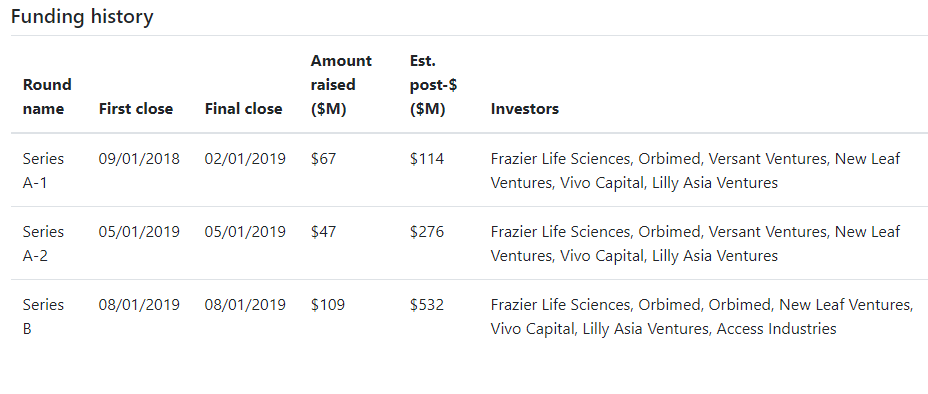

Valuations of over 250 recent biopharma venture rounds

Comprehensive data on biopharma startup funding and exit activity.

700+ startups, 1,100+ investors, and detailed profiles of 100+ venture-backed IPOs from 2018 through 1H 2020.

Comprehensive information on biotech startup funding and exit activity since 2018:

Estimated valuations of 250+ private venture rounds

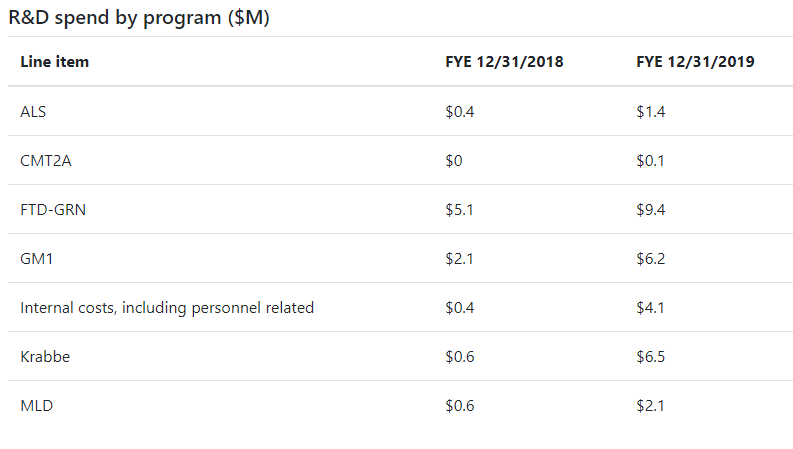

Breakdown of R&D spend by program and functional area for dozens of companies

Info on hundreds of private startups that have raised over $44B in venture capital since 2018: therapeutic area, development stage, and more

Investment activity for over 1,100 biotech investors

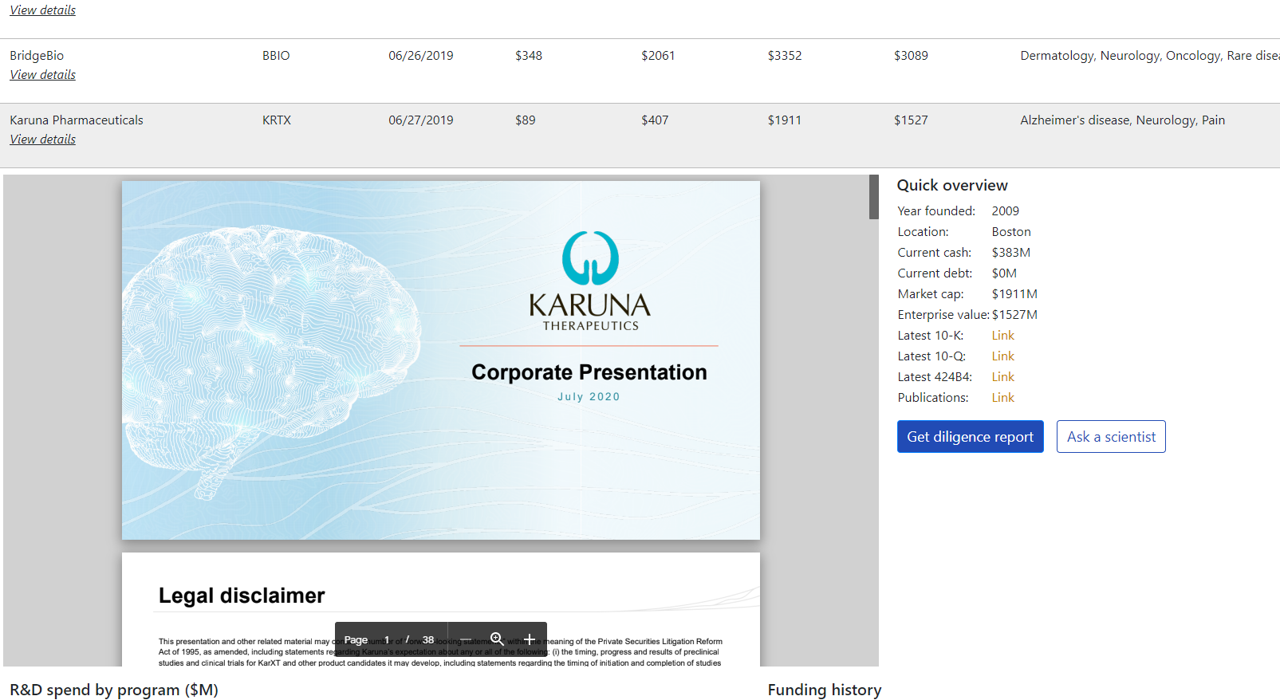

Quick access to investor presentations, SEC filings and publications for recent IPOs

Detailed IPO info: proceeds, valuation, post-IPO performance, and more

M&A comps

Negotiate better deals

Get an information advantage with estimated valuations of over 250 recent venture investments in biopharma startups.

Make your funding go farther

Benchmark you financial plan with breakdown of R&D spend by functional area for dozens of companies.

Quickly research public companies

Corporate presentations, SEC filings and publications at your fingertips. Access public and M&A comps by therapeutic area and development stage.

Find the right investors

Find investors who fund companies like yours. View recent investment activity of 1,100+ biopharma investors that have invested $44B+ in startups since January 2018.

Partner with venture-backed biopharma startups

Get in front of biopharma startups that have recently raised large rounds -- before they decide on new hires, partners or vendors.

Information on therapeutic area, location, development stage, funding raised and investors for 700+ biotech startups that raised a total of $44B+ since 2018.