Young CEOs have built many of the largest biotech companies

Richard Murphey, 4/17/2019

“I always maintain that the best attribute we had was our naïveté… I think if we had known about all the problems we were going to encounter, we would have thought twice about starting… Naïveté was the extra added ingredient in biotechnology.”

- Herb Boyer, co-founder of Genentech, as quoted in Genentech: The Beginnings of Biotech 1

“Genentech early on was a completely wild place. It was part of the excitement of being there. Young people doing breakthrough science and at the same time having real fun.”

- David Goeddel, interviewed by Sally Smith Hughes, 2001 2

When Jeff Marrazzo started Spark Therapeutics, he was just 34 years old. He was just 36 when Spark raised $161M in its IPO, and only 40 when Spark was acquired by Roche for $4.8B earlier this year.

Spark's extraordinary accomplishments are well-known: the clinical benefits of its products, the technical achievements of its team, the first-of-its-kind FDA approval, and the returns to investors. But what makes Spark most unique is something less widely discussed: the fact that Jeff built Spark while in his 30s.

Today, young biotech CEOs are almost unheard of. But that wasn’t always the case. Historically, young CEOs have started as many large, lasting biotech companies as experienced CEOs.

If young, inexperienced CEOs can build great companies, then why don't investors fund them? I’ll explore this question in this series of posts.

- This post will examine a few analyses of CEO age and startup success in biotech and tech.

- The second post will explore a hypothesis that biotech's current preference for experienced CEOs arose from a challenging and risk-averse period in the industry.

- The third post will describe some evidence that biotech is emerging from this "dark age" and present a case that conditions are good for young scientists to build the next generation of lasting biotech companies.

It's a great time to start a biotech company, but young biotech CEOs face unique challenges that aren't addressed by the existing startup ecosystem. The biotech VC world is built to help experienced pharma executives transition to entrepreneurship. The tech startup ecosystem provides immense support to young programmer-CEOs. There's comparatively little support for young biotech entrepreneurs, so it isn't surprising to see them starting fewer successful companies.

Age is just a number

Before jumping in, I want to emphasize that I'm not arguing that either “young / inexperienced” or “experienced” entrepreneurs are better. The data shows that great biotech entrepreneurs come in all ages and all levels of experience. But the current conventional wisdom is that only experienced CEOs can succeed in biotech. The goal of these posts is to challenge that perspective and encourage more investment in and support for the next generation of talent.

Young CEOs have built many of the most impactful biotech companies

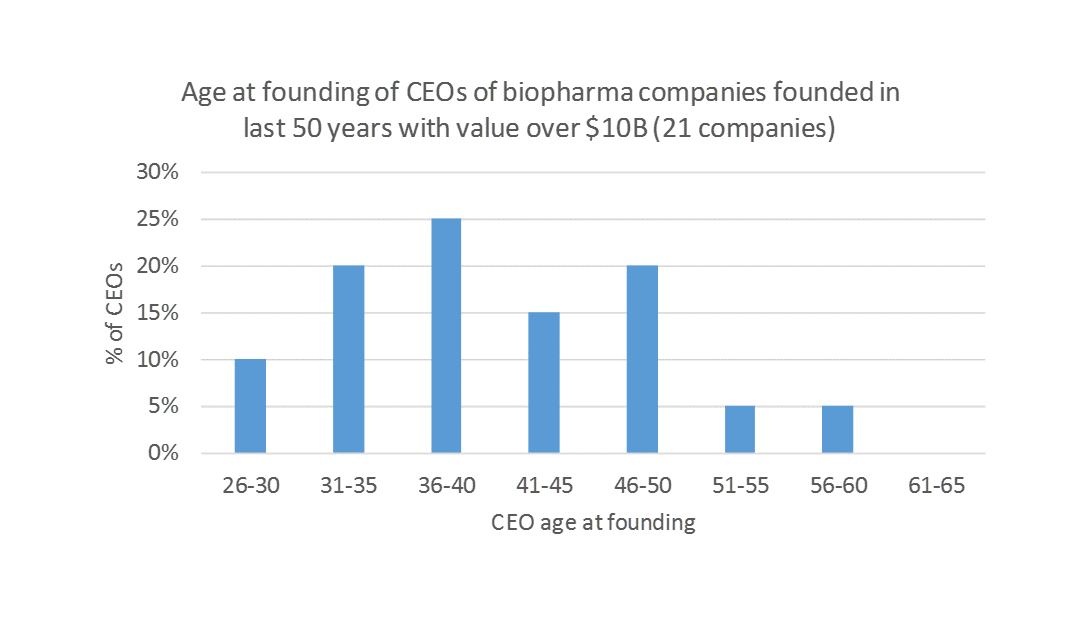

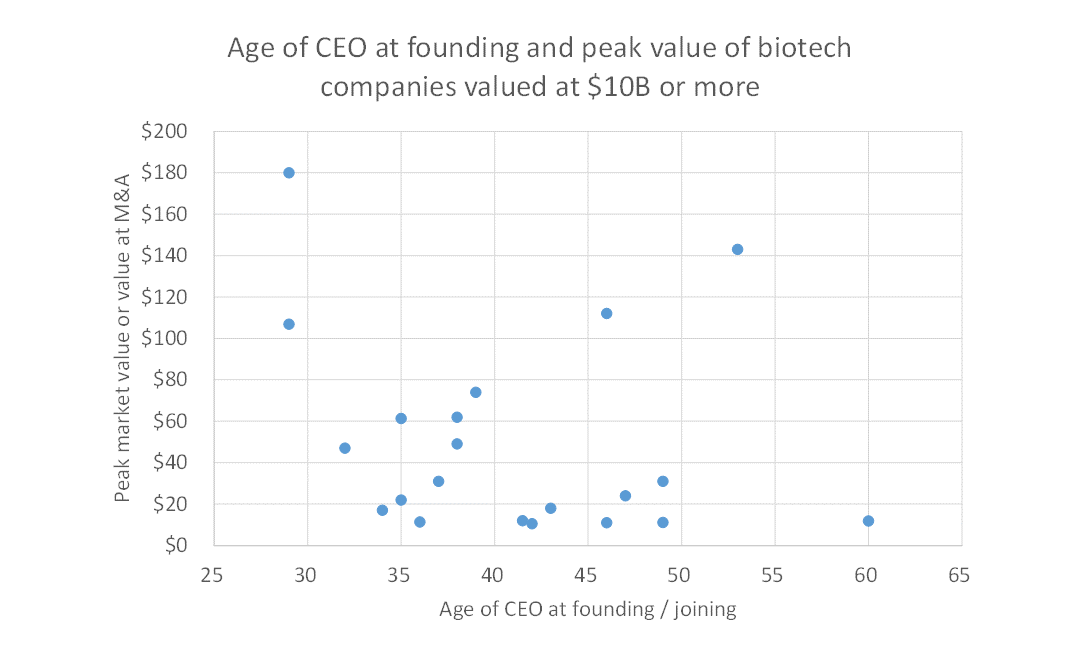

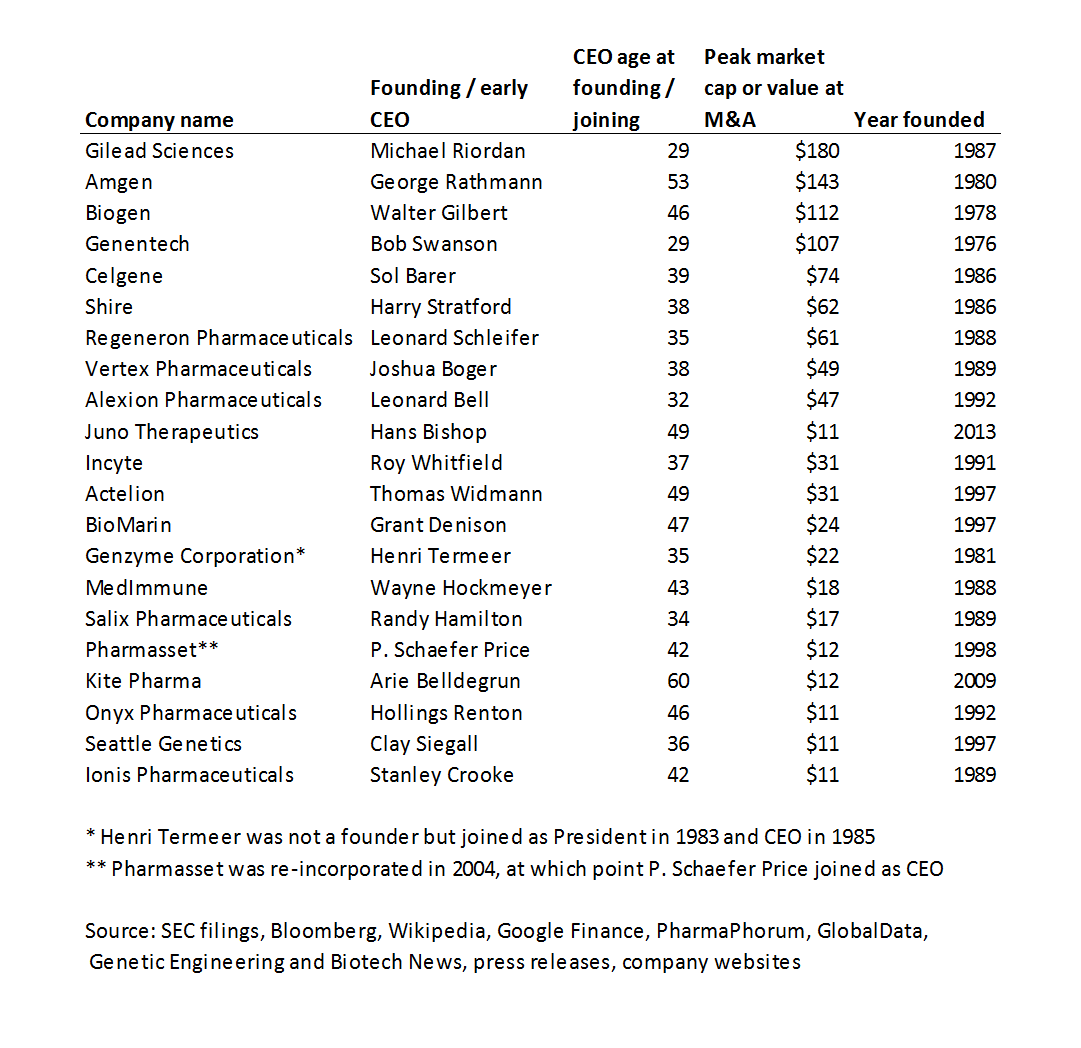

Throughout the history of the biotech industry, as many lasting biotech companies (defined as companies with $10B+ in market value or that were acquired for $10B+) were started by young CEOs (in this post, “young” = under age 40) as by experienced CEOs. Companies started by younger CEOs have grown larger than companies started by older CEOs 3. Two of the four biggest biotech companies of all time, Genentech and Gilead, were started by CEOs younger than 30. Only two $10B+ companies, Amgen and Kite, were started by CEOs over the age of 50.

But today’s startup ecosystem is heavily biased towards experienced CEOs. While it is difficult to find comprehensive data on the age of startup CEOs, anecdotally, venture investors overwhelmingly prefer experienced CEOs 4. I’ve tracked $17B worth of venture investments into biotech companies in 2018, and while I have not analyzed the CEO’s age at each of these companies, I can only think of two young CEOs that raised Series A or later rounds for biotherapeutics companies in 2018: Alice Zhang at Verge Genomics and Armon Sharei at SQZ Biotech.

The data I used is presented below 5. To my knowledge, there is no unbiased dataset examining the age of CEOs of all biotech companies ever started. This dataset of companies started in the last 50 years that were acquired for $10B or more, or that trade at market caps of $10B or more, is 1) a tractable dataset and 2) represents the most successful biotech startups of all time. I was able to compile a list of 21 such companies using public sources 6. I've tried to create a comprehensive list, but corrections / additions are welcome. 7:

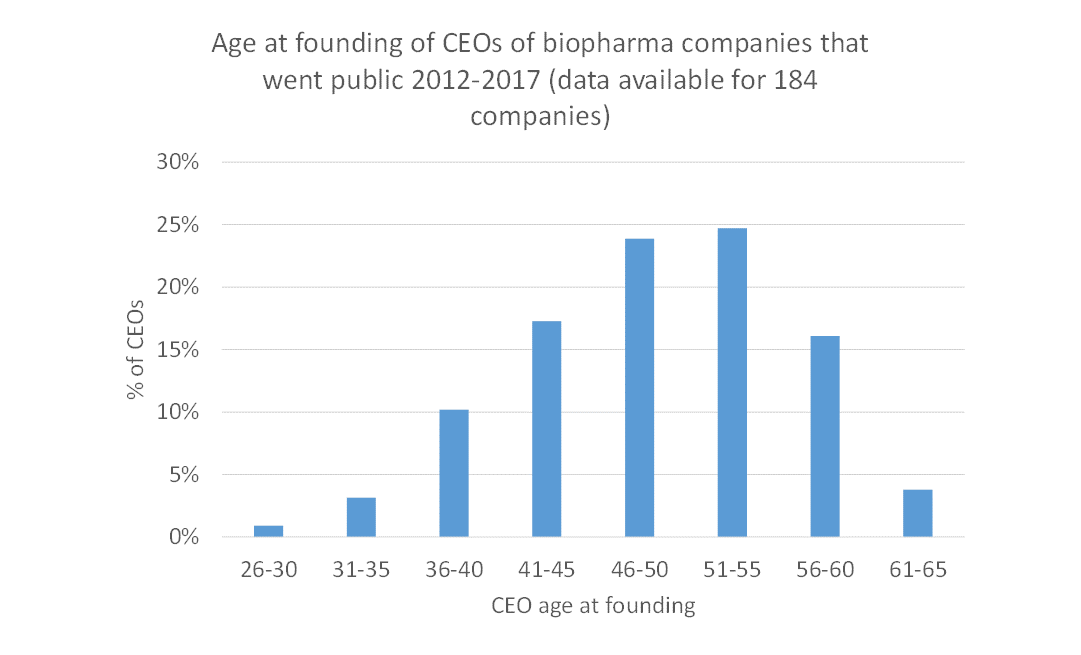

There are a few other analyses of CEO age and startup success. One analysis showed that the majority of biotech companies that recently went public have CEOs older than their mid-40s.

Based on avg. time from founding to IPO of 4 years of 2018 IPOs

The major limitation of this analysis 8, which the author acknowledges, is that in the last couple decades there has been almost no VC investment in biotech companies led by young CEOs 9. If no young CEOs receive funding, then we can't draw conclusions about the abilities of young biotech CEOs from this analysis. An alternative explanation for this data is that young CEOs are capable, but are not being funded.

Why VCs rarely invest in young CEOs is a good question, and one I'll explore in the next post.

In tech, young CEOs outperform

The above analyses are limited in that 1) they do not directly measure returns and 2) they do not include a baseline of all venture investments, including failed investments. I’m not aware of any datasets on biotech startup performance that don't suffer from these same limitations, but there is some such data for tech startups.

It may be tempting to dismiss any comparison between tech and biotech offhand. But biotech should be mindful of the history of young founders in tech. Just 10 years ago, tech startup CEOs looked a lot like biotech startup CEOs do today: successful mid-career executives hired by VCs to run companies as "professional CEOs". When Andreessen Horowitz was founded in 2009, the most controversial part of their strategy was a preference for young technical founder-CEOs. The arguments that tech VCs made to support their preference for experienced CEOs echo the arguments biotech VCs made today: that young people can’t responsibly manage large sums of money, can’t manage people effectively, or can't build successful organizations. Things change quickly in venture capital.

Perhaps more importantly, it suggests that talented young CEOs can close the “experience gap” very quickly, through earning their own experience and / or by building an experienced team. Investors value startups based on future growth potential, but often value CEOs based only on their past accomplishments. Quick-learning young CEOs provide the benefits of youth and rapidly absorb the lessons of experience.

The best analysis I've seen of age (as a proxy for experience) and founder performance is an analysis from First Round Capital of 10 years of its investments in tech startups 10. First Round is one of the leading tech seed funds (there isn’t really such a thing as a seed fund in biotech – and there wasn’t such a thing in tech until First Round). They analyzed the performance of their investments over a 10-year period, covering over 300 companies and 600 founders.

The study found that younger founders outperformed. The average age of a First Round-funded founder was 32, but teams with average founder age of under 25 performed nearly 30% above average.

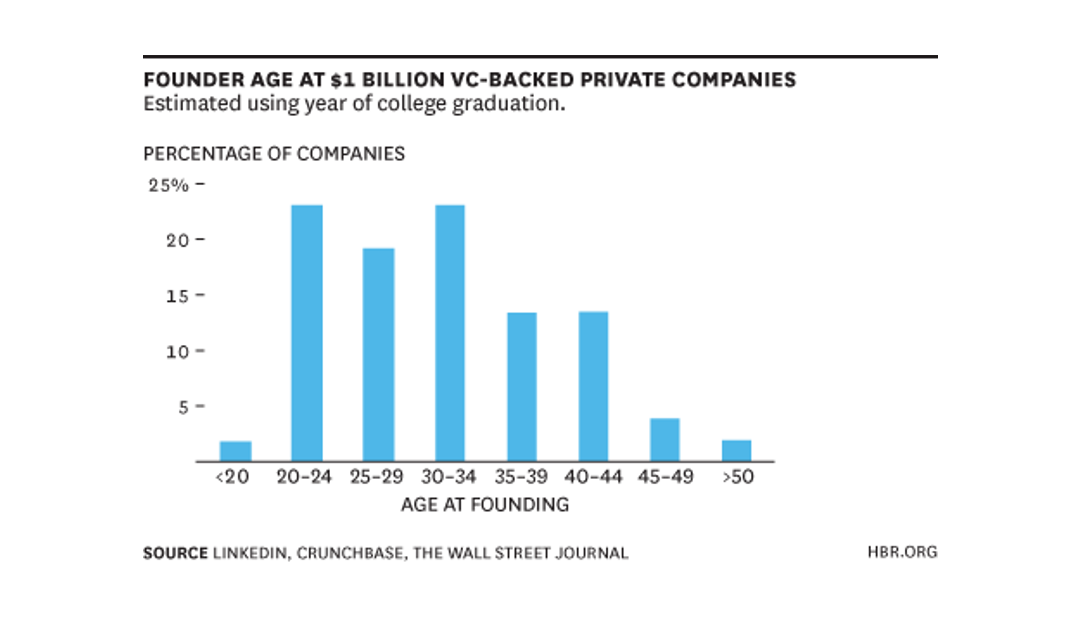

When we look at a broader sample of tech startups, we find more evidence that younger CEOs can build great companies. A Harvard Business Review article examined the ages of founders at tech “unicorns”: companies valued at $1B or more. This is somewhat analogous to our study of CEO age at founding of $10B+ biotech companies, but obviously in software, not biotech; with a lower valuation threshold; and looking at a shorter time period.

"Young" tech CEOs are younger than "young" biotech CEOs, likely because even inexperienced biotech CEOs will likely have a PhD or some postdoc experience. When we adjust for academic training, it looks like CEOs with 0-10 years of professional experience are particularly capable of building large companies.

If all this is true, then why don’t investors fund young biotech CEOs? I'll discuss this in the next post.

Sign up to stay updated on future posts

1 Genentech: The Beginnings of Biotech. By Sally Smith Hughes. Chicago: University of Chicago Press, 2011.

2 David V. Goeddel, Ph.D., "Scientist at Genentech, CEO at Tularik," an oral history conducted in 2001 and 2002 by Sally Smith Hughes for the Oral History Center, The Bancroft Library, University of California, Berkeley, 2003. Accessible at http://www.lib.berkeley.edu/libraries/bancroft-library/oral-history-center. Quoted with permission according to "fair use" standard: http://www.lib.berkeley.edu/libraries/bancroft-library/oral-history-center/rights

3 For companies that were acquired, I looked at value of the company at the time of acquisition, and for companies that were public, I looked at the peak market value of the company. I then plotted the value of companies against the CEO age at founding (or joining, if the CEO joined a few years after founding as is the case with Genzyme or Pharmasset).

4 Tech VCs have started to become more active in biotech in the last ~2 years, and many of these investors prefer to fund young CEOs. However, most of these investors focus more on computational or data science founders than biologist founders. Further, most of these investments are in seed rounds, and it is unclear how many of these companies will go on to raise Series A rounds.

5 I’ve only included companies that were either acquired for over $10B or that currently trade at over $10B. Thus I have not included companies that previously traded at a market cap of over $10B, but no longer trade at that level. The reason for this is simply that I could not find a good dataset of all biotech companies that have traded at over $10B at some point over the last 50 years. Bluebird bio, Sarepta and Alnylam come to mind as companies that recently traded at market caps of over $10B but no longer trade at that level. Bluebird was founded in 1992 as Genetix Pharmaceuticals but “refounded” in 2010 as bluebird bio with Nick Leschly as CEO along with Third Rock and Genzyme leading the Series B. Nick was ~38 when he became CEO. Sarepta was founded in 1980 as AntiVirals and later AVI Biopharma. I’m not aware of who originally founded the company or who the CEO was. The company went public in June 1997. Denis Burger became CEO in 1996 and was CEO at the time of IPO, and was 54 years old when the company went public. The company’s stock shot up and crashed with the dotcom boom. Chris Garabedian was CEO from 2011-2015 and was ~44 when he became CEO. Douglas Ingram was ~52 when he became CEO in 2015. Alnylam was founded in June 2002. John Maraganore has served as CEO since 2002 when he was ~39. He joined ~6 months after the company was founded so was not technically a founder.

6 This analysis is based on lists from several public sources, including Google Finance, Wikipedia, Fortune 500, PharmaPhorum, GlobalData, SEC filings, Genetic Engineering and Biotech News, press releases and company websites. I excluded companies that primarily manufacture generic drugs, non-FDA regulated medicines or consumer products, diagnostics or tools, or medical devices.

7 One complementary dataset is a Silicon Valley Bank report on biotech venture investments and exits. According to Silicon Valley Bank, there have been 75 VC-backed biotech “unicorns” – companies with valuations of over $1B that have been acquired or gone public – from 2013 to 1H2018. I don’t have data on the ages of the CEOs of those companies. Further, looking at the count of companies over a certain threshold is a less valid proxy for returns that looking at the total valuation of the companies due to the “power law distribution” of VC returns: one Genentech is worth more than dozens of companies worth $1B each.

8 This chart is adapted from this analysis and assumes 4 years from founding to IPO (median time from founding to IPO for companies that went public in 2018; I don’t have data on median time from founding to IPO for IPOs in 2012-2017).

9 Further limitations include 1) the exclusion of companies that exited via M&A before going public and 2) focusing on number of IPOs is an imperfect proxy for success. Evaluating market value of public companies or, even better, returns to investors would be better metrics for success.

10 There are other studies of founder age and success, although a discussion of these is beyond the scope of this post. Some of these analyses suggest that older founders are more likely to succeed, and some suggest young founders are more likely to succeed. The most notable recent such study I am aware of is “Age and High-Growth Entrepreneurship” from March 2018. This study concludes that older founders are more likely to succeed than young entrepreneurs, but the authors define success as growth in employment using Census records. This is a less-than-ideal metric, especially for biotech and software industries, which often can grow very large with very few employees. The study also claims that they analyze success based on sales growth, however, I did not see any charts, figures or data in the manuscript related to sales growth, and I’m not sure how they would get sales data for private companies. In any event, biotech startups don’t generate sales, and the valuation and returns of many tech startups is not necessarily tightly correlated with sales, so while this is a helpful piece of evidence, its methodology make it less relevant for analyzing performance of tech and biotech CEOs.