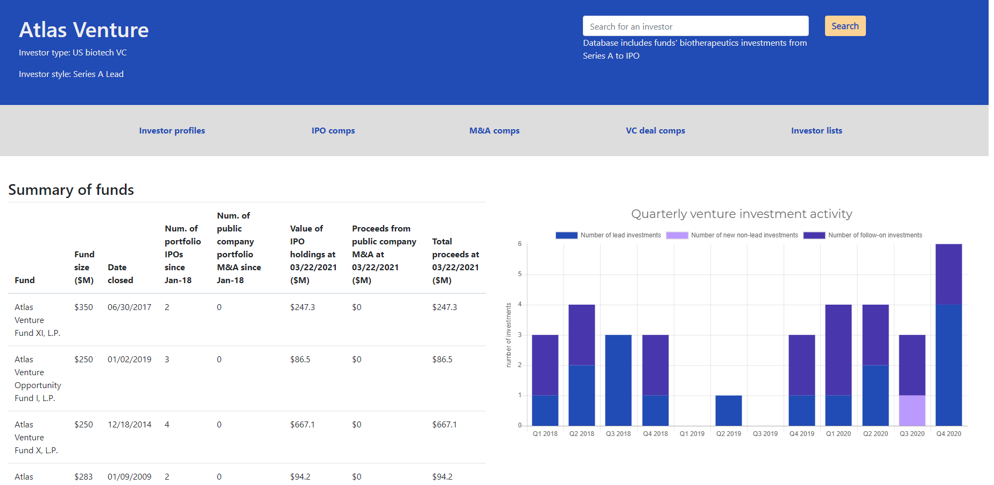

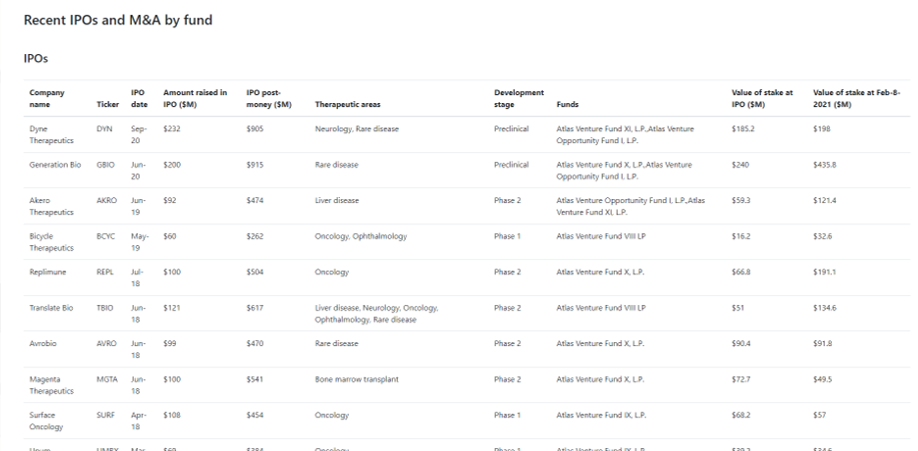

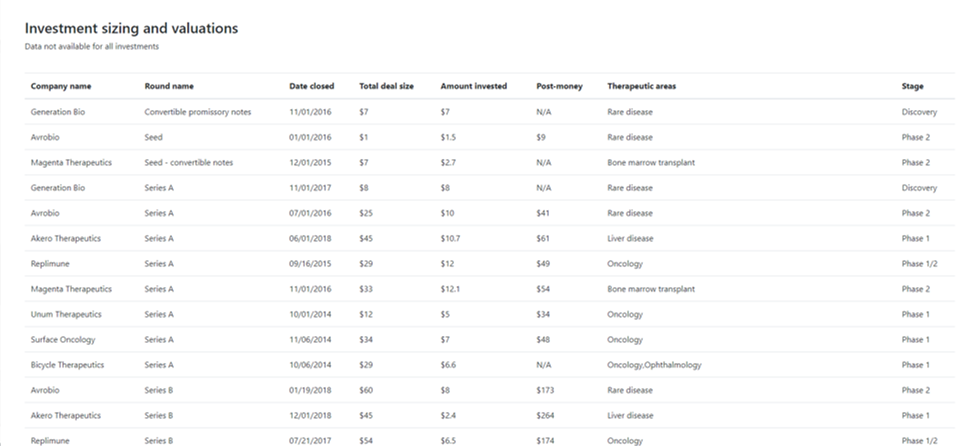

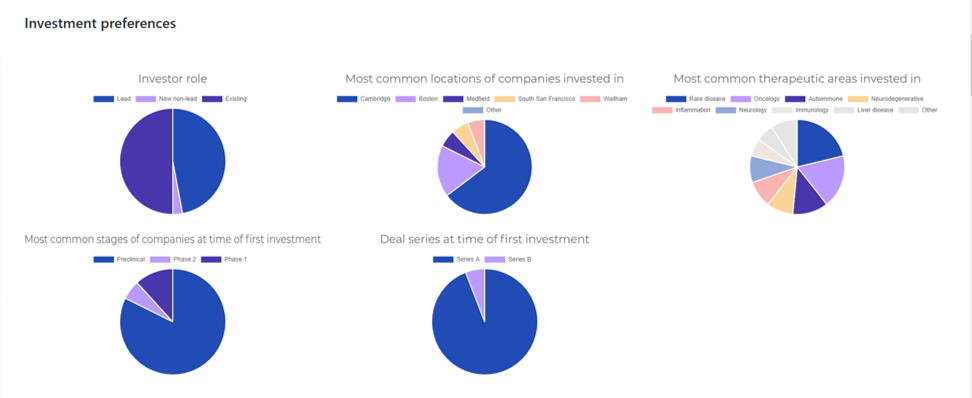

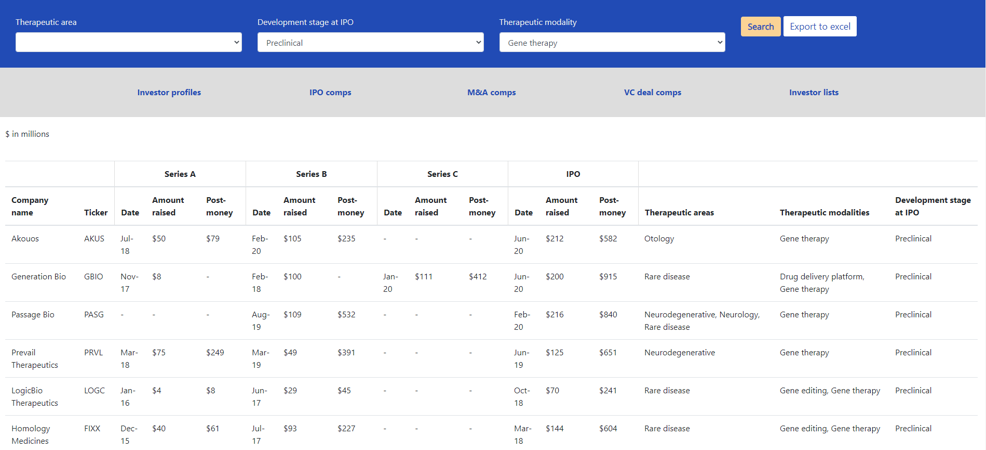

Biotech venture investor database

See how funds are faring during market turmoil with deal-level cash-on-cash returns, exit proceeds, check sizes, and performance metrics for 1,500+ biopharma investors covering $80B+ in global venture investment since January 2018.