When Jeff Marrazzo started Spark Therapeutics, he was just 34 years old. He was just 36 when Spark raised $161M in its IPO, and only 40 when Spark was acquired by Roche for $4.8B earlier this year.

Spark's extraordinary accomplishments are well-known: the clinical benefits of its products, the technical achievements of its team, the first-of-its-kind FDA approval, and the returns to investors. But what makes Spark most unique is something less widely discussed: the fact that Jeff built Spark while in his 30s.

Today, young biotech CEOs are almost unheard of. The conventional wisdom is that only experienced executives can build successful biotech companies. The goal of this post is to challenge that conventional wisdom, and encourage more investment in and support of the next generation of entrepreneurial talent.

This post is a summary of a more detailed series of posts I wrote on this topic. The first post in the series is here

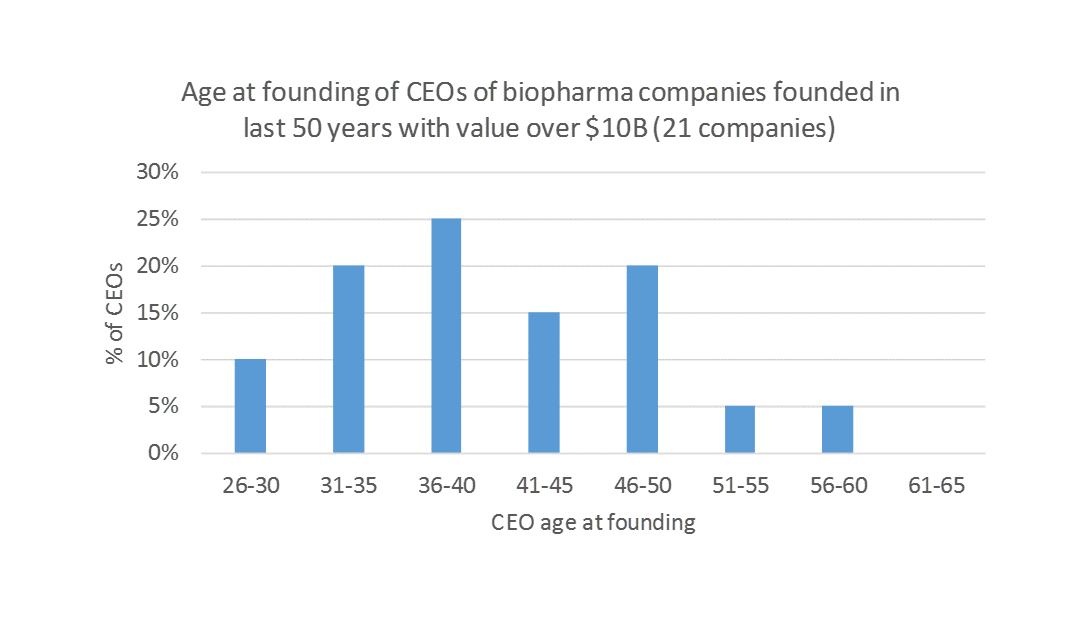

Young CEOs have started as many $10B+ biotech companies as experienced CEOs

Source: Bay Bridge Bio

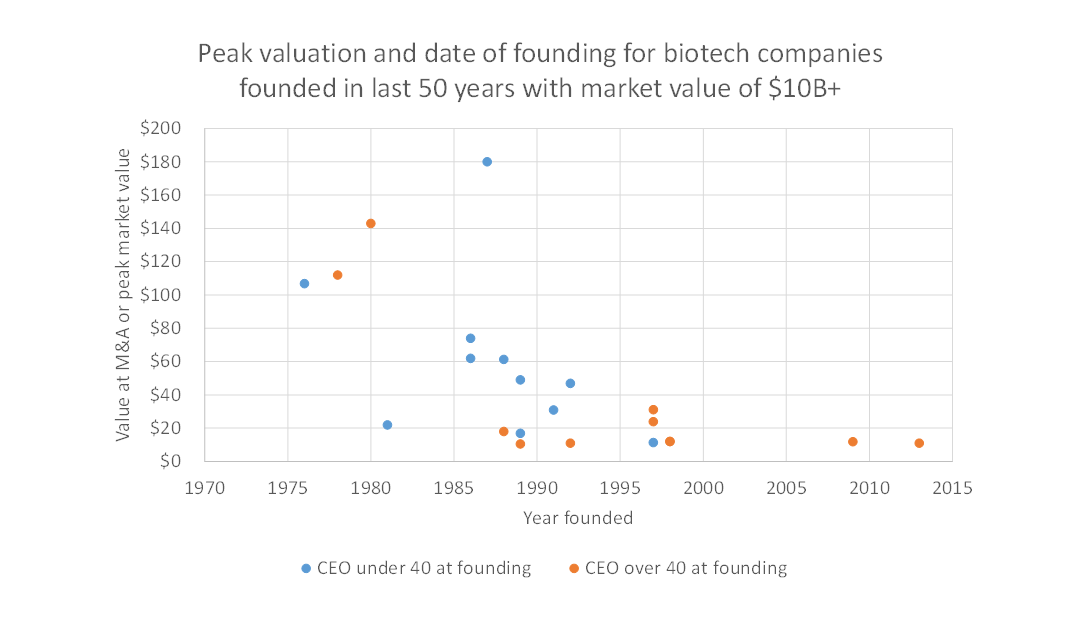

Throughout the history of the biotech industry, as many lasting biotech companies (defined as companies with $10B+ in market value or that were acquired for $10B+) were started by young CEOs (in this post, “young” = under age 40) as by experienced CEOs. Two of the four biggest biotech companies of all time, Genentech and Gilead, were started by CEOs younger than 30. Only two $10B+ companies, Amgen and Kite, were started by CEOs over the age of 50.

For a more detailed discussion of data on startup CEO age and performance, see this post 3.

If young CEOs can build great companies, why don't investors fund them?

Investors' preference for experienced CEOs is a rational response to the "dark ages" of biotech startups

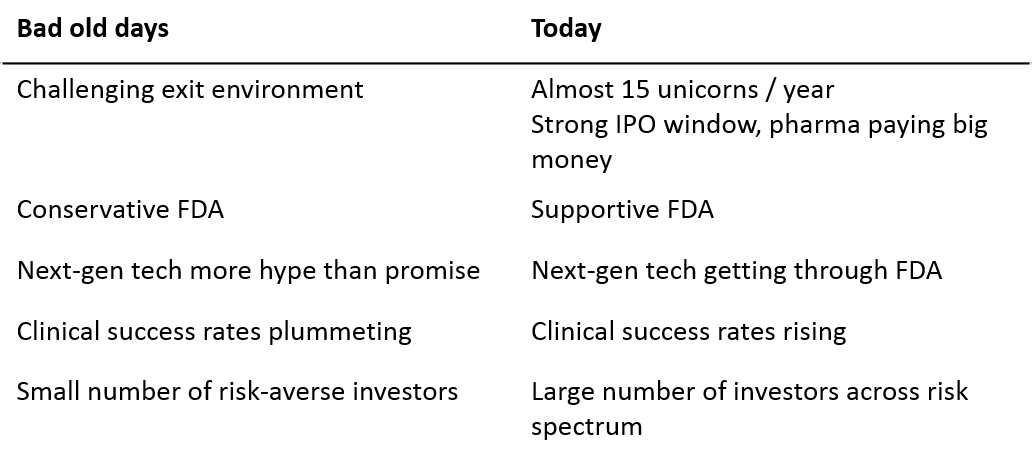

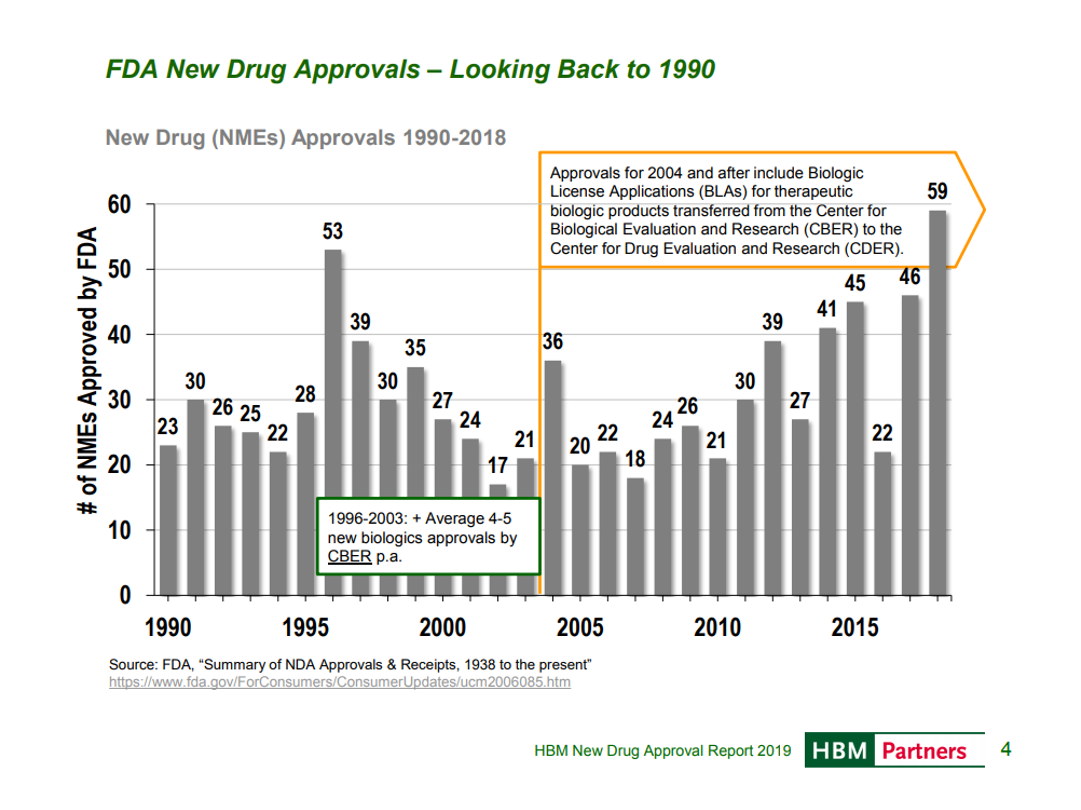

I hypothesize that the industry’s current preference for experienced CEOs is a rational response to the “dark ages” of the late 1990s and 2000s. This period saw very few lasting companies get built.

Source: Bay Bridge Bio

Why was this time period so challenging?

For a more detailed discussion of these challenges, see this post.

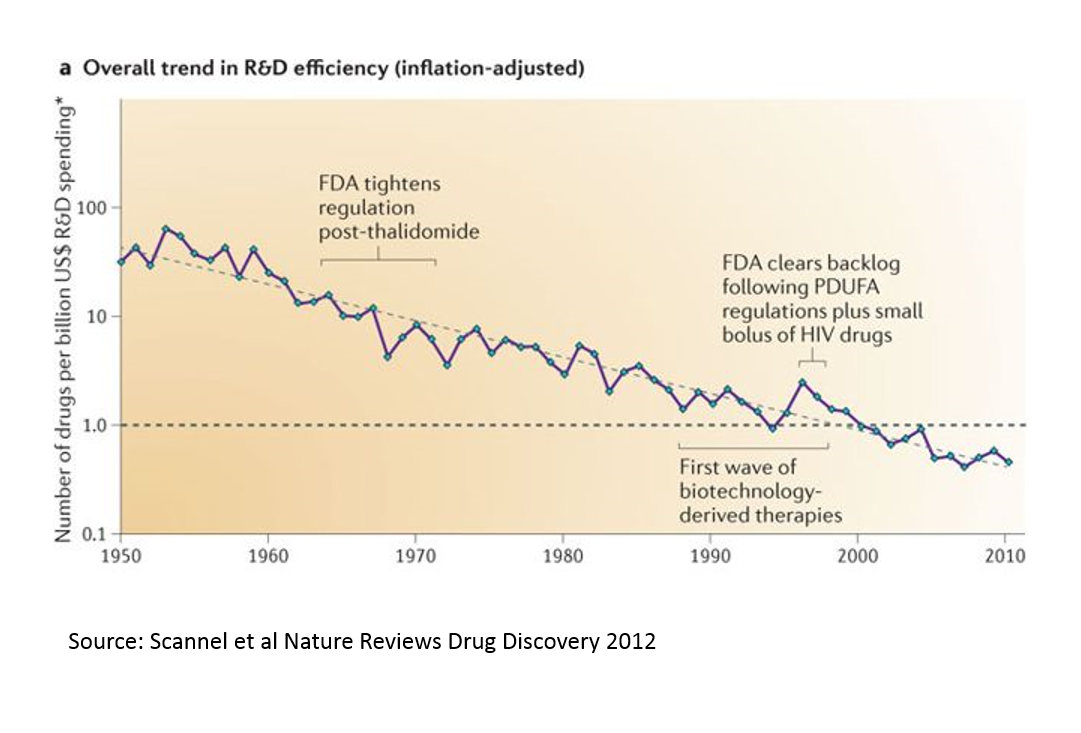

Eroom's Law put the cost of developing a drug out of reach of cash-strapped startups.

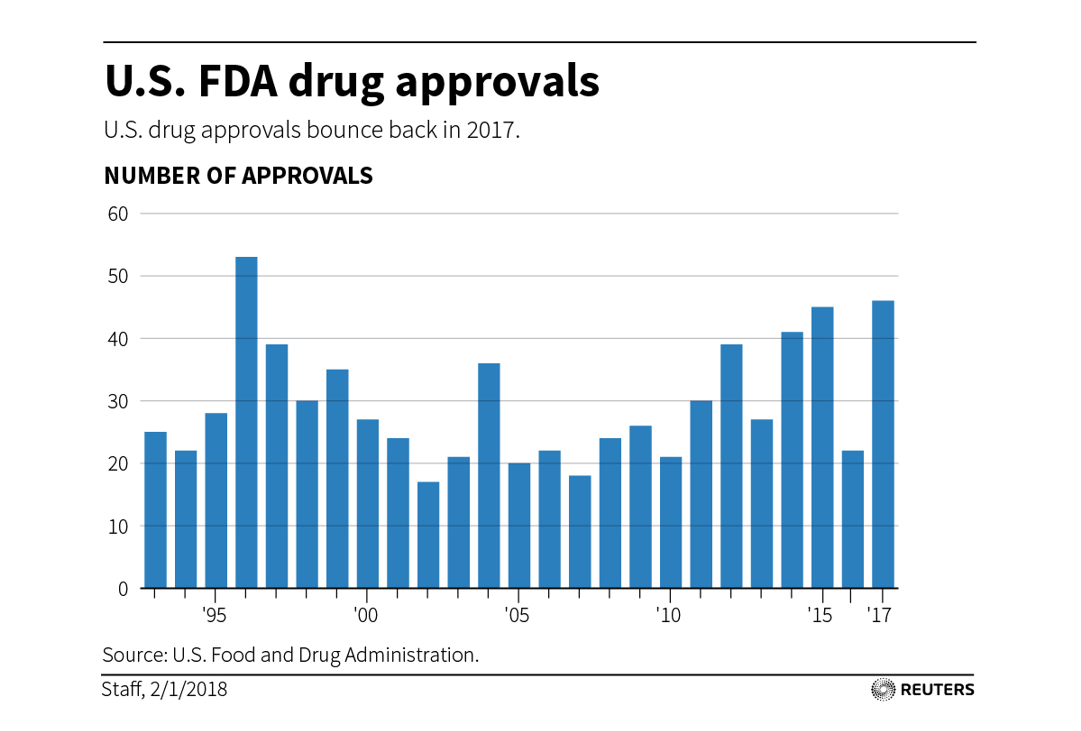

A conservative FDA was approving fewer new drugs, and big companies were better able to absorb regulatory risk than were startups.

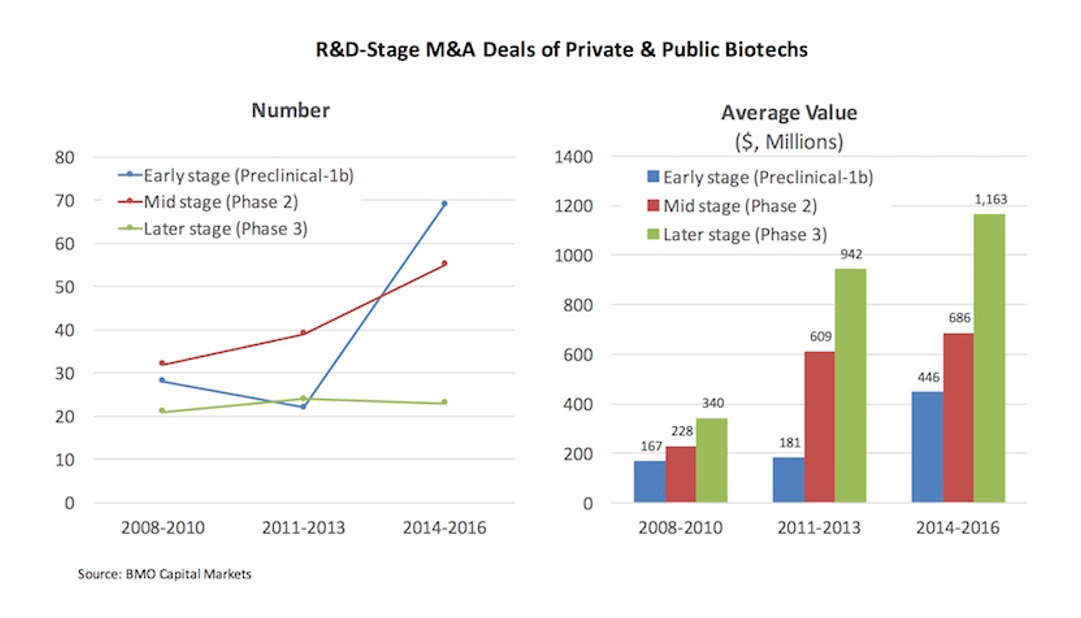

The exit environment was challenging, so it was hard for biotech venture investors to make money.

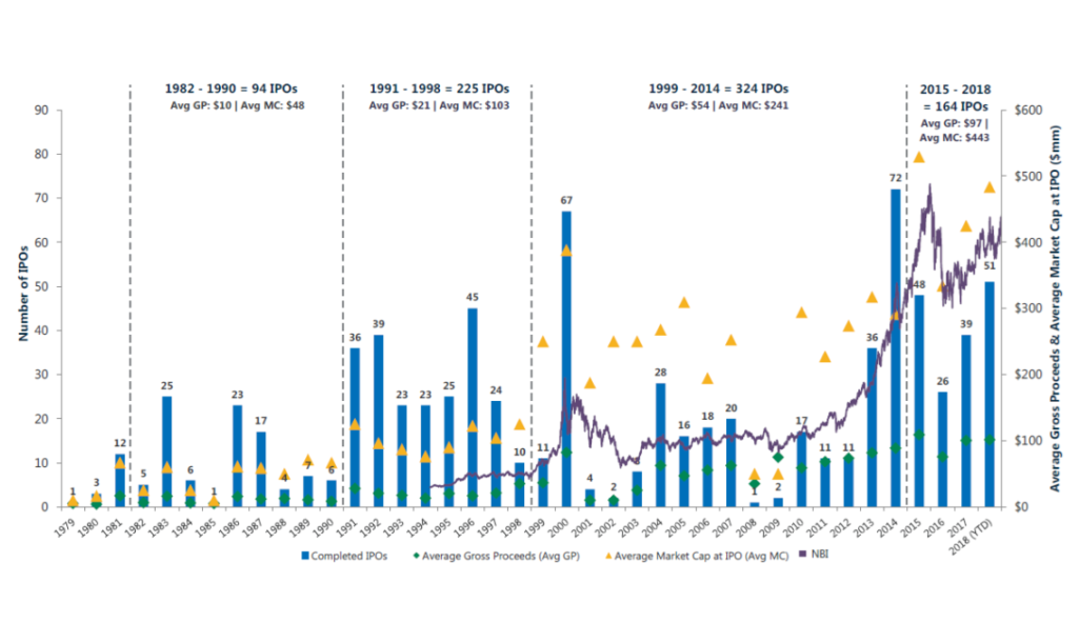

Biopharma IPOs by year, source: MTS Partners

A technological drought prevented startups from getting off the ground. The breakthrough technologies of the turn of the century – gene and cell therapy 1.0, antisense therapy, the sequencing of the human genome – that could have fueled the next wave of startups proved to be more hype than reality 4.

Investors became more risk-averse in response to these challenges. Investors reduced “management risk” by not funding young CEOs.

The industry has emerged from the dark ages

To read more about biotech's recent "renaissance", check out this post.

We are seeing a new generation of high-growth biotech companies emerge, built on next-generation technology. Unlike the build-to-buy startups of 10 years ago, these new startups increasingly are becoming stand-alone companies, opting to do late-stage development and even commercialization on their own.

Some of these companies are getting bigger, faster than even tech startups. When Kite was acquired in 2017, it was more valuable than Dropbox, and about as valuable as SpaceX and Twitter. Kite was founded earlier than all of those tech companies. The days when only software companies could become huge are behind us.

We are seeing biotech "decacorns", but there are plenty of unicorns as well. Between M&A and IPOs, a total of 75 biopharma startups reached $1B+ “unicorn” valuations from 2013-1H2018.

What's enabling these companies to grow so quickly?

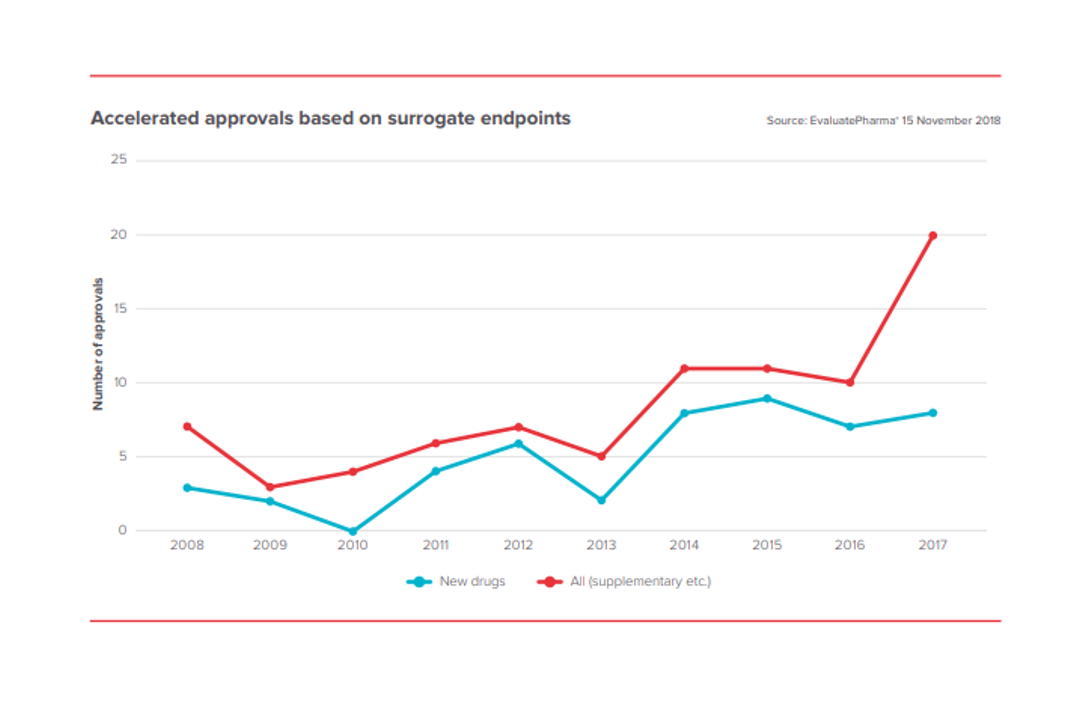

In recent years, FDA has become much more supportive of innovation. FDA’s willingness to support innovation is critical to bringing novel therapeutic modalities like gene therapy, cell therapy and microbiome therapy to patients.

In the 2000s, the new therapeutic modalities – oligonucleotide therapy, gene therapy, cell therapy, genomic medicine – proved to be more hype than reality. But these novel therapeutic modalities have matured through the “trough of disillusionment” and are generating real, highly impactful medicines.

Checkpoint therapies have turned some cancers from death sentences to manageable chronic diseases. Precision medicines like Loxo’s Vitrakvi enable physicians to treat cancer based on genetics, rather than the tissue the tumors originate in. Advances in gene and cell therapy have shown tremendous clinical benefit for patients with B cell malignancies, SMA (the most common genetic cause of infant death) and a form of congenital blindness.

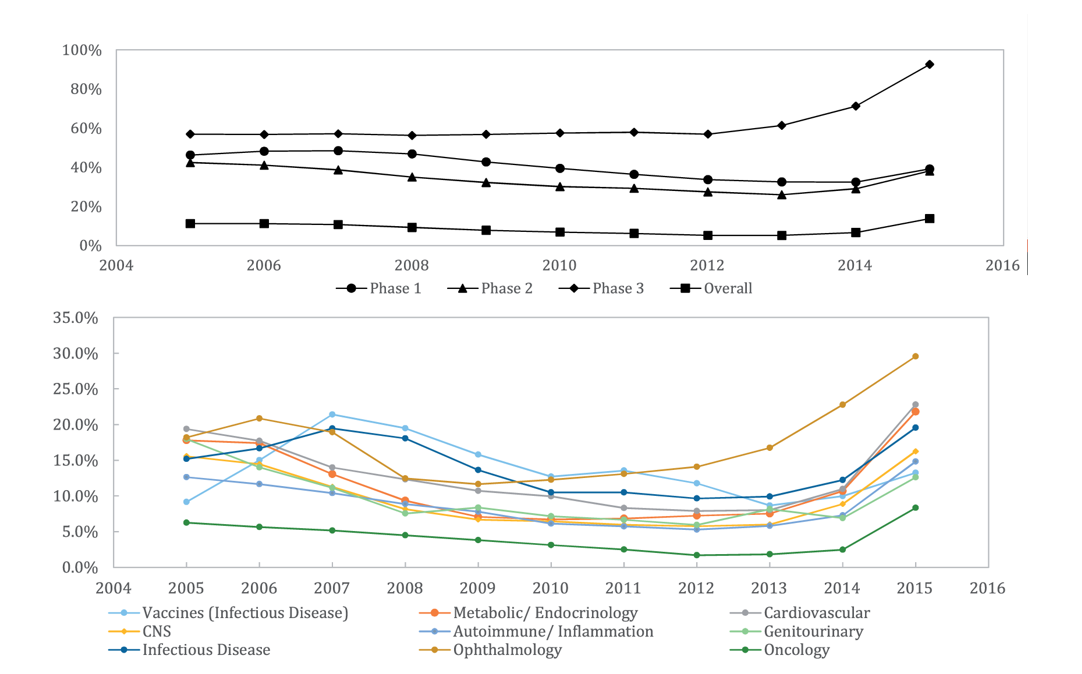

Clinical success rates are rebounding after years of decline. Phase 2 and 3 failure is the biggest driver of the cost of drug development, so higher clinical success rates is a big deal.

Source: Wong et al Biostatistics 2018

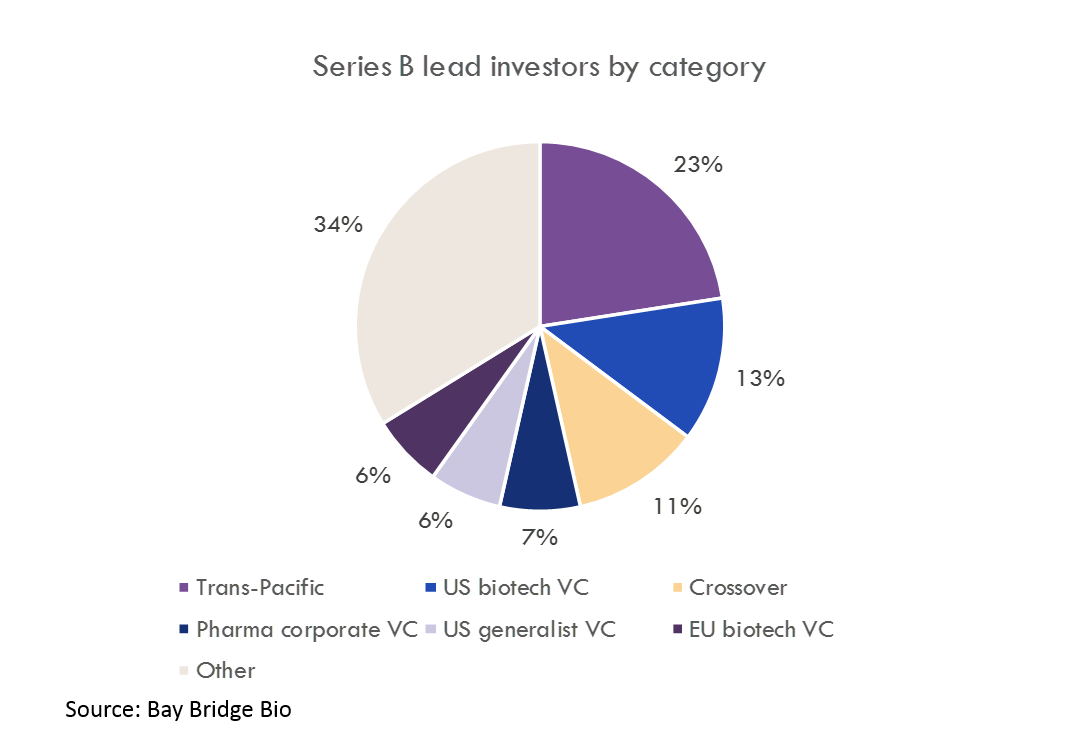

Investors are flocking to biotech, a sector that until recently was the last bastion of specialist investors. Capital is no longer a constraint for high-quality startups. Favorable public markets enable small companies to take on later-stage R&D and even commercialization. Risk-tolerant early-stage VCs enable companies to tackle ambitious science.