A new kind of biotech startup needs a new kind of founder

Richard Murphey, 4/26/2019

“Most successful founders would probably say that if they'd known when they were starting their company about the obstacles they'd have to overcome, they might never have started it. Maybe that's one reason the most successful startups of all so often have young founders.”

- Paul Graham, co-founder of Y Combinator, in "Schlep Blindness"

“Twentieth-century companies, competing in slower-moving markets, could thrive for long periods on a single innovation. If the VCs threw out the founder, the professional CEO who stepped in could grow a company without creating something new. In that environment, replacing a founder was the rational decision.

But 21st century companies face compressed technology cycles, which create the need for continuous innovation over a longer period of time. Who leads that process best? Often it is founders, whose creativity, comfort with disorder, and risk-taking are more valuable at a time when companies need to retain a startup culture even as they grow large.”

- Steve Blank, Startup Stock Options

In the previous post, I argued that biotech investors’ preference for experienced CEOs was a rational reaction to the tough biotech environment of the 2000s. In this post, I'll argue that the startup world has emerged from these "dark ages", and that young founders are positioned for success in this new world.

We are seeing a new generation of biotech companies emerge, built on next-generation technology. Unlike the build-to-buy startups of 10 years ago, these new startups increasingly don't need pharma, opting to do late-stage development and even commercialization on their own. History tells us that young scientists may be well suited to leading these ambitious, science-driven companies.

The return of big biotech startups

The days when $500M exits were as good as you could hope for in biotech are gone. In the last 2 years, several biotech startups have grown to $5-10B+ valuations just ~5 years after raising their first round of venture capital.

These companies are getting bigger, faster than even tech startups. When Kite was acquired in 2017, it was more valuable than Dropbox, and about as valuable as SpaceX and Twitter. Kite became a "decacorn" more quickly than all of those tech companies. The days when only software companies could become huge are behind us.

Notably, all of these companies are built upon next-generation therapeutic technology (Loxo is a small-molecule company but is groundbreaking in that its lead drug is the first cancer drug developed specifically to treat tumors based on genetics rather than tumor location). These companies all have valuable, late-stage assets, but considerable value lies in their scientific, technological and manufacturing platforms.

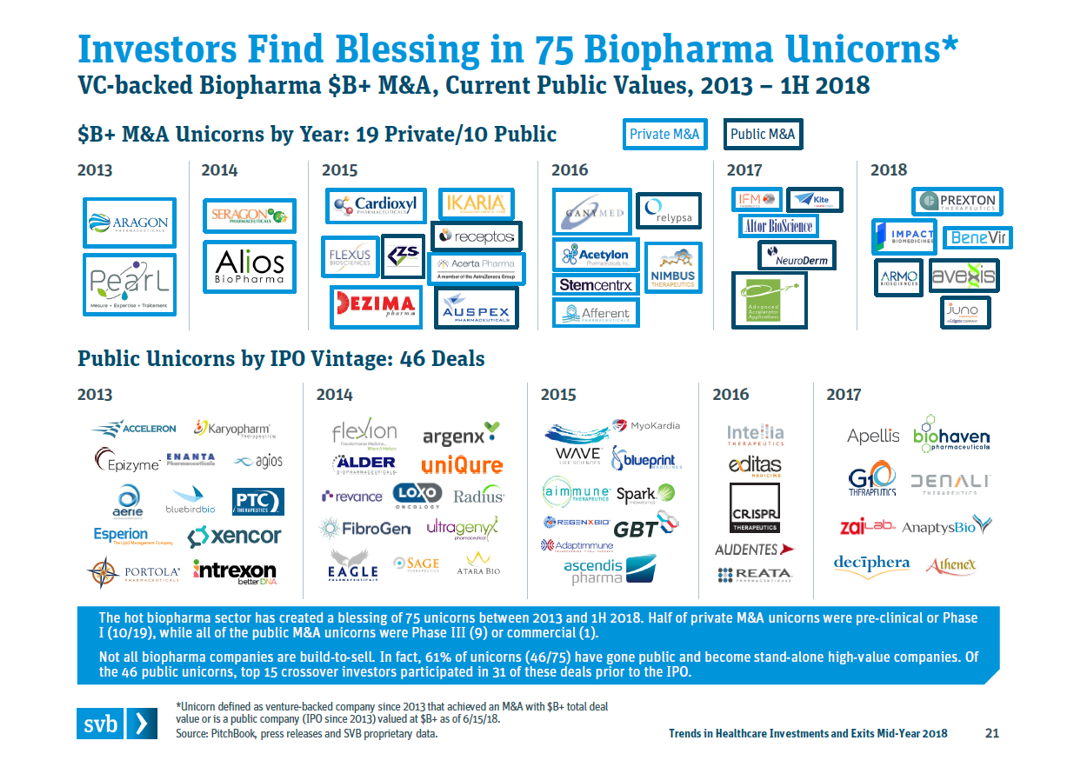

These startups that grow to $5B+ valuations are rare, but there are quite a few companies in the $1B-5B tier. Between M&A and IPOs, a total of 75 biopharma startups reached $1B+ “unicorn” valuations from 2013-1H2018.

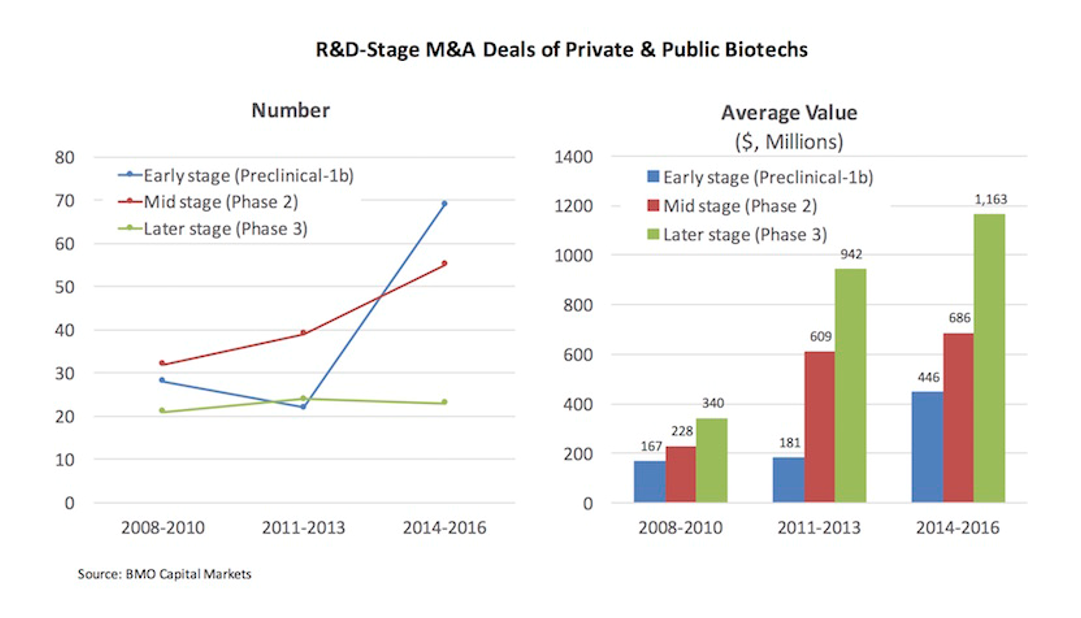

These “unicorns” reflect a broader trend towards biotech startups becoming more valuable, more quickly. The below figure from Bruce Booth’s blog (analysis done by BMO Capital Markets), which we discussed briefly in the last post, shows that this trend toward earlier and bigger exits is generalizable across all M&A exits.

M&A valuations are increasing across the board. In 2008-2010, the average M&A exit was $167-340M depending on stage. In 2014-2016, the average value at M&A exit is $450M-1.2B. The average preclinical-Phase 1 M&A valuation in 2014-2016 was greater than the average Phase 3 valuation in 2008-2010.

As we will discuss later, the re-emergence of the “big exit”, and the fact that a good Phase 1 company today is more valuable than a good Phase 3 company 10 years ago, makes a whole new set of companies “venture-backable” 1.

What’s enabling these companies to grow so fast?

Some of the increase in startup valuation is market-driven: pharma, having cut R&D en masse over the last decade and buffeted by patent expiries on blockbuster drugs, is forced to pay up to buy products from startups to sustain revenue growth. At the same time, generalist investors, having endured a decade of low interest rates and increasing competition for promising assets, are flocking to biotech, an area that has until recently been the last major bastion of specialist investors.

But there’s evidence of strong fundamental drivers of this wave of fast-growth, high-value biotech startups.

FDA is more supportive of innovation

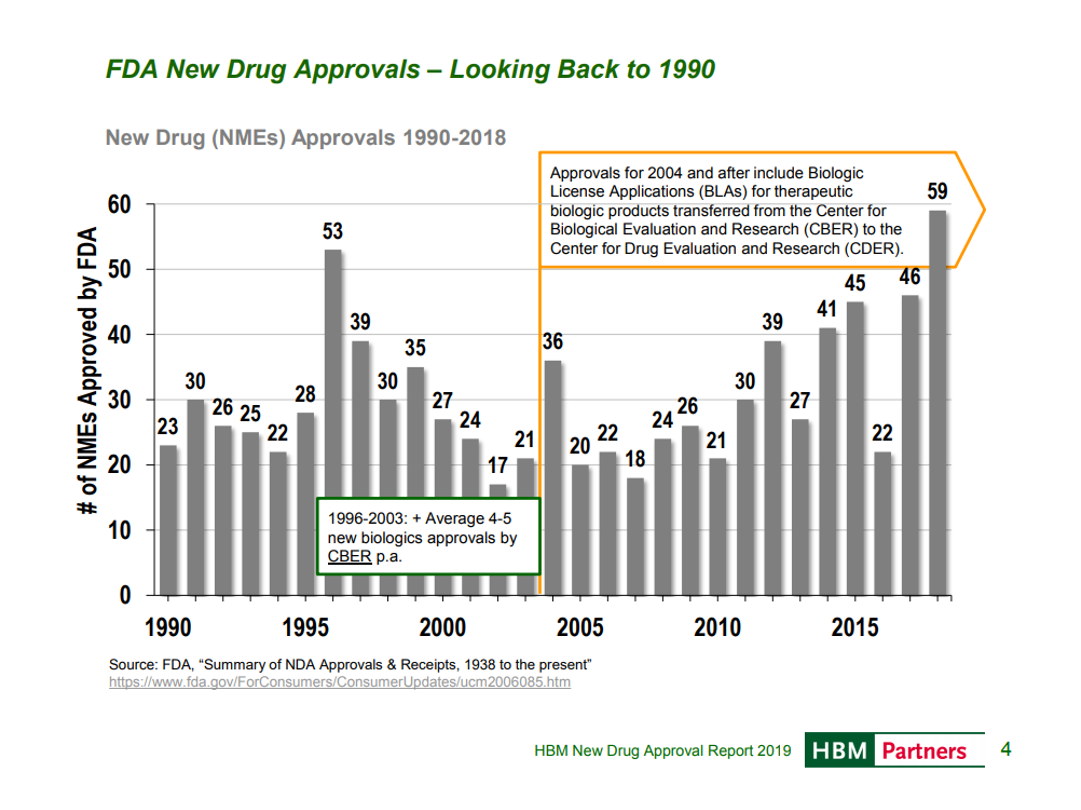

The last post showed that in the 2000s, FDA was approving fewer drugs than in the preceding decade and the first years of the 2010s. In recent years, FDA has been markedly more supportive of innovation.

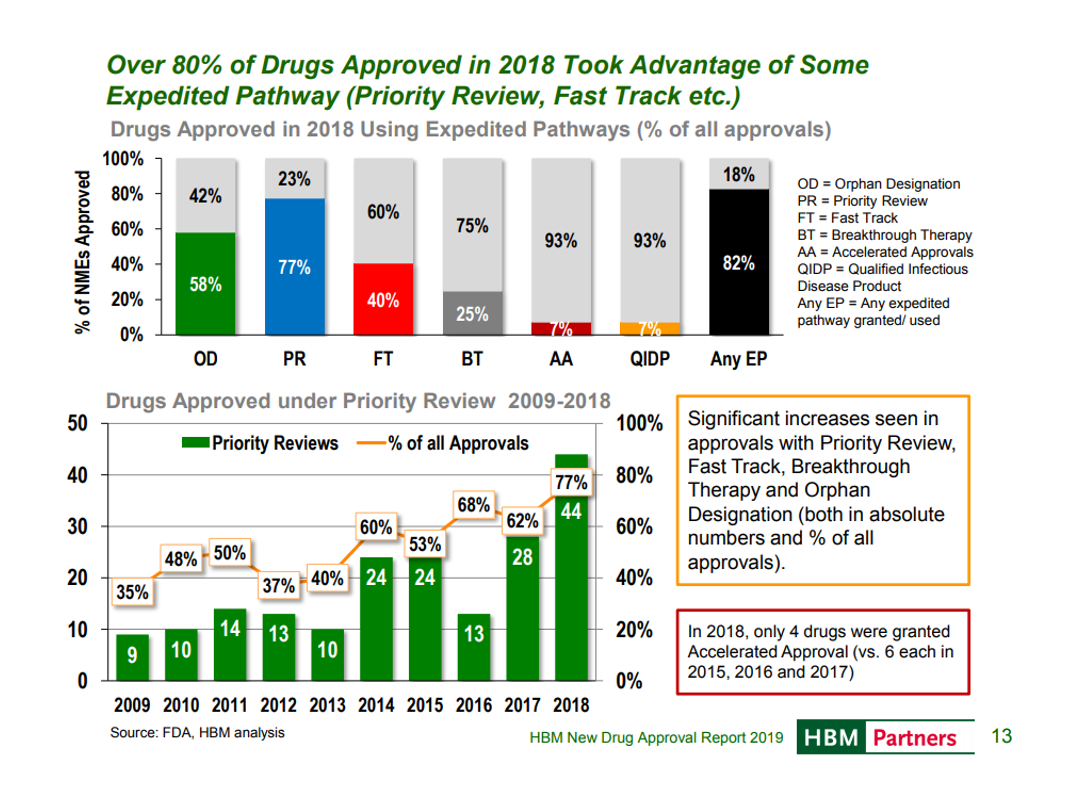

In 2018, FDA approved a record number of new drugs. An HBM report puts this in historical perspective:

FDA is not just approving more drugs, but making efforts to approve them faster and engage more with companies throughout the FDA process, with more drugs taking advantage of some expedited pathway.

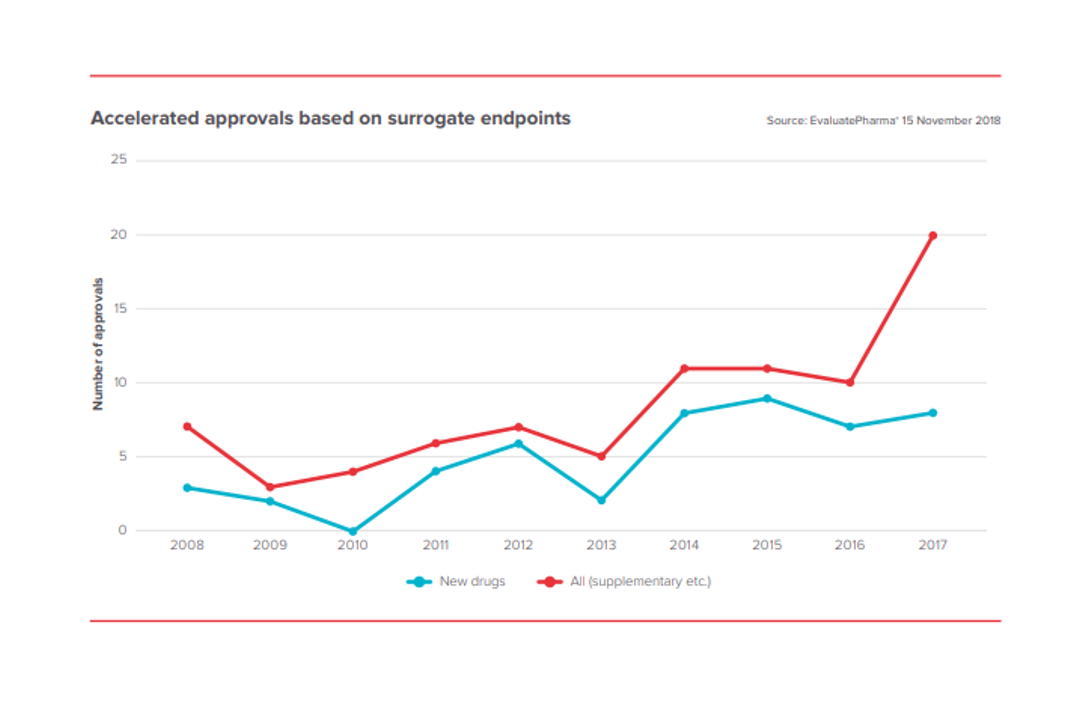

FDA is also approving more drugs based on surrogate endpoints. This dramatically decreases the cost of drug development, as it allows effectiveness to be demonstrated more quickly (you don’t need to wait for longer-term outcomes endpoints) and more cheaply (you can often measure significant improvements on surrogate endpoints with fewer patients than with outcomes endpoints).

FDA’s willingness to support innovation is critical to bringing novel therapeutic modalities like gene therapy, cell therapy and microbiome therapy to patients.

Transformative medicines

In the 2000s, the new transformative therapeutic modalities – oligonucleotide therapy, gene therapy, cell therapy, genomic medicine – proved to be more hype than reality. But these technologies have matured through the “trough of disillusionment” and are generating real, highly impactful medicines.

Advances in immunology have created checkpoint therapies that have turned some cancers from death sentences to manageable chronic diseases. Advances in genomics are improving clinical trial success rates, improving our understanding of biology, and redefining our conception of cancer; leading to drugs like Loxo’s Vitrakvi, which targets cancers with specific mutations, regardless of which tissues the tumors originate in. Advances in cell therapy have generated CAR-T therapies that have revolutionized treatment of B cell malignancies. Advances in gene therapy have given us potential cures for the most common genetic cause of infant death and a form of congenital blindness.

All of the $5B+ valuation startups I highlighted earlier are developing truly innovative therapeutic platforms. These are not pharma’s traditional small molecules or biologics 2. Big pharma has some of the most talented scientists in the world for developing small molecule drugs and biologics, and tried-and-true playbooks for developing them, but most of the expertise in these new modalities is in academia and small companies.

Drug failure rates turning around?

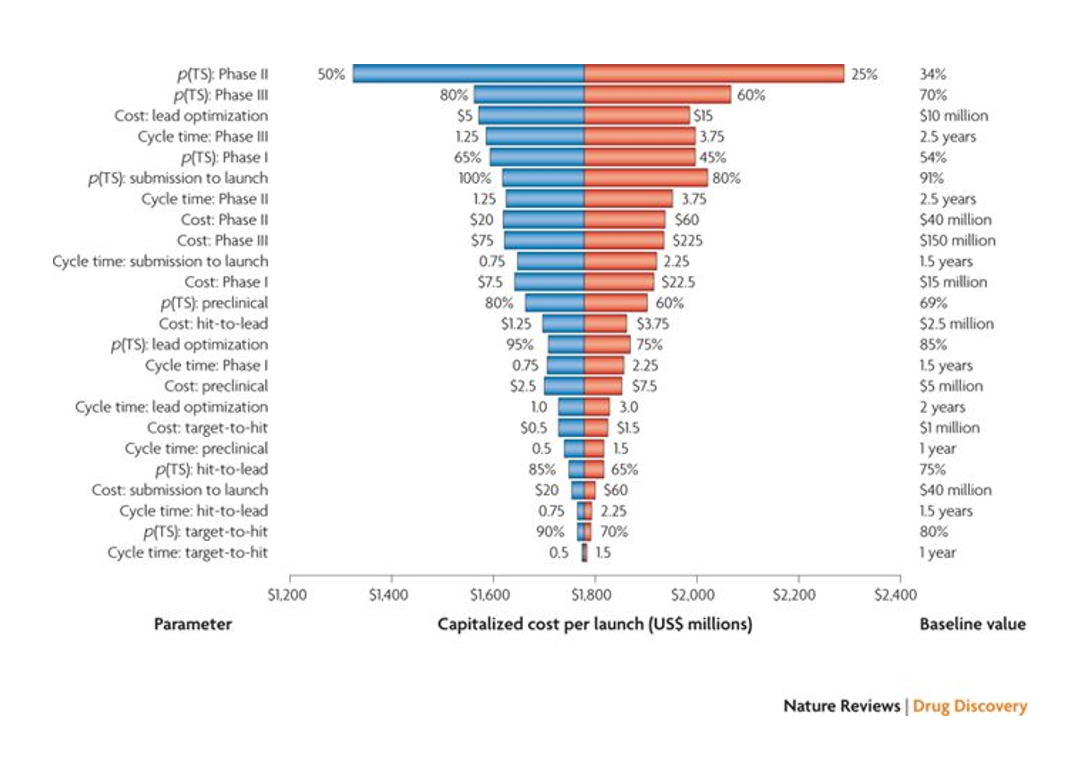

The exponentially increasing cost of drug development is the pharma industry’s “Sword of Damocles”. Despite massive improvements in efficiency at various stages of the drug development processes – some of these improvements approximating Moore’s Law in the magnitude of efficiency gain – the cost of drug development is increasing exponentially.

The biggest driver of the cost of drug development is Phase 2 failure. Phase 2 is the first time a drug’s effectiveness is tested in humans. It can cost $50-100M+ to get a drug through Phase 2, and 60-70% of drugs fail in Phase 2. Phase 3 failure is the second biggest contributor to the cost of drug development .

If we are looking to reduce the cost of drug development, improving clinical trial success rates seems a good place to start.

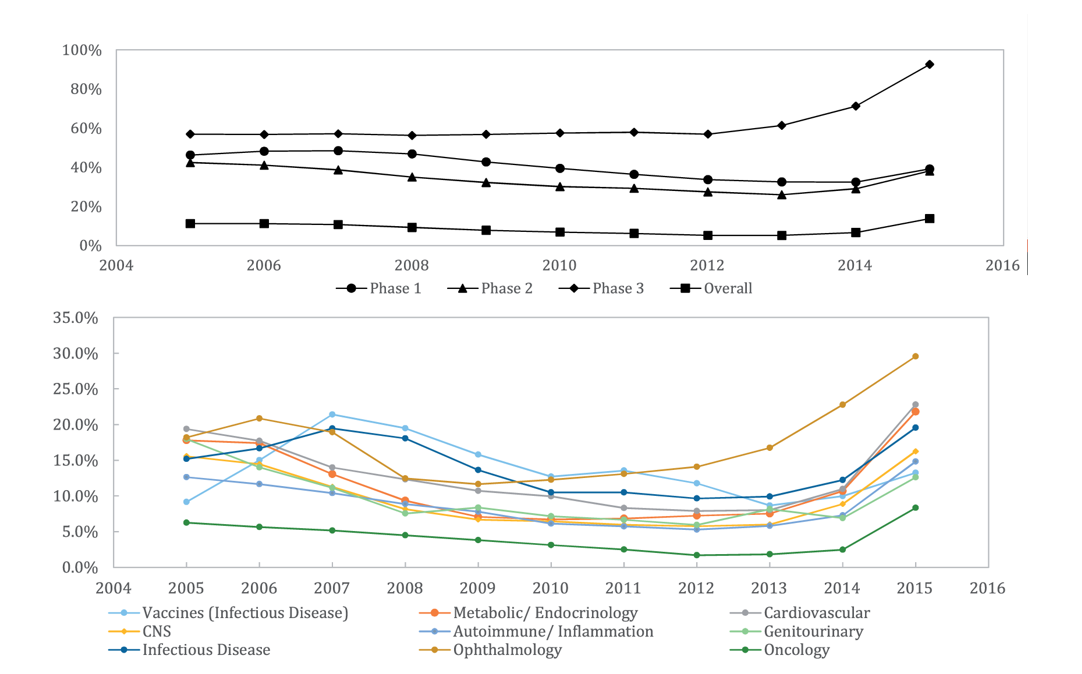

A recent paper out of MIT suggests the industry has been doing just that:

Probability of clinical success by clinical trial stage and disease area over time, Wong et al Biostatistics 2018

Consistent with the idea that the 2000s were a “dark age” in biotech and pharma, we see declining clinical success rates until ~2012. Then we observe an across-the-board improvement in success rates. The authors of the paper attribute this to 1) greater use of biomarkers in selecting patient populations for clinical studies and 2) a new wave of medical breakthroughs. FDA's aforementioned greater support of innovation undoubtedly also contributes.

A more supportive FDA enabling faster, cheaper approvals combined with higher clinical success rates makes it possible to take drugs all the way to approval on a startup budget. Kite, Juno, AveXis, Loxo and Spark took their lead drugs through, or near, FDA approval by the time they were acquired. Companies like Agios, Ultragenyx, bluebird bio and Sage are launching, or may soon launch, drugs themselves.

A new kind of startup needs a new kind of founder

The last time we saw new therapeutic modalities creating a wave of new drugs was the advent of recombinant DNA technology in the 1980s. The companies that paved the way in the development of the “second pillar” of pharma – biologics therapies – were all startups.

Most of these early biotech companies were led by young CEOs. Even the companies with experienced CEOs looked to their younger counterparts for inspiration. Amgen’s founding CEO, George Rathmann (who was 53 when he founded Amgen), looked to Genentech, founded by 29-year old Bob Swanson, as a model for how he ran Amgen. Genentech’s youth-driven culture allowed it to beat Biogen in several important categories.

When there is no playbook to follow, a big advantage of experienced CEOs who know the “rules of the game” disappears. Naivete can be a huge advantage when trying to build ambitious startups based on innovative technology. If you don’t know the conventional wisdom, it’s easier to challenge it. If you don’t know how hard things are, it’s easier to be ambitious and optimistic.

Technology for novel modalities is evolving rapidly. There is an immense space for more innovation in gene therapy, cell therapy, microbiome therapy and computational biology. There are huge technical hurdles to the development of the next generations of these modalities. While some of these hurdles will prove intractable, some will be overcome in the next few years. Will these advances come from the current leaders in the field -- companies that are led by former big pharma execs, or that have been acquired by big pharma? Or will these advances come from startups and academics with innovation in their DNA?

The lessons we learned from the golden age of biotech and the last two decades of software startups is that when technology is moving quickly, technologist-founders outperform. When the playbook has yet to be written, innovation becomes more important than experience. When technological challenges are daunting, naivete is an asset.

So where are the great biotech startups with young CEOs?

Investors are smart, and if there’s money to be made somewhere, they’ll invest. So why are so few young scientists starting companies and raising money?

In the next post, I’ll argue that there are few venture-backed biotech startups with young CEOs because young scientists and biotech entrepreneurs receive virtually no support, while experienced biotech CEOs and young tech CEOs benefit from tremendous amounts of support.

Sign up to stay updated on future posts

1 The increase in early-stage M&A values also created a huge windfall for the early-stage investors who were active in the 2000s. These investors invested at low valuations in an effort to generate venture returns on ~$300M exits. When their investments started exiting at $500M-1B, these investors generated massive returns.

2 Loxo’s drug is a small molecule, but the genetics and biology underlying the development of the drug are completely novel – it’s the first cancer drug approved specifically to treat tumors based on biomarkers rather than location (Keytruda was approved to treat any solid tumor with a specific genetic feature, but this was after it had been approved for treatment of multiple specific solid tumors and Keytruda was not designed to treat tumors with specific mutations, whereas Vitrakvi was).