The world's most expensive drug?

An intro to biotech1 business and finance through a case study of Zolgensma

Richard Murphey, 5/9/2019

In late May 2019, Novartis is expected to launch Zolgensma, a gene therapy that is a potential cure for one of the most common genetic causes of infant death. Novartis acquired Zolgensma through its $8.7B acquisition of a startup called AveXis in 2018. Zolgensma is expected to treat at most a few hundred, maybe a thousand, patients per year.

Wait a second... Novartis spent $8.7B to buy a company developing a drug to treat a few hundred patients? Dropbox is worth $10B, but it has over 500M users. When Instagram was acquired for $1B, it had 30M users. How can a company with a 4-digit number of potential customers be worth almost $9B?

By charging $2M per patient.

How can a company get away with such a high price? Why would they charge such a high price in the first place? Are they taking advantage of sick babies? Or are they being rewarded for developing an innovative, life saving medicine? Is this fair, or is this just greed?

Answering these questions requires an understanding of how the drug industry works. The goal of this post is to provide an intro to the "business of biotech" by analyzing the finances of AveXis, the company that developed Zolgensma, with a financial model you can play around with.

I've embedded the model below. There's a "download" button on the bottom-right.

Feel free to contact us with questions or sign up to get emailed when we write something new.

Biotech startups like AveXis develop most of the new drugs our society receives, so are a great starting point for understanding the industry as a whole. AveXis in particular is an exemplar of the contradictions of the industry: cutting edge science creating life saving medicines, but at a sky-high price.

It's a long post, and though you don't need a background in biotech or finance to understand it, it will get a bit technical. You may want to download the excel file and refer to this page as you work through the spreadsheet. The terms and methodologies outlined here are slightly simplified but representative of the kind of analysis that biotech investors and financial analysts do.

This isn’t intended to be an exercise in financial modeling, but a financial model of a real company is a great way to learn about business models in biotech. Why do investors focus so much on cancer and rare disease? Why are late-stage drugs so much more valuable than early-stage drugs? Why do biotech VCs do so much more diligence than tech VCs? Why are drugs so expensive? The answers to all of these have a lot to do with risk and value. In other words, finance.

Short version

- Developing drugs is really expensive and really risky

- Profitable drug development requires 1) managing these risks very carefully and 2) creating drugs with tremendous clinical value

- When companies fail at the above, unfortunately they resort to charging really high prices

- Big pharma companies have struggled at R&D over the last few decades, so increasingly rely on buying startups and charging high prices to sustain growth

- Why is price a big deal? Price is a powerful financial lever

- Changing price does not generally increase costs, so revenue gains from price increases are almost pure profit

- In contrast, increasing revenue through selling to more customers requires increased sales and manufacturing expense, and thus lower profit per unit of increased revenue ("contribution margin")

- Increasing revenue through making more products is increasingly less profitable for big pharma, whose returns from R&D investments are approaching 0%

- Companies with clinically valuable medicines generally have more control over price than they do over other variables (competition, probability of success, etc)

- High-priced drugs can be cost-effective, but AveXis' drug will likely not be cost-effective

- AveXis represents a "best case" outcome for startups, but still requires a very high price for the company to recover its R&D costs

Here’s the TOC:

- Brief overview of AveXis’ lead product

- Analysis of AveXis’ finances, using the financial statements as a way to introduce key biotech business concepts

- Revenue

- Revenue build

- Market penetration

- Price

- Probability of success

- Expenses

- Cost of goods sold

- Selling, general and administrative expense

- Research and development expense

- Analysis of AveXis’ valuation

- Discussion of the factors that drive valuation

- Discussion of why Novartis paid what it did, and why they could be wrong

- Is this drug worth $2M per treatment?

This post is adapted from a lecture I gave as part of a career development program for young scientists, first in 2017. I've updated data since then where relevant.

AveXis

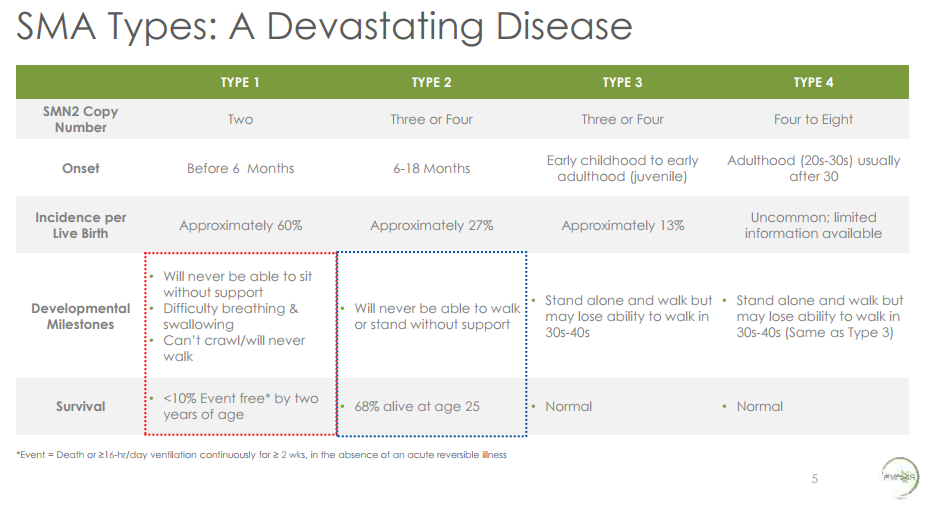

AveXis is a gene therapy company developing treatments for spinal muscular atrophy (SMA). SMA is the most common genetic cause of infant death. SMA is caused by loss of a gene called SMN1. The loss of this gene causes motor neurons to wither away, which leads to muscle atrophy and loss of muscle function (“use it or lose it”), and in the most severe forms of the disease, ultimately death. For a good layperson’s overview of SMA, check out this video .

From AveXis presentation at AAN 2017, accessible here

It is a terrible disease. Babies with Type 1 SMA2, the most severe form of SMA, will never be able to sit without support, have difficulty breathing or swallowing, cannot crawl, and will never walk. Over 90% of babies with Type 1 SMA will die or require continuous ventilation by age 2 . This is what people in the pharma industry call an “unmet need”. Only a few hundred patients in the United States have Type 1 SMA.

From AveXis presentation at AAN 2017, accessible here

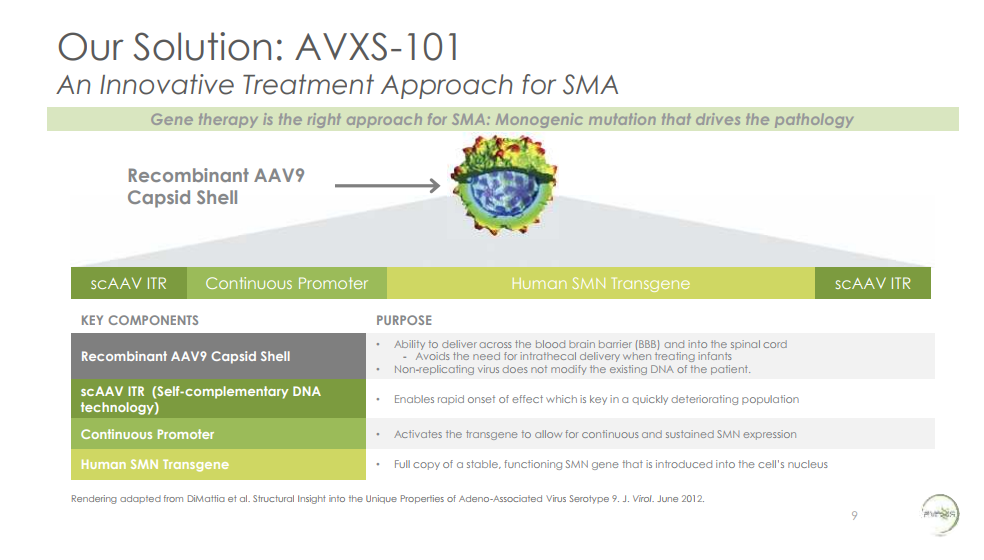

AveXis’ lead product, AVXS-101, is a gene therapy that delivers a functional copy of SMN1 to motor neurons. It has potential to be a true cure. The technology underlying gene therapy is highly innovative and only recently has matured to the point where it has true therapeutic potential. At the time AveXis began developing AVXS-101, no gene therapies had ever received FDA approval despite decades of attempts to develop gene therapy products (the first gene therapy was approved in the US in 2018).

From AveXis presentation at AAN 2017, accessible here

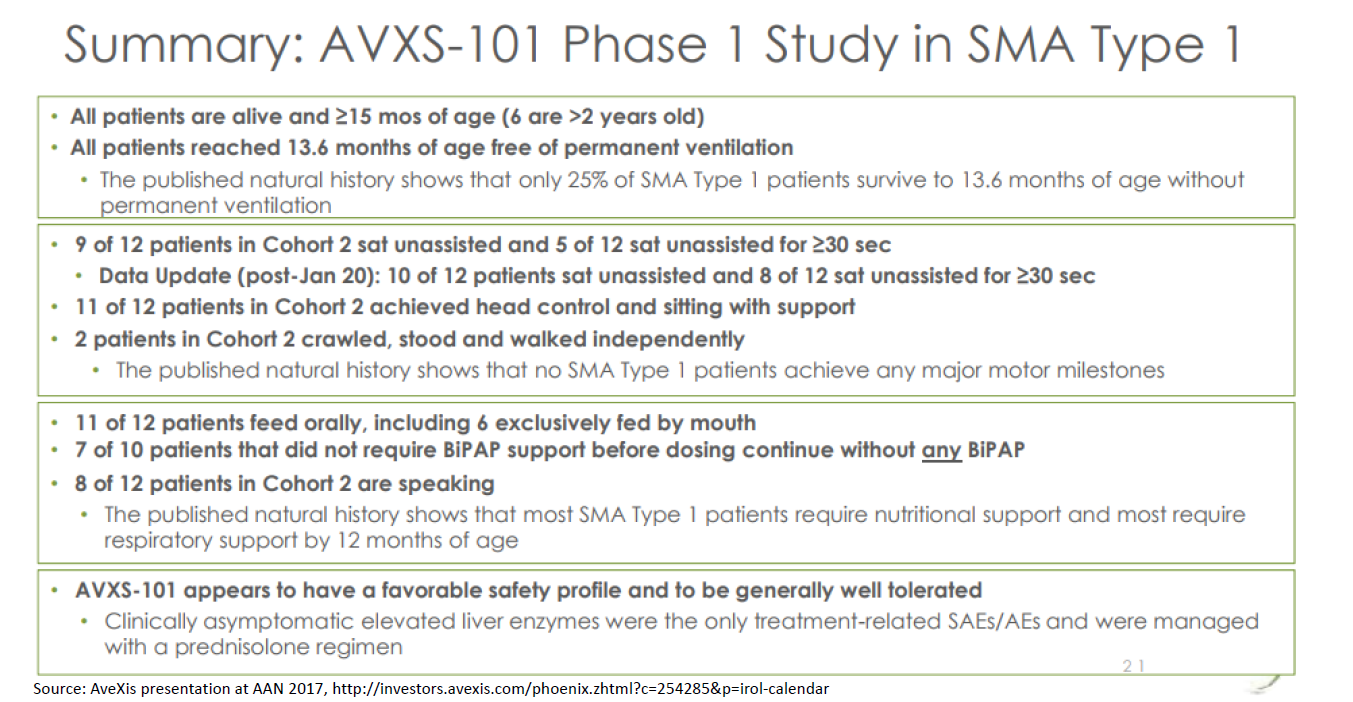

The preliminary clinical evidence suggests that AVXS-101 (Zolgensma was called AVXS-101 when it was in the development stage; drugs typically don't get a "brand name" until closer to launch) is a transformative therapy. A clinical study of their drug showed that 15/15 patients receiving AVXS-101 lived to 13.6 months without requiring continuous ventilation. Only 25% of patients are expected to live that long, or live that long without ventilation. At the 20-month time point, 9/9 patients were alive and not ventilated (the other six patients were not 20 months old yet so weren’t included in that analysis). Only 8% of babies are expected to be alive and not on ventilation at 20 months. 10 of 12 patients receiving the highest dose sat unassisted, and two crawled. The drug also appears to be safe.

Patient advocacy groups describe the effects of the drug as “miraculous” (video here). For a deeper overview of the history of gene therapy, and a good description of a patient and family perspective, this is a good article.

A full discussion of the clinical evidence is beyond the scope of this post, but I’ll note that typically you’d want to see a much more robust study before drawing strong conclusions about whether the drug is safe and effective. This is a Phase 1 study: it is very small (just 15 patients) and uncontrolled (no placebo or active comparator; it is also open-label / unblinded and non-randomized). Typically, a study with such limitations wouldn’t tell you much about whether a drug is safe and effective and would potentially be subject to bias.

But this case is a bit different. The natural history of the disease (what percent of patients reach various motor milestones and survive to various ages) is fairly well characterized. The natural history studies act as a sort of “synthetic” control, although an imperfect one -- using historical controls can exaggerate perceived treatment effects. The endpoints are objective, so are less subject to bias – do patients die or not? Can patients walk or not? And the effect size is very large: all patients are alive at each follow-up point, whereas the natural history studies suggest very few patients would be alive without treatment. So this study is pretty powerful, despite its limitations.

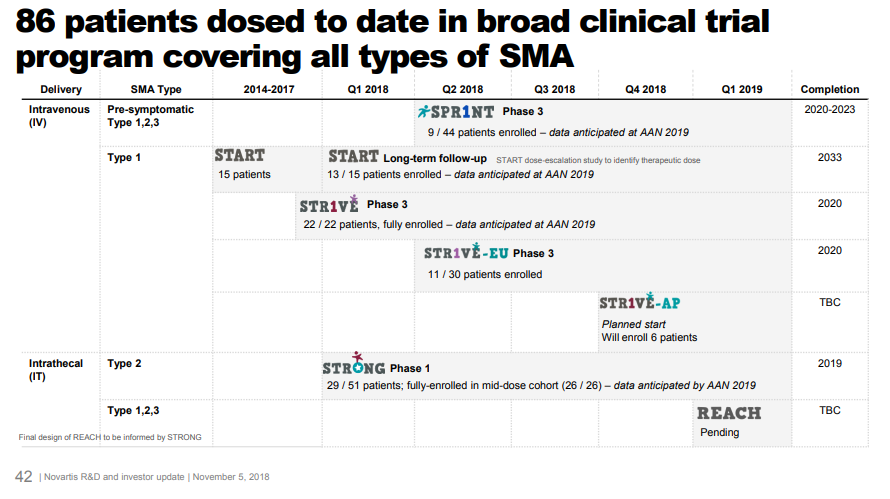

AveXis has conducted additional studies to strengthen the evidence base, including a Phase 3 study with 22 Type 1 SMA patients. Data from this study will be presented at the American Academy of Neurology meeting in the next few days (May 4-10). AveXis is also enrolling patients in several other studies, in both Type 1, Type 2 and presymptomatic SMA.

From Novartis Nov. 2018 investor day, accessible here

AveXis / Novartis submitted for FDA approval with full data from just the initial portion of the 15-patient Phase 1, interim data on all 22 patients from the Phase 3 study, and interim data on a subset of patients for the other studies. This is possible because of FDA programs that make it easier to develop drugs for severe rare diseases. For a disease with just a few hundred patients a year, it’s very difficult to fulfill FDA’s requirements of multiple “adequate and well-controlled studies”. Without these expedited approval pathways, investors would not fund research into these rare diseases.

Financial analysis

It seems like AVXS-101 is an incredibly valuable medicine. But is it a commercially viable product? We will take a look at the company’s finances to estimate the value of the product.

Revenue

As you see from the historical financial statements, AveXis has never generated revenue. Companies can’t market drugs until they are approved by FDA, and it takes years of expensive R&D to get FDA approval. Most biotech startups never generate revenue – they either fail or get acquired before approval, usually by a company that has a sales force and commercial infrastructure.

In other industries, as a first approximation you can simply project future revenue using the historical revenue growth rate. That isn’t possible for pre-revenue biotech.

Instead, we will do a “revenue build”. Our revenue build is comprised of:

- Annual births in the US (source: CDC)

- Incidence of SMA (% of live births diagnosed with SMA) (source: Verhaart et al 2017 Orphanet Journal of Rare Diseases)

- Percent of new SMA diagnoses by type (source: ibid)

- Percent of newly diagnosed Type 1 patients receiving treatment (source: consensus equity research estimates and benchmarking of Spinraza launch)

- Price per patient (source: consensus equity research estimates)

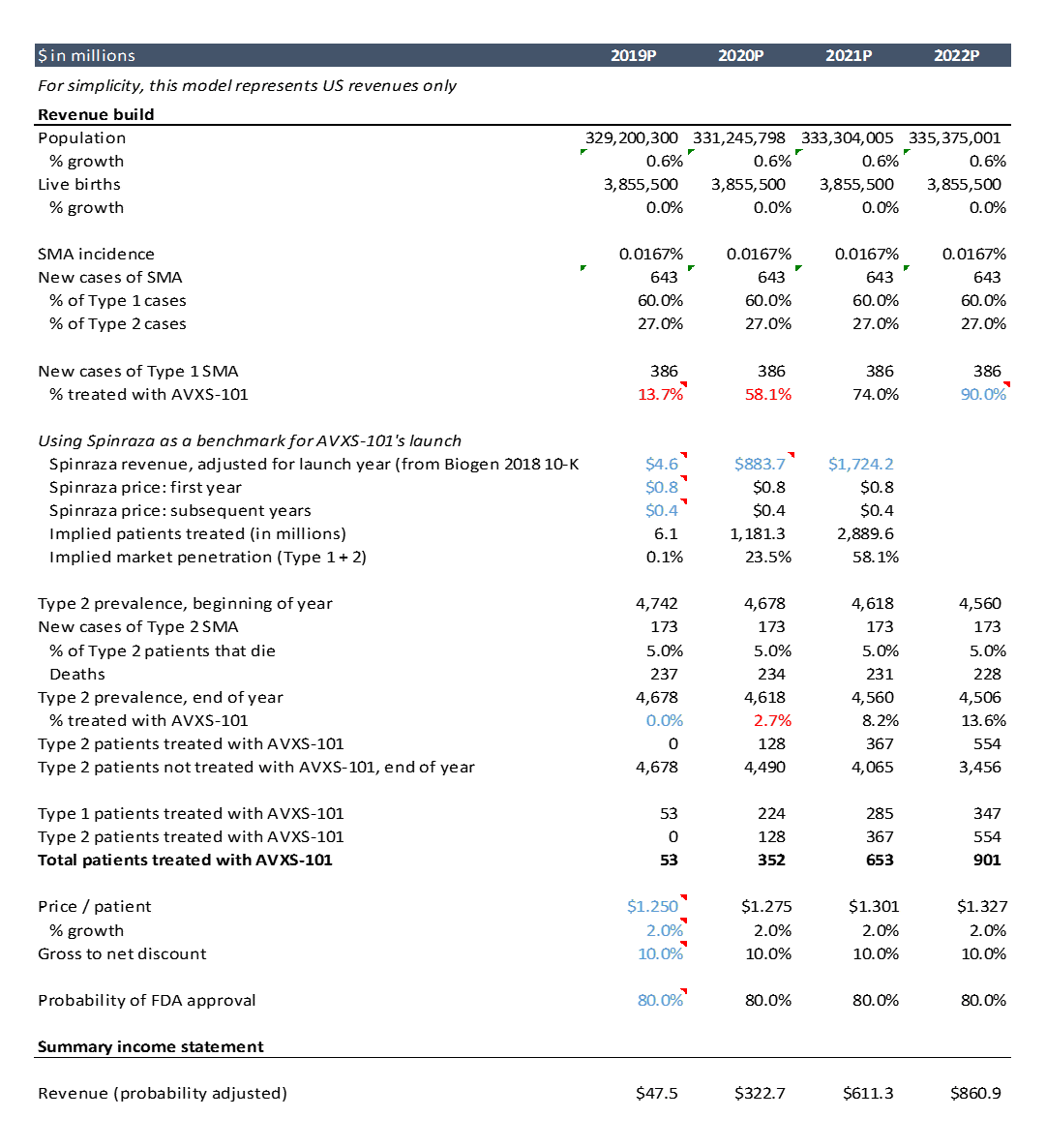

Here’s a screenshot of the spreadsheet showing the revenue build. I’ll walk through this in detail below.

As this is just an example, I did only cursory research to get these assumptions. Doing more thorough and rigorous research into these assumptions is a critical part of biotech investing and finance, but this high level analysis will suffice for the purposes of this post. The actual model itself is not nearly as important as the research that goes into the assumptions: talking to doctors and researchers and reviewing the literature / data to understand whether the tech will work and whether the product will be valuable.

How you do the revenue build will differ for each product, but the idea is the same. You can model more detailed things like % of patients who are undiagnosed, % who have adequate insurance, % who have access to care and other variables. AVXS-101 is a one-time treatment (more on that later), but for drugs that you take more frequently, you often model things like average dose per patient (often dosing is based on body weight), adherence to prescribed dosing regimen (to account for missed doses), and price per dose.

Where do you find data to support your assumptions? For epidemiology data (ie number of patients eligible for the drug), you can generally google the disease of interest and find relevant literature. For dosing information, you can often check the doses used in clinical studies of the drug or the company's presentations, or if it is FDA-approved, the Prescribing Information (here’s the prescribing information for a competing SMA drug, Biogen’s Spinraza).

Modeling pricing and market penetration, ie how many patients will get the drug per year, is more difficult.

Market penetration

For this example, I assume the drug is approved in May 2019. For the first two years of launch, I assume market penetration rates similar to that of a competing product: Biogen’s Spinraza.

Spinraza was launched in late 2016 in the US (and in other countries in 2017) to treat SMA. In 2017, its first full year on the market, the drug did $883M in sales. In 2018 it did $1.7B in sales. The drug costs $125,000 per injection. Per the prescribing information, the drug is dosed with four loading doses over a ~2.5 month period, then one maintenance dose every 3 months thereafter. This comes out to a total cost per patient of $750,000 in the first year of treatment and $350,000 each year thereafter.

We can estimate total patients treated by dividing revenue by price per patient, adjusted for how many patients are in year one vs. subsequent years of treatment. We can then divide patients treated per year by total eligible patients (Type 1 and 2, as Biogen’s drug is used for both types) to get an estimate of market penetration. AveXis’ drug will be used initially in Type 1 SMA (they have not yet published data on AVXS-101 in Type 2), but I model AVXS-101 penetration in Type 1 SMA as having similar trajectory to Spinraza’s penetration in Type 1 and Type 2 combined.

Spinraza is only in year 2 of its launch, so I only use Spinraza’s penetration rates to model the first two years of AveXis’ launch. I assume peak penetration is 90% in year 4 of launch and stays that high throughout the projection period. I assume year 3 penetration is 75%.

These are workable starting assumptions, but in a real analysis you’d want to do more research. You can better diligence these assumptions through 1) KOL / doc calls (KOL = key opinion leader, an influential doctor), 2) surveys and 3) benchmarking adoption of similar drugs.

If you are starting or investing in a company, “KOL calls” or “doc calls” are essential. The term “KOL call” is basically a fancy way of saying “talking to customers”. Typically in these calls you first try to learn about the problem: how patients present, how they are diagnosed or staged, the treatment options available, how they decide on a treatment plan, and the limitations of available treatment. Then you talk about the solution: you present data on the drug of interest and get the doctor’s reaction, diving into as much detail as needed. Often you can ask what percentage of patients the doctor would prescribe the product of interest, though this is often not very reliable. For launched drugs, you can ask how many patients they treated in a given quarter (hedge funds do this to predict quarterly earnings). You can also ask about the competition.

If you work at a big company or a fund, you’ll probably have access to a paid service like GLG that helps you find KOLs and organize calls. You’ll typically pay a few hundred dollars an hour for calls. Otherwise, you have to network your way into KOL calls, or use a service like Slingshot Insights that’s like GLG for individuals rather than companies.

This Xconomy article describes a physician’s take on novel SMA drugs, and gives you a bit of a sense for what you can learn in KOL calls. STAT News and a company called Slingshot Insights are hosting a KOL call with an SMA expert in the next few weeks, so if you have a subscription to STAT you can join but I think you have to pay otherwise (I’m not trying to advertise for STAT or Slingshot, though I think Slingshot is a cool service). You can also check out biotech Twitter May 4-10 during the AAN conference; I’m sure there will be much discussion of the AVXS-101 data presented there.

After doing a few KOL calls, you can do a larger, quantitative market research survey to estimate adoption. If the prescribing population is sufficiently small, you can potentially survey most of the relevant physicians and get a pretty good sense of uptake. You’d really only do this if you were an institutional investor, pharma company or consulting firm, otherwise it’s probably overkill. Some analysts suggest that based on surveys, the market could be split 1/3, 1/3, 1/3 between Spinraza, AVXS-101 and a competing small molecule drug from Roche / PTC Therapeutics.

Price

Price is another critical issue that is hard to estimate. In this analysis, I use an estimated $1.25M “list price” and a 10% average “gross to net” discount, and grow price at the rate of inflation. “G2N” discounts reflect rebates or discounts paid by drug manufacturers to third parties involved in distribution. A good overview of G2N is here.

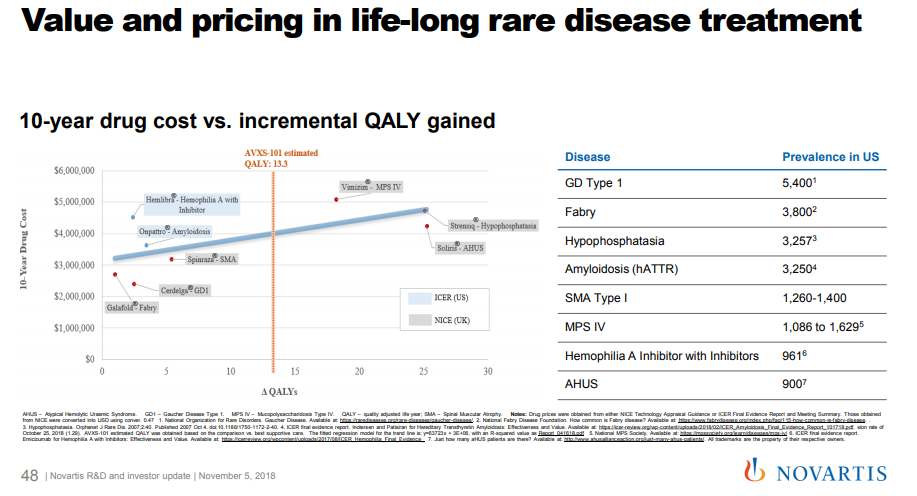

Pricing is determined by negotiation between manufacturers and payers. While not binding, analysis by ICER, a non-profit that does health economic analyses of drugs, is informative. ICER’s analysis said that AVXS-101 is likely cost effective at a price of $310,000-900,000 per treatment for Type 1 SMA using a QALY benchmark (using a life-year gained benchmark yields a cost-effective range of $710K-1.5M). The price AveXis (now Novartis) is expected to charge is higher than ICER’s maximum threshold. Novartis argues that AVXS-101 would be cost-effective at a price of up to $4-5M. If you are curious about the health economics of innovative drugs, ICER’s full report is worth a look.

Pricing is a particularly thorny issue for gene therapy. Current gene therapies are composed of a non-replicating “harmless” virus that delivers a gene to the nucleus of cells. While not harmful, these viruses are typically immunogenic – when first administered, the immune system recognizes the virus as foreign, and if the virus is administered additional times, the immune system will likely neutralize the virus before it can deliver its genetic payload.

Pricing a one-and-done drug is problematic. We pay for most drugs on a per-dose basis. The total lifetime cost of the drug is amortized into many smaller per-dose installments. If the drug stops working, or a patient chooses another drug, then you don’t pay for the drug anymore.

But if a drug is a one-shot therapy, you have to pay for the drug before you know whether it works for the patient, or for how long it will work. And the total cost of the drug comes all in one chunk rather than being spread out over several months or years. Payers don’t like this. It isn’t clear they will cover gene therapies at the prices pharma is charging. Leading gene therapy companies like Spark, Novartis / AveXis and bluebird bio are experimenting with new ways to finance these drugs, potentially with installment plans or pay-for-performance features.

Probability of success

This line item is unique to biotech, and is probably the most important and challenging assumption to model for development-stage biotech companies. Most drugs fail to get FDA approval, so all projected revenues and profits are just imaginary numbers in a spreadsheet. We need to estimate the probability that AVXS-101 receives FDA approval, and then probability-weight all future revenues by that amount.

Equity research assumes an 80% probability of success. For drugs that have submitted an application to FDA for approval, probability of FDA approval is ~85% across all indications (I wrote a blog post on the basics of the drug discovery process including probability of success at each stage). But relying on benchmarks for probability of success is incredibly dangerous. You really need to look at the particulars of the drug in question.

If you are investing in biotech and not spending a lot of time diligencing this assumption, you are buying a lottery ticket.

You could write a library’s worth of books on how to do this. A large part of what biotech investors get paid to do is estimate the probability of success of a given drug or technology. This Quora answer from Antoun Nabhan is a pretty good and approachable intro to what goes into predicting probability of technical success.

Apart from actually doing experiments, you typically diligence probability of success through a combination of reading scientific literature, analyzing data and study designs, and talking to experts in the various technical domains required to bring the drug to market (chemistry, biology, pharmacology, toxicology, regulatory science, clinical science, bioengineering, etc.).

So that’s revenue. It’s the hardest line item to model. Next we’ll look at expenses: cost of goods sold (COGS), selling, general and administrative expenses (SG&A) and R&D. Then we’ll look at valuation.

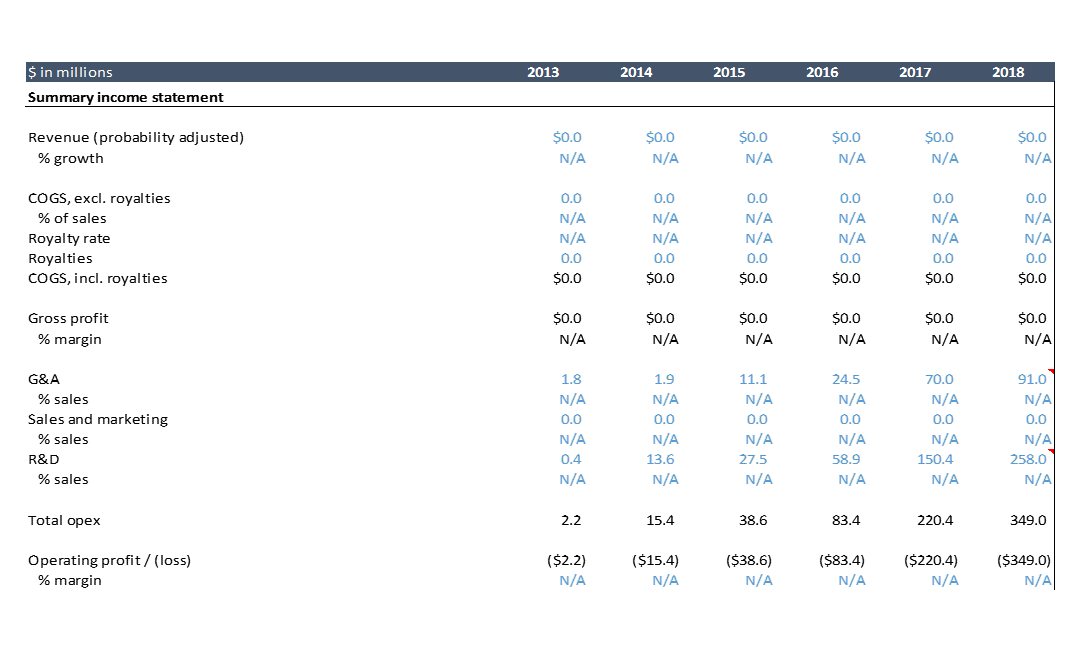

Expenses

How much does it cost to develop a drug? The above shows AveXis’ historical profit and loss statement. AveXis spent over $700M from 2013, the first year it discloses its financials, through 2018. The drug is expected to be approved in 2019. AveXis has only studied its drug in 86 patients as of November 2018. Most drugs require testing in hundreds or thousands of patients before approval, but because of FDA incentives for developing innovative drugs for severe rare diseases, AveXis can get away with a small clinical development plan. So the clinical development cost for AveXis’ drug is lower than what you’d typically see.

On the other hand, AveXis is breaking new technological ground by developing one of the first ever gene therapies. There’s a lot of cost involved in building out the infrastructure to manufacture gene therapies at scale, a lot of trial and error, and a lot of expensive consultants and vendors. I'd imagine that this expense is why AVXS-101 has been so expensive despite a pretty small set of clinical studies.

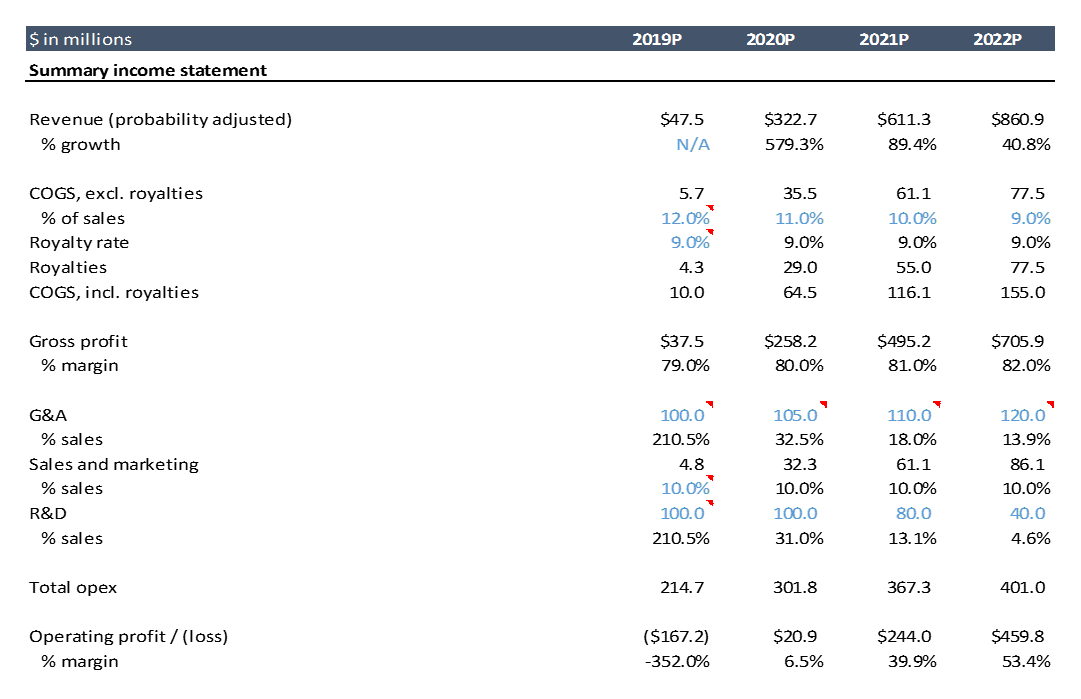

Below is the projected profit and loss statement for AveXis (I just show through 2022 here; the excel goes out to 2033. I’ll walk through expenses in detail below.

COGS (cost of goods sold)

AveXis currently has no sales. COGS is “cost of goods sold”, so if there are no sales, there are no COGS. COGS can have fixed and variable components, but it is often modeled based on a percentage of sales as much of COGS is typically variable.

For traditional small molecule drugs, or even biologics, COGS are typically a very small percentage of sales (until patent exclusivity expires). The cost of production is simply very low compared to the price per drug. Drugs are “high margin” products.

COGS for gene therapy (and many next-generation therapies like cell therapy and microbiome therapy) are much higher per-unit than traditional small molecules or biologics. The processes for making these drugs at scale has not been optimized (the approved gene and cell therapies target very small patient populations, and no one has attempted to scale manufacturing for highly prevalent conditions). For a high priced gene therapy like AVXS-101, COGS is still a low percentage of sales, even if per-unit costs for gene therapy are orders of magnitude higher than for small molecule drugs on an absolute basis.

Royalties are also often included in COGS. These can be royalties to a university or hospital that the company licensed technology from, or to an important supplier who has a unique enough product that they can negotiate royalties. AveXis licensed a core piece of technology, its viral vector, from a company called Regenxbio, and owes them royalties.

SG&A (selling, general and administrative expenses)

SG&A reflects all non-R&D overhead: salaries and benefits of executives and non-R&D employees, rent, legal fees, etc. For simplicity, here we use equity research estimates for the first few years, then forecast this as a percentage of sales. You can benchmark what other similar companies spend on SG&A as a percentage of sales. You can also do a bottoms-up estimate: how many employees does the company have, what is the company’s fixed administrative expense structure, how many salespeople and other commercial employees will it have to hire to grow sales, and how much will those employees cost.

R&D (research and development expenses)

This is the cost of all in-house R&D personnel, facilities, research and lab supplies and equipment, and payments to third party research groups. This is where the preclinical and clinical study costs show up.

Looking at AveXis’ historical financials, we see that the $500M of R&D expense accounts for ~70% of AveXis’ total expenditures. From 2014-2017, AveXis was only doing one clinical study, and that study involved just 15 patients. They were also certainly working on manufacturing, quality and other research, but to my knowledge they did not have any follow on products at this point. They started enrolling five other studies in 2018, and were presumably spending on preparing for those studies in 2017. You can clearly see the ramp in R&D spend during that time.

But that seems like a lot, doesn’t it? $500M to study your drug in just 86 patients, across just one completed 15-patient study and five other ongoing studies? The notes to the financial statements give us a bit more detail on where that money went.

From the 2017 annual report:

“Research and development expense increased from $58.9 million for the year ended December 31, 2016 to $150.4 million for the year ended December 31, 2017. The increase was primarily attributable to increases of $56.9 million in third party clinical and manufacturing research and development spending related to our clinical trial and clinical trial product manufacturing, $15.8 million in salaries and personnel related expenses driven by increased headcount across all research, development and manufacturing functions, $7.5 million in license fees and $11.3 million in other research and development expenses.”

In 2017, R&D spending jumped by almost $100M from 2016. Most of that went to contract manufacturing and research organizations. Pharma companies, especially small biotech companies, outsource a lot of their manufacturing and clinical trial operations. But it isn’t typically this expensive. As I mentioned above, gene therapy is a new modality and no one has figured out manufacturing and logistics yet. There probably aren’t many good contract development and manufacturing firms for gene therapies, and they’re probably expensive.

It looks like AveXis is building its own manufacturing facilities now that it is more established: page 92 of the 2017 10-K in the “Properties” section says “a portion of [AveXis’] warehouse space is being converted into manufacturing space”, which suggests to me they don’t have manufacturing in-house as of the time of this filing. Page 108 (“Investing Activities”) describes their investments into developing manufacturing facilities.

Page 23 of the 10-Q (quarterly report) from Q1 2018 shows that R&D jumped from Q1 2017 primarily due to $135M in payments under license agreements (I’ve excluded these costs from the model as they are “non-recurring”, and you should exclude non-recurring costs from forecasts). They also spent a lot on their own manufacturing facility, suggesting they are transitioning manufacturing to this location: in Q1 2018 they spent $13.8M more on facilities and supplies for the facility than they did in Q1 2017, and spent $12.8M more on salary and headcount. Clinical trial-related expenses increased only $4.0M from Q1 2017.

How do we project R&D? In this model we just use equity research estimates for the first few years and thereafter project R&D as a constant percent of sales. This is a low-resolution approach. Ideally you’d want to understand how much the company would need to continually invest in developing its manufacturing capacity, what additional clinical studies they’d need to run, and how much they’d all cost.

Importantly, we only model expenses for AVXS-101 here. If the company invests in follow-on products, you’d expect to see a lot more R&D expense. Developing future products might be cheaper than the first product. Manufacturing expense was a big component, and if a lot of that is fixed cost (ie setting up a manufacturing facility), then they wouldn’t have to incur those expenses again for follow on drugs. If so, that would be a big competitive advantage. But we don’t know how much of that manufacturing component of R&D is fixed vs. variable.

Valuations of 150+ biopharma VC rounds

Access detailed financial profiles of 75+ biopharma startups that went public in 2018 and 2019, including estimated private-round valuations.

Valuation

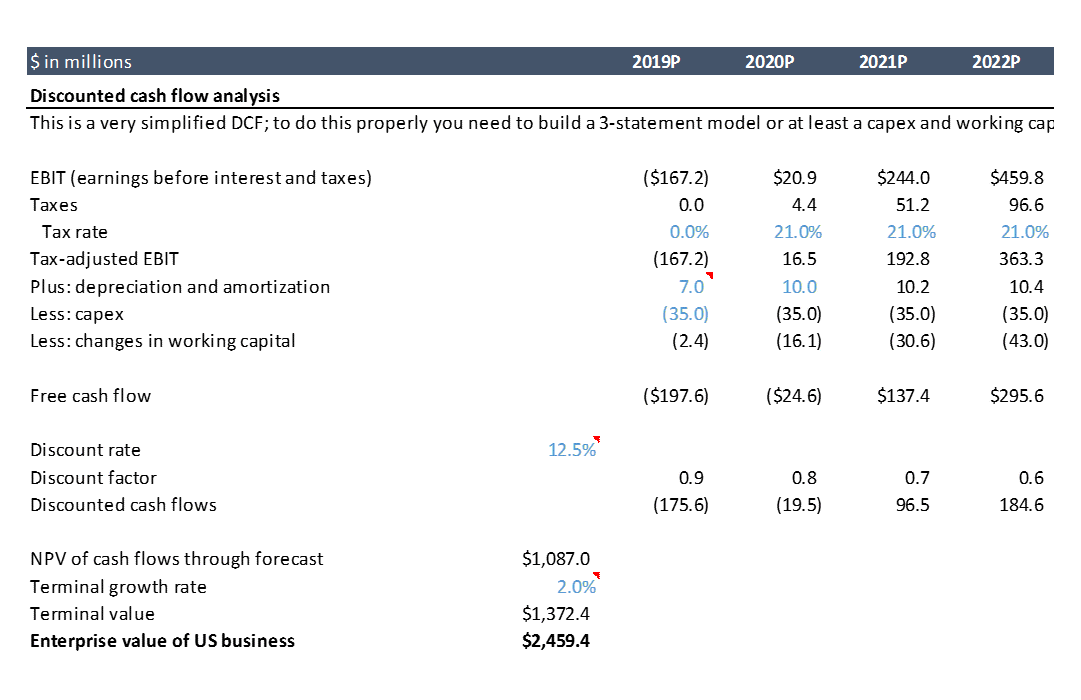

Now that we’ve projected AveXis’ financials, we can analyze valuation. In biotech, you typically rely pretty heavily on discounted cash flow analysis, or “DCF” (I wrote a separate post that talks more about valuation techniques). A full discussion of what DCFs are and how they work is beyond the scope of this post, but there’s plenty of good info on the internet. The basic idea is that the value of a business is the sum of all the cash it will ever generate. You calculate this by calculating projected annual cash flows (which are different than profits – profits are an accounting concept and there are several subtle but significant differences between cash and profits). Then you “discount” the future cash flows back to the present time, because a dollar today is worth more than a dollar next year (“time value of money”). You can check out the calculations in the spreadsheet.

Using the assumptions in our model gives us a value for AveXis of $2.5B. At the time I first did this analysis back in 2017, the company was trading at a market cap of ~$3B. Our model only includes US revenues for simplicity, but the drug will be sold in the EU and other countries as well, so including ex-US business probably gets us to around $3B.

Downside scenarios

Biotech is known to be an incredibly risky industry. What does the valuation look like in downside scenarios? Remember, AVXS-101 is not yet FDA approved and we only have data on 15 patients.

You can play around with various assumptions in the model to see how they change valuation. A few things I highlighted are:

- Modeling risk

- Competitive risk

- Technical / regulatory risk ("binary" risk)

Modeling risk

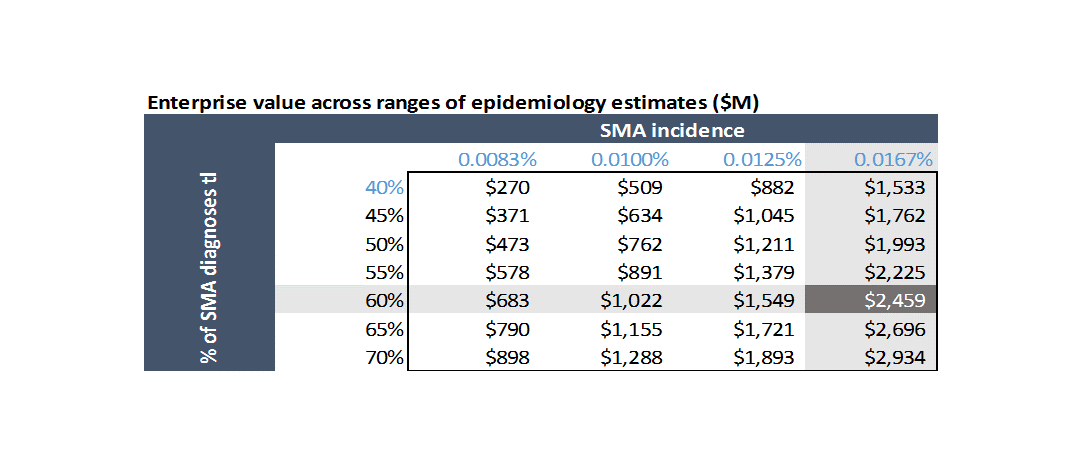

This is simply the risk that your assumptions are bad. Specifically, there is a range of estimated incidence for SMA in the literature, and a range of estimates of what percent of cases are Type 1 versus other cases. What happens if there are fewer patients than you modeled?

Competitive risk

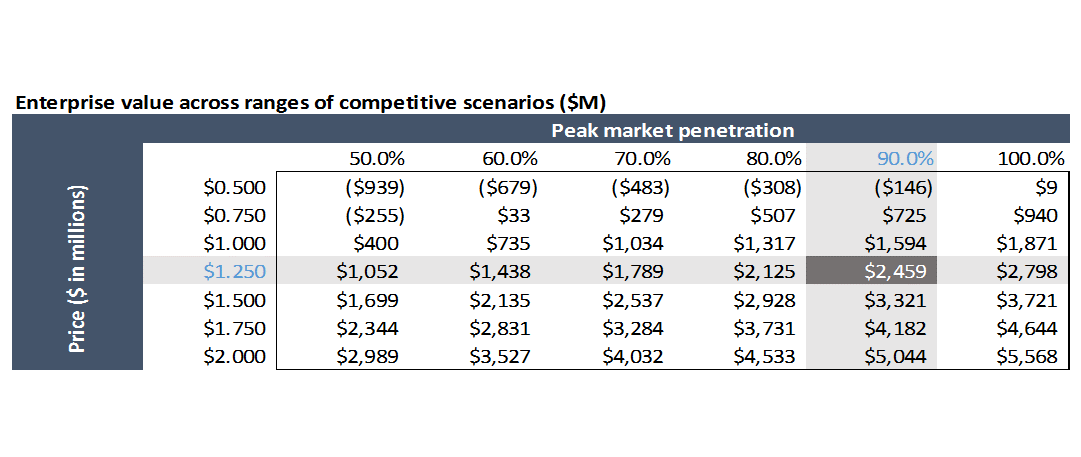

AVXS-101 be second to market at best, and there are several earlier-stage competitive programs that could end up having better profiles than AVXS-101. What if competitors take more share than you anticipate, or force you to compete more aggressively on price?

How real is this competitive risk? I'm not sure. To analyze this, you'd want to really critically dig into the data on both drugs, and talk to a lot of physicians and payers.

Quick note: some of the values in the above chart are negative. This is because in the model, R&D and SG&A are fixed inputs for the first few years, then held constant as a percent of sales. So at a lower price and lower revenue, the model still has the same SG&A and R&D as if you had a higher price. In reality, the company would decrease SG&A and R&D expense if it looked like they could only charge $500K / patient or be a second / third-tier product. Or the company would shut down.

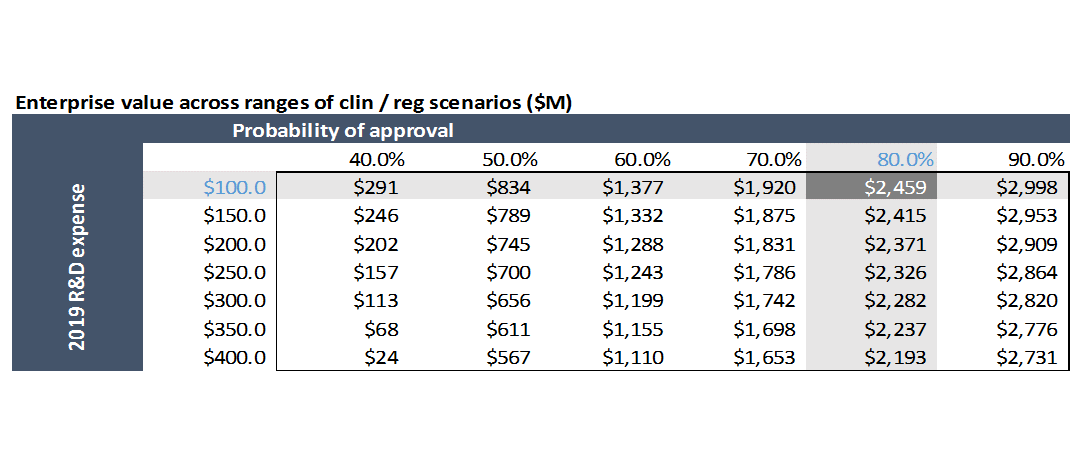

Technical risk

What if AVXS-101 doesn’t work as well in later studies? What if it doesn’t get approved, or FDA requires additional studies? In the data we reviewed, all patients receiving the drug had survived. The company has since studied more patients, and in April the company announced that one patient had died due to respiratory failure (a typical cause of death in SMA). A few days later they announced that another patient died, potentially due to a drug-related adverse event.

As drugs are studied in increasingly larger patient populations, you’re more likely to find adverse events, and you often find that drugs aren’t as effective as they initially seemed. I’d argue that it’s unlikely that it won’t get approved even in light of this data, but there’s a chance it won’t be as competitive commercially as it first seemed. Novartis took on some real risk when it bought this company.

This also shows how important FDA incentives are to driving rare disease research: if FDA required the normal amount and type of studies for approval, investors probably wouldn’t fund research into these diseases. AVXS-101 was allowed to submit for approval based on data from just a Phase 1 study. For a drug in Phase 1, probability of success is just ~10%, which isn’t even on the chart I show below. Companies usually have to conduct Phase 2 and 3 studies before submitting for approval. The probability of FDA approval for drugs that have submitted for approval is 80%+. So these FDA incentives not only reduce the cash cost of studies, but greatly reduce the risk as well.

Despite these risks, Novartis paid $8.7B for this business. Why?

Novartis presumably valued AveXis using a model similar to the one we’re working with. Their model was certainly more complex and they certainly did orders of magnitude more research into their assumptions than I did, but our model isn’t a terrible approximation. Remember, the stock market valued the company at roughly the same valuation as in our model (a lot of our assumptions are drawn from the estimates of professional stock analysts). Novartis must have believed something that the rest of the market didn’t.

What could they have seen to make them think this business is worth $8.7B? A helpful exercise is to go into the spreadsheet and play around with assumptions until the valuation (in cell F98) gets to $8.7B. What do you have to believe to pay $8.7B for this business? Go ahead and do that, and then read on for my take on what they might have seen.

One explanation is that AveXis is a best-in-class platform in a strategic area. They have leading capabilities in developing gene therapies for neurological disorders, and could use those capabilities to develop additional drugs. In June 2017, AveXis announced it had expanded its license with Regenxbio to include viral vectors for treating two other diseases: Rett syndrome and a genetic form of amyotrophic lateral sclerosis .

If these drugs prove as transformative as AVXS-101 for SMA, that would certainly add value to the business. These are earlier-stage efforts, so the probability of success is much lower, but it is possible that they could be developed more cheaply due to AveXis' experience and infrastructure from AVXS-101. Could these two drugs combined make up the $5B valuation gap between AveXis’ market cap and the price Novartis paid? If there’s good scientific rationale for these programs working, and the unmet need is high, it’s possible. Maybe Novartis even has other programs in mind. This acquisition could give Novartis a leadership position in one of the most promising new areas of biotechnology and be well worth the $8.7B price tag.

Drug pricing as a financial lever

But there’s a less chartable explanation as well: Novartis is simply planning on charging a higher price than what investors expected. Pricing is a very powerful lever, and is one that drug companies have a relatively good deal of control over. There’s only so much you can do to increase the probability of success of your drug or control the competition, but a company with a drug as effective as AVXS-101 typically has a lot of leverage on price.

If you just change cell M46 from $1.25M (cost of a treatment) to $3M, the valuation goes to $8.5B. While this is a bit simplistic, it seems reasonable (increasing price by 2.4x yields increased valuation of 3.5x in this model because projected R&D and SG&A don’t increase if you increase price: theoretically, if you just increase price and not volume, you shouldn’t increase variable costs). Changing the price to $2M, which appears to be what Novartis will charge, gets the valuation to $5B. Remember our model is just for the US business. Including Europe and maybe Japan, and a bit of value from the pipeline programs, would get the valuation pretty close to $8.7B. In this case, the deal is less of a strategic investment into gene therapy and more of a "pricing arbitrage" play.

So Novartis may have paid a premium for this business because they thought they could charge a much higher price than others might have anticipated. In a November 2018 presentation to investors (see slide 48), Novartis suggested that a price of $4M per dose of AVXS-101 would be within the cost-effectiveness range of other comparable drugs. Recent news suggests they plan on charging $2M per treatment.

Is this drug worth $2M?

Is the drug worth $2M? As mentioned above, ICER's analysis suggested that AVXS-101 would be cost-effective at $310,000-900,000 per treatment, based on cost / quality-adjusted life year gained benchmarks. If you use life-years gained, rather than QALYs, ICER says Zolgensma could be cost-effective at up to $1.5M per treatment. That's below $2M, but a bit more in line with the $1.25M price that equity research modeled. Using the most aggressive acceptable value for cost-effectiveness -- $1.5M -- would still be one of, if not the most expensive, drugs ever. But it would be tougher for Novartis to justify its $8.7B acquisition price at a price of $1.5M or lower per treatment.

But as we mentioned above, ICER recommendations are not binding. Spinraza, Biogen's competitor to Zolgensma, costs $750K in year 1 of treatment and $350K thereafter. ICER says Spinraza would be cost-effective at $72,000-130,000 for the first year of treatment and $36,000-65,000 thereafter. Though it priced at a premium to the cost-effective price, Spinraza has done incredibly well, with almost $900M in revenue in its first full year on the market and $1.7B in year 2. Zolgensma's price is higher in absolute terms than Spinraza's, but it is closer to the ICER recommendation than Spinraza's.

Could Novartis have paid less than $8.7B to buy AveXis, and then been able to charge a lower price? I'm not sure, but probably not. Novartis paid a 72% premium to AveXis' stock price prior to the deal announcement, which is a healthy premium, but it isn't uncommon to see a premium so high for a strategic biotech asset. They probably didn't have much of a choice.

Did AveXis need to sell at an $8.7B valuation to make a return for its investors? Yes and no. The job of investors is to generate returns for their clients -- often pension funds, university endowments, or unions. The job of a company's board of directors is to ensure that the company acts in the interests of its shareholders. They have to maximize value. Did most investors get a decent return when AveXis was trading at $3B? Most did. Some generated incredible returns. Remember, AveXis spent $700M to develop Zolgensma. But again, investors' job is to maximize returns, and a big part of the board of director's job is to represent investors.

Most big pharma companies these days have more cash than they know what to do with. Their internal R&D engines are sputtering, with returns to R&D approaching 0%. So these companies rely on expensive acquisitions of startups to replenish their pipelines when drugs go off patent. To make a return on these expensive acquisitions, companies often choose to be aggressive on price. Unless big pharma R&D productivity massively increases, or startups decide to go it alone rather than sell to big pharma, this is the imperfect system we're dealing with.

Conclusion

Hopefully this was a helpful introduction to the business of biotech. I think the most important takeaways are that developing drugs is really expensive and really risky, and the only way you can make money in the industry is to both 1) manage these risks incredibly well and 2) create drugs with tremendous clinical value to make up for the risks. When companies fail at these -- which most of the industry has been in the last ~20 years, unfortunately they resort to charging really high prices.

AveXis is a true outlier. It will likely be one of the first companies in the world to get a gene therapy approved, its product has potential to be a true cure for a terrible, life-threatening disease, and it generated tremendous returns for investors. The model you looked at represents success that 99.9% of people in the industry can only dream of. But even now, it’s not a sure bet.

For companies whose drugs turn out to be less effective than AveXis’ potential miracle cure (ie 99% of all drug companies), or who must study their drug in larger, riskier clinical studies (ie any non-cancer or rare disease indication), they must thread an even finer needle. Sure, they may have larger patient populations, but their pricing will be lower and costs higher.

Unless your drug is life-saving, it is hard to charge a high enough price to cover the costs and risks of development. This is a major reason why we don’t see much R&D activity in prevalent diseases like depression, cardiovascular disease and stroke: when probability of success is low, and good “standard of care” treatment exists (good = patients don’t die within a few years of diagnosis), it is hard to justify investing in expensive and risky R&D programs. There just isn’t enough money in it.

Hopefully this was helpful! Feel free to contact me with questions or sign up to get emailed when I write something new.

Sign up to stay updated on future posts

1 In this post (as in all my posts), “biotech” means R&D-focused companies developing novel FDA-regulated prescription medicines. No medical devices, genomics, diagnostics, or comp bio companies that don’t develop medicines.

2 There are 4 types of SMA. Type of SMA is determined by the number of copies a patient has of a “pseudogene” called SMN2. SMA is caused by loss of functional SMN1 gene. SMN2 is 99% identical to SMN1. However, because of a single base pair difference between SMN1 and SMN2, most of the protein produced by SMN2 is rapidly degraded and non-functional. Some patients have as few as two copies of SMN2, so they produce little functional SMN2, and thus cannot compensate for the loss of SMN1. These patients have “Type 1” SMA. Some have as many as four to eight copies of SMN2, and produce enough functional SMN2 to offset a lot of the motor neuron loss caused by loss of SMN1. These are Type 4 patients and they have normal life expectancy, though they may lose ability to walk around age 30-40.