Seed investing in biotech

Richard Murphey

In a previous post, I analyzed the returns of some of the most successful startups in tech and biotech. This showed that returns to seed investors in these biotech startups generated impressive returns of over 100x. However, returns to seed investments in the tech startups generated much higher returns: 1,000x-10,000x+ for the best investments.

In tech, a $100,000 seed investment could become a $1 billion. These returns have led to the development of a robust seed investment in tech, comprised of massive venture funds, corporate venture arms, incubators, accelerators, seed funds and wealthy individuals.

In biotech, you can turn a $100,000 seed investment into $10M or more if you invest in the best companies. You may not become a billionaire from one investment, but you can certainly do well.

You may think this means that investing in tech is better than investing in biotech. But as I discuss in another post, some of the most successful VCs of the last decade are early-stage biotech VCs.

There is a clear opportunity for seed investing in biotech. But there isn’t much of a seed investing ecosystem in biotech. Until the last few years, most investors have viewed biotech as too risky, too expensive, and too regulated to be an attractive investment. People didn’t think seed investors in biotech could generate 100x returns.

Obviously, biotech startups have changed. They can get bigger, faster, on less capital than ever before.

But the seed investing ecosystem has yet to adapt. Many investors have made efforts to adapt the tech seed investing playbook to biotech, and some of those efforts seem promising.

Another approach is to start with the seed investing approach that successful biotech funds use, and then add some features that have worked well in tech.

Returns in seed investing: tech vs. biotech

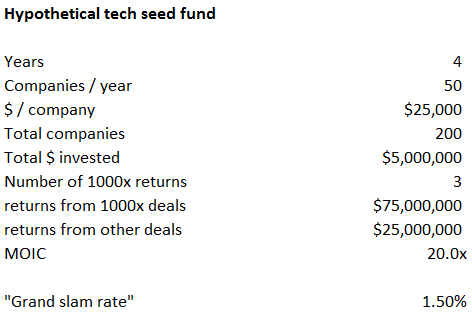

Below, I’ll examine a hypothetical tech seed fund (based on mid-2000s Y Combinator) and a hypothetical biotech seed fund (based on Flagship’s model). This is meant to illustrate some ways that seed investing strategy can be effective in biotech, where return ceilings are lower. These are just illustrative calculations and are quite sensitive to key assumptions, so view this as a starting point for you to more rigorously test these assumptions.

From what I can tell, this is fairly typical for an accelerator or angel investor around 2010 (any later than 2010 and we don’t know how well the investments have performed). All in all, this fund turned $5M into almost $70M: an impressive 20x return on the fund.

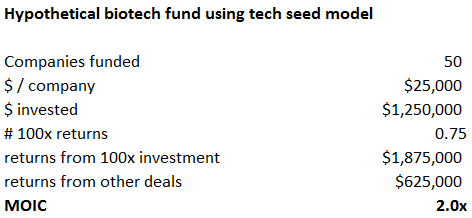

As we saw above, “grand slam” seed investments in biotech generate returns on the order of 100x, vs 1,000x. If we assume that the above portfolio only invests in biotech, and the returns from top investments are 100x each, and assume a similar success rate, we get much lower returns of 2x:

Next, let's model the returns from a seed fund that is designed for biopharma. Again, the main difference between tech and biotech is that in tech, the best seed investments return 1,000x+. In biotech, the best seed investments return on the order of 100x. All other things equal, a “power law” seed investing strategy in biotech will return 10x lower than a power law seed investing strategy in software / tech. A biotech seed investing strategy needs to be optimized for a market where returns are capped at ~100x (rather than capped at 1,000-10,000x, like in software).

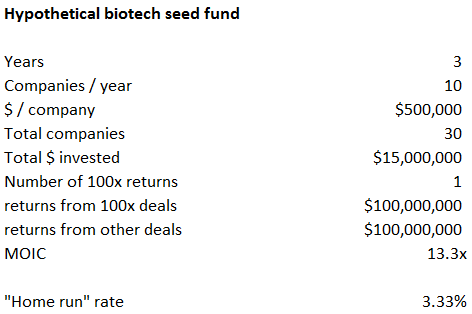

And that is essentially what biotech VCs have done. I’ll illustrate with a model intended to represent Flagship’s strategy, as there is more publicly available data about their strategy than others.

This differs from the example tech fund in the following ways (these figures are estimated based on info from Flagship's website as well as an analysis I did on one of Flagship's funds):

- 10 companies / year instead of 50

- $500,000 / company instead of $25,000

- One “home run” company (“home run rate” of 3.3% vs “grand slam rate” in tech of 1.5%)

- $1M invested into “home run” company because of tranched approach: protocos get more capital if initial experiments are promising

- “Home run” investments represent 50% of total portfolio (higher concentration and lower loss rates) instead of “grand slam” representing 75%

This example fund returns a (theoretical) 13x return. And it is less dependent on outlier returns: even if there are no “home runs”, it still returns a 7x.

What is driving the difference? In this illustrative model, three things: higher “hit rate”, tranched investing, lower loss rate / more singles and doubles / portfolio concentration.

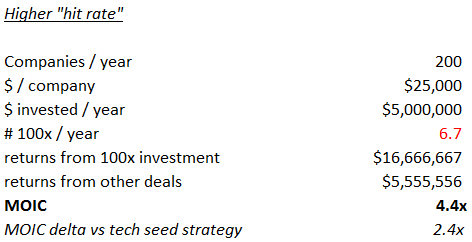

Higher "hit rate"

First, let’s change the “hit rate” from 1.5% in the illustrative tech strategy to 3.3% that we used for the biotech model (recall that “hits” in biotech are home runs, not grand slams). As we are more than doubling the number of successful investments, we are more than doubling returns.

How would a fund increase the “hit rate”? A fund could do this by improving their sensitivity to detect good investments, or to add value to companies operationally (or even transactionally). It seems likely that biotech investors do both of these: they know what science has potential to create meaningful medicines. Many biotech VCs play hands-on roles at the early stages of company building, even forming companies in-house and managing them with partners or employees of the fund at early stages. Further, many established biotech VCs have good relationships with IPO investors and potential acquirors, and can potentially conjure up exits where a less-connected group may not be able to.

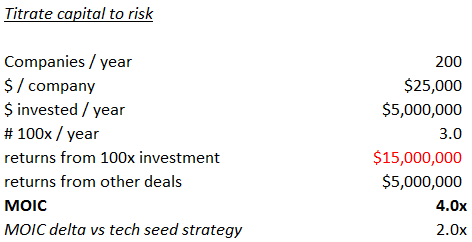

Titrate capital to risk

In many cases, seed capital is deployed gradually based on the results of initial experiments. In some cases, a smaller amount of capital is needed to prove the concept and justify a larger round. In other cases, an initial experiment won’t work, and the project will be abandoned.

Titrating capital to risk allows investors to make more investments per a set amount of capital. This is somewhat analogous to strategies that some tech investors use, where they write small checks to many companies, and then double down on the winners.

However, a key difference in biotech is that many VCs start companies in house rather than by funding companies started outside of the fund. Funding companies started by entrepreneurs – rather than “protocos” started by the VC – in this manner is not always practical or desirable, and requires a lot of trust and alignment between entrepreneurs and investors to work.

I don’t have great data on the impact of staged deployment of seed capital. It can be tricky to model. In this example, I assume that the fund invests twice as much in the “home run” investment as it does in its other investments. This provides an additional 2x to the fund’s MOIC. If we assume the fund only invests 30% more in the home run, then the incremental MOIC is only 0.6x.

Although this whole exercise is meant to be illustrative, this particular scenario is perhaps the most subject to assumptions. However, some funds do deploy capital in this way, and when done correctly, this can be an important way to test the robustness of science in a capital efficient manner.

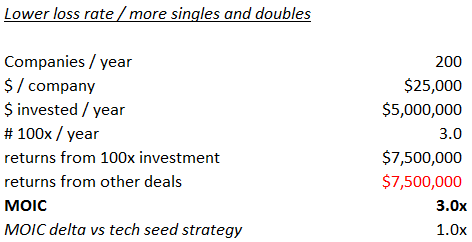

Lower loss rate / more singles and doubles

To generate venture returns in a sector where cash-on-cash returns are lower, portfolio returns must be less skewed: you can’t afford to lose money on as many deals as you can in tech. In a tech portfolio, a single-digit percentage of investments can account for the majority of returns. In biotech, loss rates – the percentage of investments that lose money – need to be lower.

In this example, I assume that 50% of a fund’s returns come from non-outlier investments (consist with Flagship Fund IV’s performance). This contrasts with the illustrative tech portfolio where only 25% of returns come from non-outlier investments.

Larger check sizes

Another key difference between tech and biotech are round sizes. I don’t model this, because I use cash-on-cash returns that won’t change based on the amount of the round, but it is a key difference. Early rounds – seed, Series A and Series B – are larger in biotech. Part of this is because investors need to concentrate more capital into winning investments. But much of this is because it takes longer to achieve significant value inflection in biotech, as shown in a previous post. A software company can reach product-market fit with just a few hundred thousand in capital, while a biotech company won’t achieve human proof of concept until tens or hundreds of millions are invested.

Early-stage investing in biotech requires a different approach than early-stage investing in tech

The tech seed / angel investing strategy is thus unlikely to be as effective in biotech. That isn’t to say that seed investing can’t work in biotech – the data above suggest it can – but it suggests the type of investing needs to be different: larger check sizes, more diligence, and lower valuations.

Could biotech seed investment returns look more like tech? It is possible. But because the biggest driver of the cost and risk of drug development is Phase 2 failure, the biggest value inflection happens after successful human proof of concept. I haven’t seen any technologies that can reduce this risk enough to enable seed returns of 1,000x+, but I haven’t seen that many technologies.

But succeeding in biotech seed investing doesn’t require game-changing technological breakthroughs. It merely requires a bit more discipline and rigor than tech investing. And because there are so few seed investors in biotech relative to the number of exceptional entrepreneurs, seed investors may well discover a game-changing technology that is heretofore unknown.

You may also like...

Top biotech VCs of 2018 and 2019

Valuing drugs and biotech companies

Venture returns from biopharma IPOs, 2018-Q1 2019

Valuations of biotech startups from Series A to IPO

Did you enjoy this article?

Then consider joining our mailing list. I periodically publish data-driven articles on the biotech startup and VC world.