Pitch basics: products and pipeline

Richard Murphey, 9/13/2018

In this series of short posts I'll touch on a few topics that you should think through when starting a company. I'll provide some examples of slides from pitch decks of successful companies that effectively communicate these topics.

Source for the images: Rubius Therapeutics investor presentation July 2018

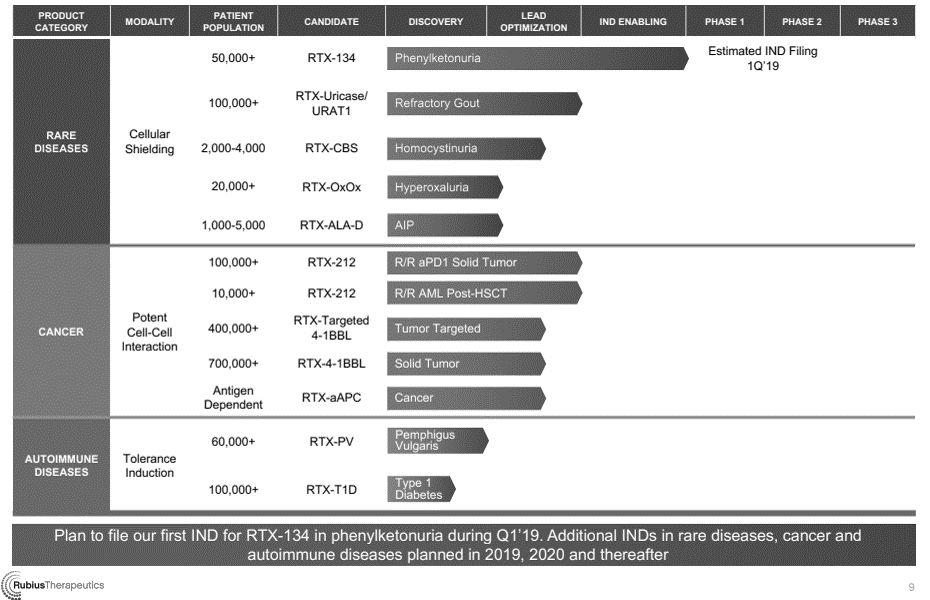

Pipeline

Pretty much every biotech company has a pipeline chart like this on their site and investor presentations. Even if you are a platform therapeutics company, you'll probably want to develop your own products at some point. Think of them as "killer apps" for your platform. Most companies that raise a Series A have at least one product.

This example is from Rubius Therapeutics, probably the most prominent recent preclinical biotech IPO. Yours probably won't be as big as this, which is fine (Rubius raised hundreds of millions to do this work). If you are earlier stage, you can include more early-stage categories instead of just "discovery", "lead optimization", and "preclinical"; for example you can add "target validation", "target-to-hit", "hit-to-lead", etc.

Product summary

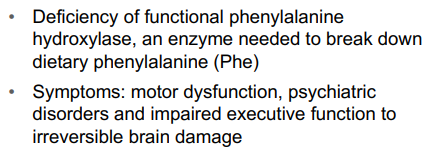

Once you orient the audience to what you're working on, you'll want to go one level deeper on each product.

I'm using the same Rubius pitch deck here, as I think Rubius does a really nice job here concisely describing all the important basics about a product (Rubius has slides for each of its core products, but I just highlight one here). The specific information you choose to include will probably be a bit different, but the topics Rubius covers here are pretty universal.

Indication: It is nice that they have a concise description of the biology of the disease (which sets the stage for why their intervention will work) as well as a description of the symptoms and prognosis (to give the reader a sense of the unmet need).

Standard of care: This is quite important -- don't gloss over this or be glib, but don't just list a laundry list of drugs without doing your homework.

- Rubius does a nice job of being specific in describing the shortcomings of existing treatments and, in the case of Pegvaliase, how the unmet need is so high that they can command a high price even despite the limitations.

- You really want to talk to physicians who treat the disease to understand standard of care. A good order of operations is to read guidelines to get a sense of the relevant products, review the data, prescribing information and FDA documentation for those products, and then be informed when you talk to physicians. If you've never done physician calls before, you'll be amazed at how much you learn.

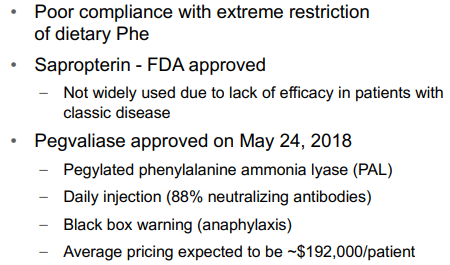

You want to include some description of your product as well. You don't necessarily need a full target product profile here, just the basics.

- Describe the mechanism of action and target at a high level (more detail can go in the discussion of your biology / platform)

- Describe any relevant dosing / route of administration info

- Describe any key features of your product. Does it need to be highly specific, or 10x more potent than standard of care? Will it have reduced tox compared to existing treatments? Is local vs. systemic activity important?

- Be specific about the indication. Don't just say you're treating "cancer", or even "non-small cell lung cancer". Be thoughtful about which line of therapy and which subpopulation you're starting with (though a full discussion of this should be in the "unmet need" and "development plan" sections). If you are really making sick people a lot healthier, you don't need a ton of patients to build a big company.

- Describe any key metrics, biomarkers and endpoints that will tell you if your product is working (can include more detail on this in the "development plan" section).

Data

This is really the meat of your pitch. When you meet with experienced biotech investors, oftentimes they'll flip to the data slides at the start of the meeting and read over them instead of listening to what you are saying. Most of them can understand your market, unmet need and value proposition in 30 seconds, and their big question is "does this work" / "could it work better than the other 50 products in the space". If they pass on an investment, they'll often say "come back when you have x data".

Some seed or earlier stage investors may not be as focused on data (or you may not have much), and may want to spend more time on your market, platform, team etc., but you always need to be prepared to talk about your data.

You can present a variety of types of data, but try to do so in a way that tells a story and pre-emptively addresses any obvious questions. Types of data you can use include:

- Clinical data: this is obviously great if you have it. If you don't, any "surrogate" human data can do a lot to validate your mechanism. If there is another drug with the same mechanism that works in your indication in humans, and you have a meaningfully and demonstrably better molecule, showcase that. The biggest risk in drug development is that things that work in animals fail in people, and if you can de-risk this it is highly valuable (see Delinia as a case study).

- Genetic link between your molecule / pathway and disease: if people with a loss-of-function mutation in your target have the exact phenotype you are trying to induce with an antibody (see PCSK9), or if they have a much higher risk for getting the disease (Apoe4), highlight that.

- Animal data: having good data in a well designed study of an accepted animal model in the disease of interest can be table stakes for raising seed or venture funding.

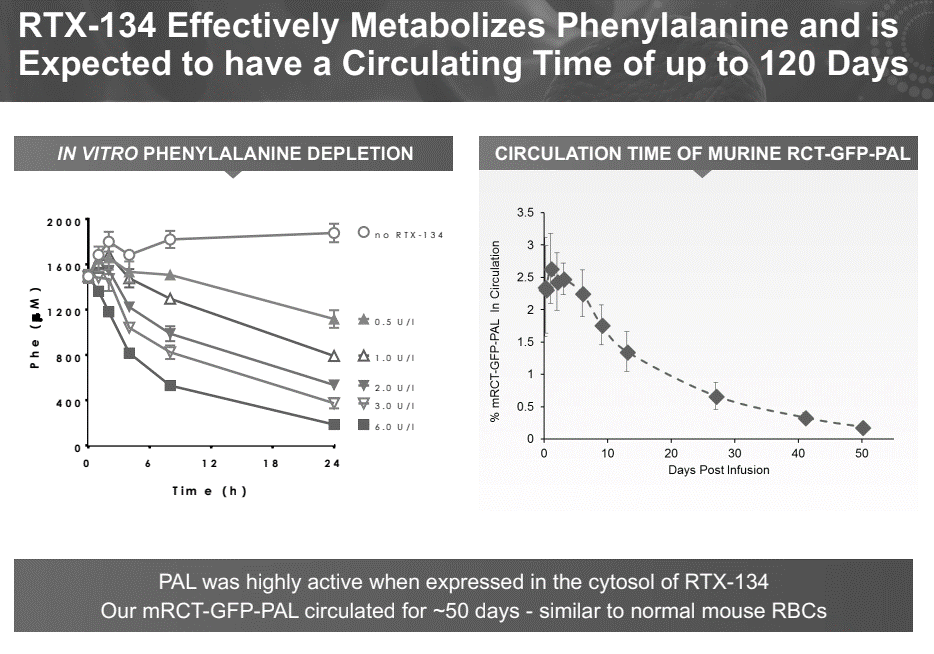

- In vitro: in vitro data showing effectiveness in relevant cell-based assays, and also data supporting the mechanism and pathway, is needed to support your animal data.

Describe the design of the study: disease model, test agents, controls, endpoints, blinding / randomization, etc. Can also discuss rationale behind certain decisions: why you selected this model, endpoint, etc. Then present the data. You don't need all the figures you'd include in a publication; just show enough to get the main conclusions across. It can be as simple as this for an initial pitch:

If the pitch is going well, you will get into a much more detailed discussion of the data, so be prepared to field a lot of questions, but you don't have time to go into the details of each study you've done, so listen to the investor and respond to their questions.

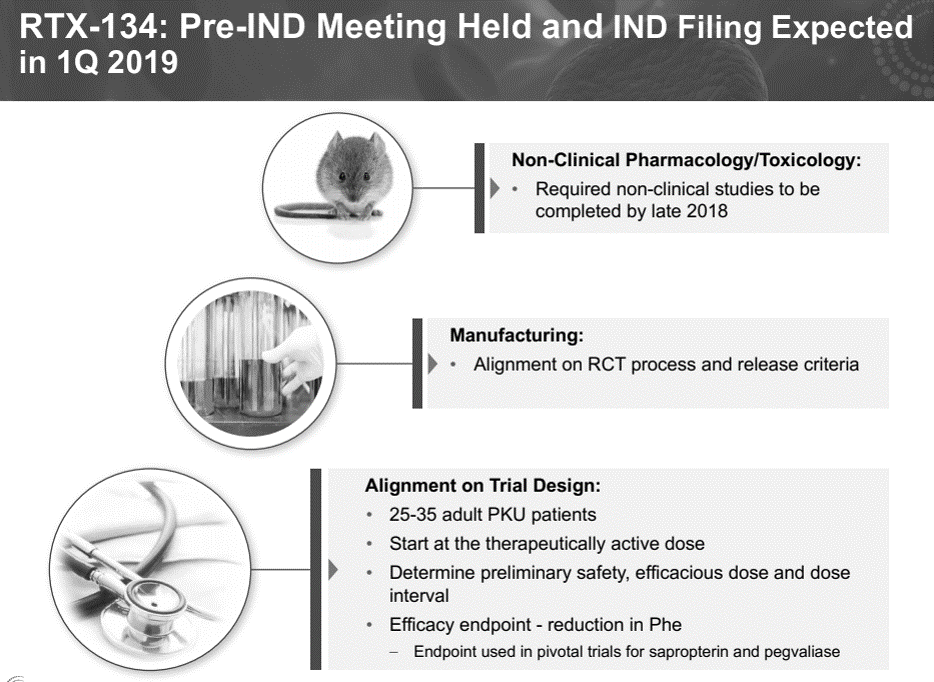

Milestones

This format is obviously just illustrative, but the content is good. When you raise money you are essentially "selling" a value-inflecting milestone. Often Series A investors these days will want to fund through your first Phase 1/2 human proof of concept study, or at least through a good chunk of preclinical development. If you are still a ways out from that milestone, break it into submilestones like Rubius does: finalize trial design, scale-up to clinical manufacturing, complete IND-enabling studies. If you are earlier than that, talk about the key animal studies you'll do, timing for selecting and optimizing leads, getting partnerships, etc.

But no matter how early you are, you should be thinking about what your Phase 1/2 studies will look like. Not only will this determine the kind of preclinical studies you need to do, but it is often the major milestone investors are funding (even if you don't get that milestone in your current round). Investors need to see the ultimate goal you're shooting for. Some investors may not be too focused on this, but you should be.

You really just want to show investors why the company will be much more valuable after you spend the money they invest.

It is important to be credible here. If you aren't sure how long something will take or how much it will cost, don't guess.

If you are a first-time founder, it can also be helpful to show how much you've accomplished during the life of the company. Most biotech startups are run by experienced biopharma executives who have managed drug discovery projects in big pharma for decades, so the execution risk is lower. If you don't have that track record, try to show how you've accomplished a lot in a short time with limited resources.

Read part three, Technology & platform, here.