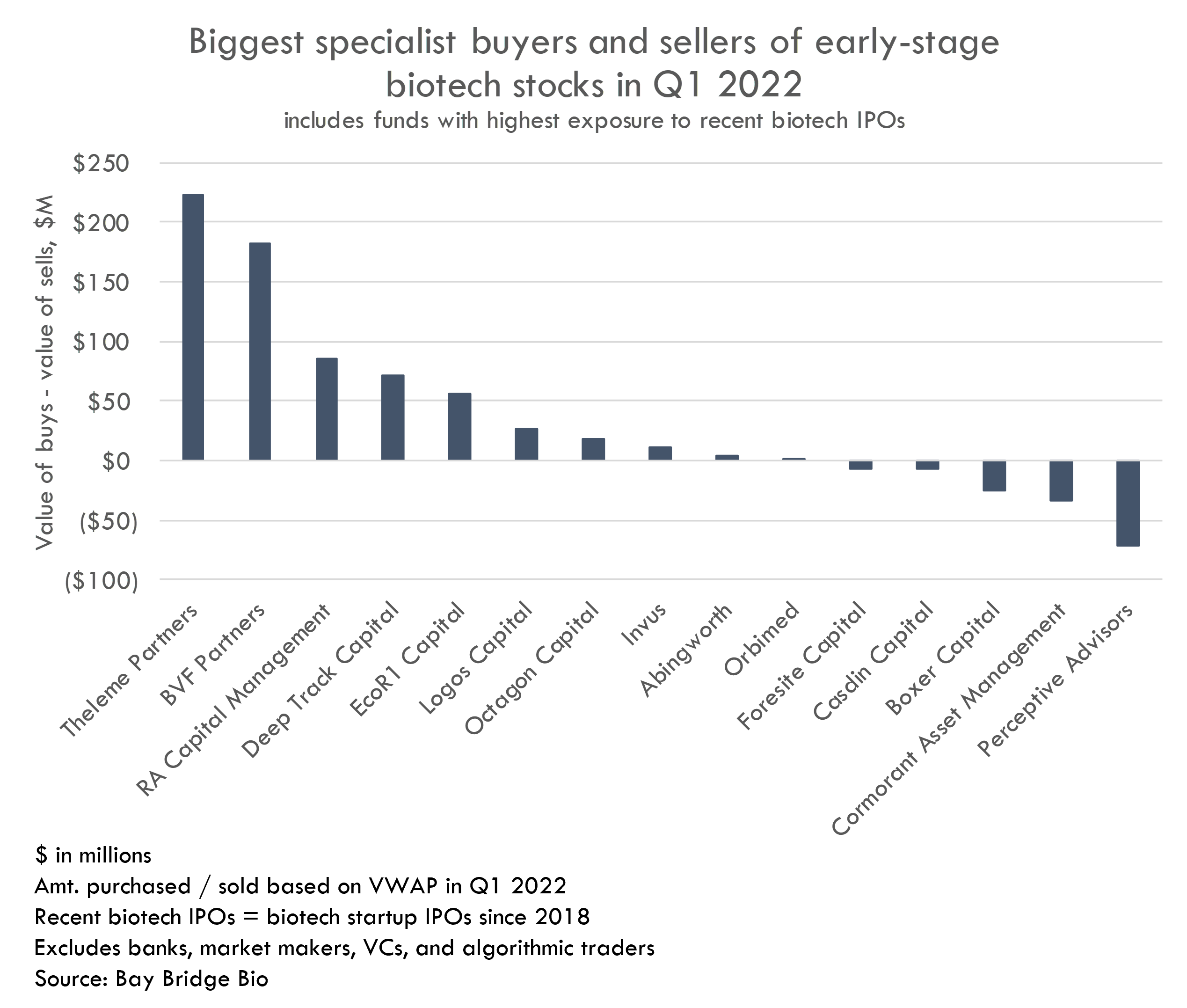

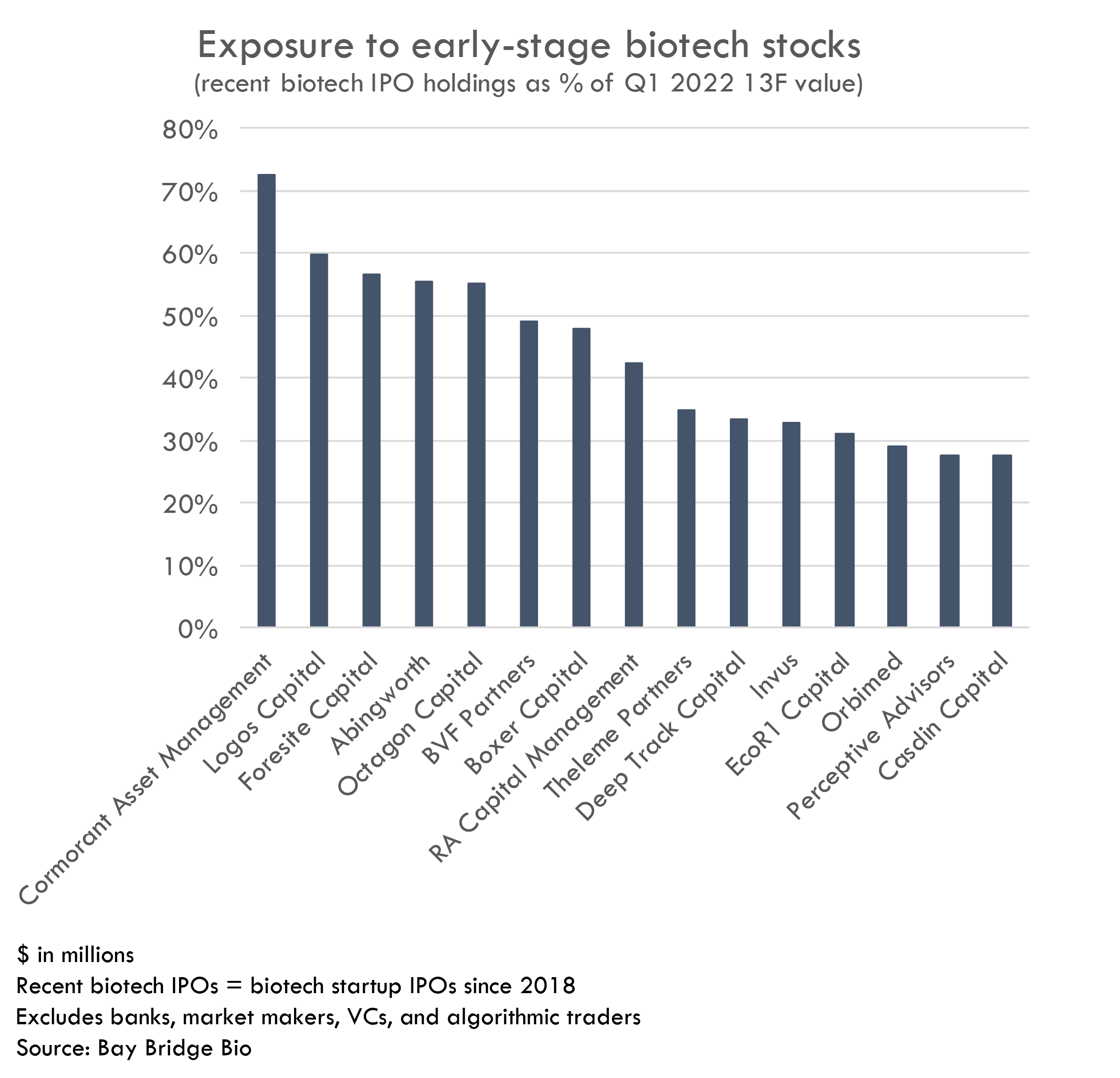

Specialist funds

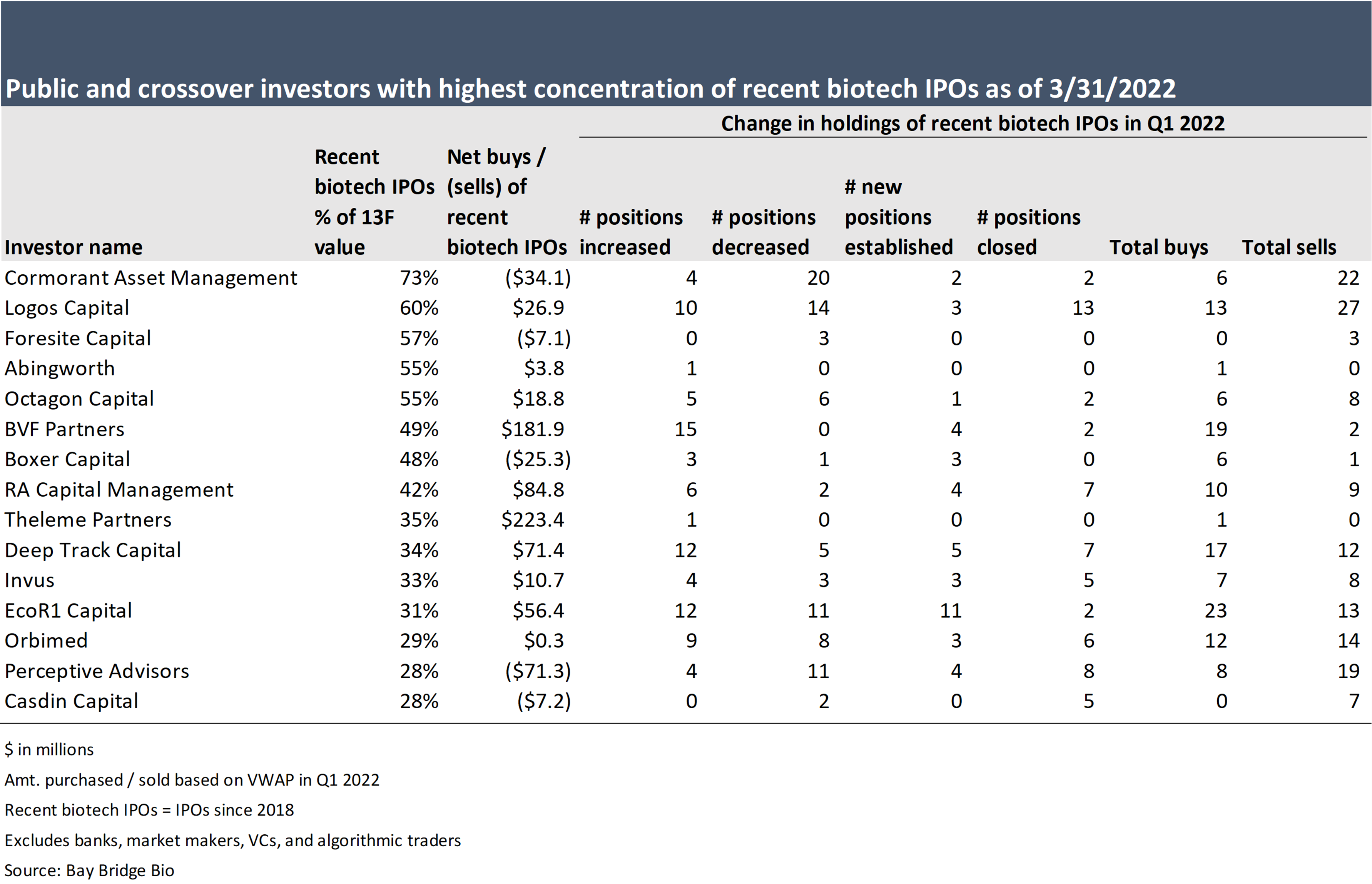

Below are the investors who have the most exposure to stocks of biotech startups that went public in the last four years (based on 13F filings):

These are mostly the crossover investors that have supported the biotech boom of the last several years. Many of these started out as hedge funds that focused on public equities, then moved into private companies as expected returns in the public markets compressed.

Track biotech investor portfolios

See which investors are doing well (or otherwise) during market turbulence. Track how the top biotech investors are investing.

As expected, these crossover investors who focus on taking private companies public have significant exposure to recent biotech IPOs.

Given the market turmoil, are these groups net buyers or sellers of early-stage biotech stocks?

Theleme Partners is a bit of an outlier, as their only major recent biotech IPO holding is MRNA. Their net buying of $200M+ represents them increasing their MRNA stake in Q1 2022.

Beyond Theleme, there is a group of crossover investors who are doubling down on early-stage biotech, viewing the current dislocation as an opportunity to buy into companies at a good price.

On the other hand, a few funds are big sellers. These funds may be sellers because their view on biotech has soured, they may be short of dry powder, or there may be structural issues with the fund driving them to sell.

To dive deeper into what these funds are doing, we can look at the change in their biotech positions in Q1 2022.

The above table shows the 15 investors with the highest exposure to recent biotech IPOs. It shows their net buying / selling activity, as well as the number of biotech positions that changed during the quarter.

Generally, funds that are net buyers increase more positions than they decrease. Some funds, like Logos, are net buyers but have sold more positions than they have bought, suggesting they are increasing the concentration of their early-stage biotech portfolio.

Others, like BVF, have increased many positions and decreased few, suggesting they are increasing their exposure to early-stage biotech more generally due to valuations becoming more attractive.

It is possible that some funds are net sellers in order to meet redemptions (some net sellers have also experienced significant AUM declines), but we cannot conclude this from this data.

Danger and opportunity

The broader market has certainly soured on risky assets, including early-stage biotech. But for investors focused on fundamentals, the crash represents a rare -- though dangerous -- buying opportunity.

Funds that have weathered the crash well and are actively deploying capital may be in a position to shape the market over the coming years. For many companies, nothing fundamental has changed about their businesses – the only change is the increasingly challenging financial markets. Companies that were fundamentally strong before the crash are still fundamentally strong, and those that had weak fundamentals are still weak. The challenge for investors is 1) differentiating between companies with strong and weak fundamentals and 2) managing their portfolios so they can help strong companies survive tough markets.

Down markets pose a unique and significant risk that has been largely absent from the biotech sector for years -- funding risk. Even strong companies can have trouble accessing capital in down markets. Investors who manage their portfolio wisely will have capital to support strong companies through the downturn. Companies with weaker syndicates may struggle to raise despite solid performance.

To learn more about how major biotech investors are managing their portfolios in the midst of market turbulence, check out our biotech investor database.