The pending biotech IPO crunch

January 20, 2022

2021 was the best year ever for private biotech companies looking to go public. 2022 looks to be much more challenging, with a potentially massive supply / demand imbalance in the IPO market.

This post will discuss what happened to the IPO market in 2021, the implications of these changes for the biotech IPO market in 2022, and how these changes may ripple through to startup funding markets.

While it is likely that going public in 2022 will be challenging, the venture market remains well funded. Startups will still get funded, but the investors and terms may change.

Boom and bust: the 2021 biotech IPO market

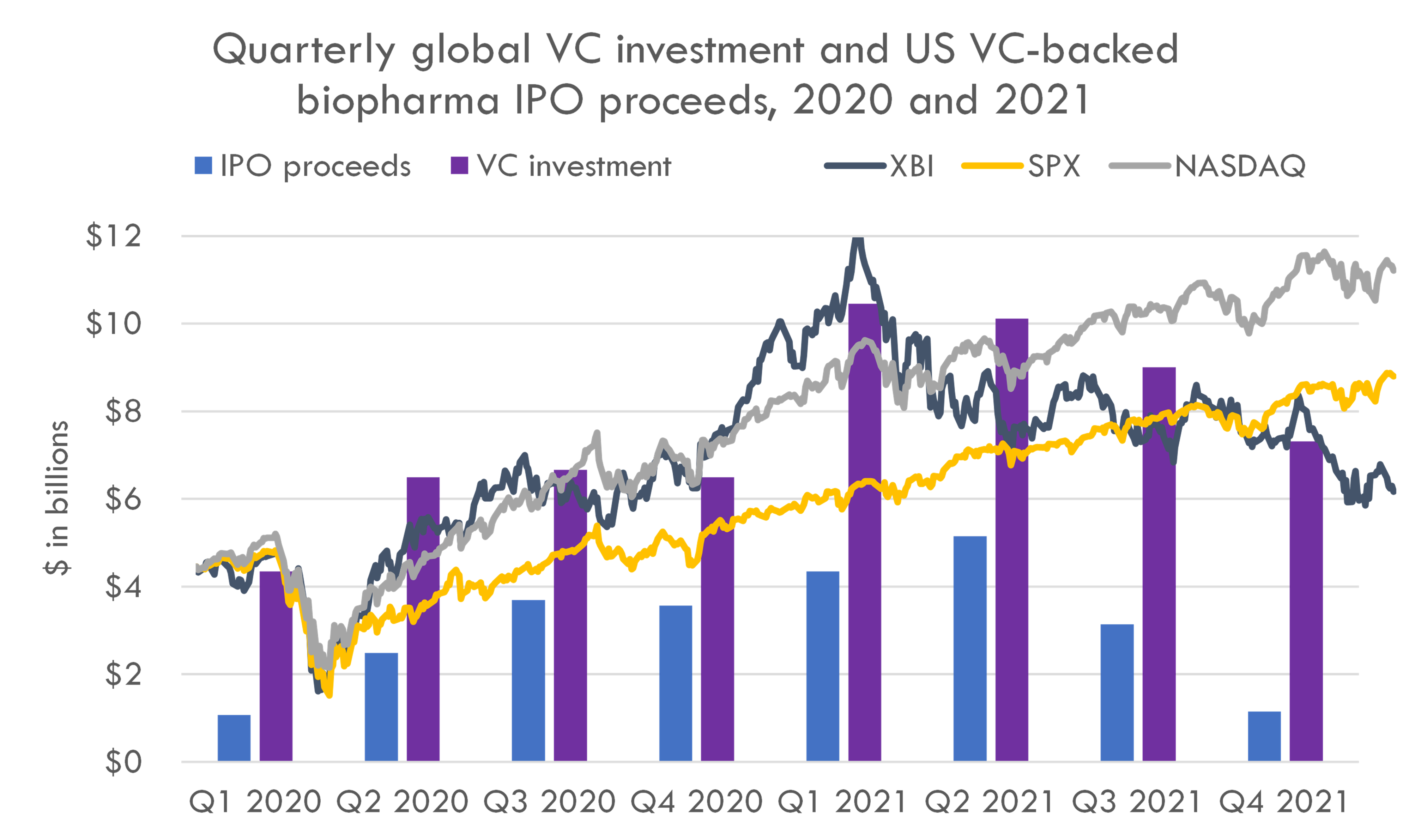

2021 started off with strong biotech stock performance: the XBI index of biotech stocks reached its peak in February. Increasing investor interest in biotech led to record biotech startup IPOs from January to August 2021.

But that momentum did not continue. Biotech stocks slumped after their February peak, with the XBI down 36% from the peak to the end of the year.

This market was not kind to the companies that went public in the first half of 2021. The stock price of companies that went public in 1H 2021 were down an average of 20% 180 days post-IPO.

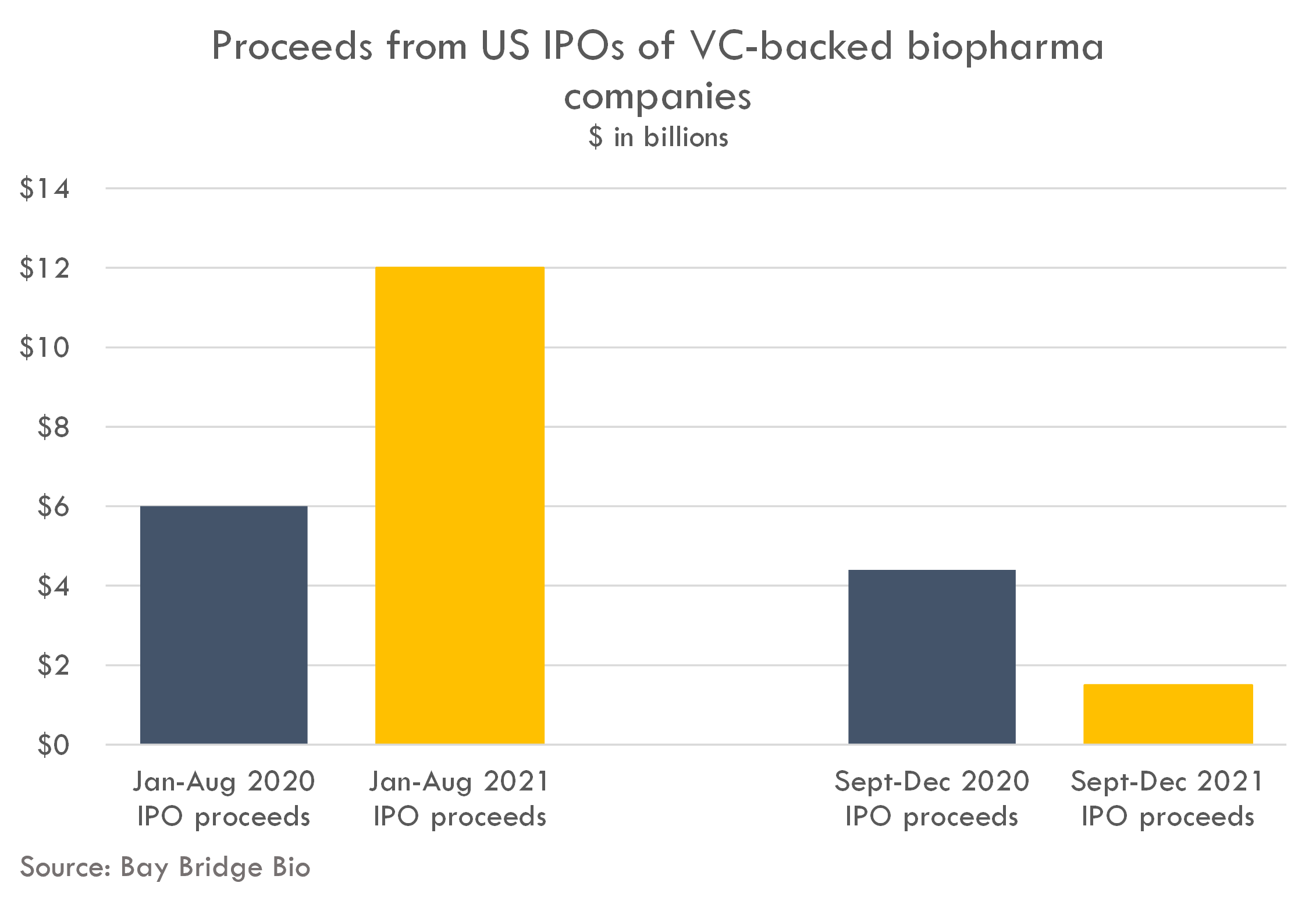

Given these significant losses, investors fled the IPO market. After raising $12B in the first eight months of 2021 (compared to $6B in the first eight months of 2020), only $1.5B was invested in US IPOs of VC-backed biopharma startups in the last four months of the year -- down almost 70% from the $4.4B raised in the last four quarters of 2020.

Benchmark VC performance

Deal-level cash-on-cash returns, proceeds from exits, check sizes, and more for thousands of biopharma investors covering $80B+ in global venture investment.

Structure of the biotech IPO market in 2022

Biotech stocks' losses in 2021 were so great that some funds faced redemptions, and some funds were rumored to have shut down. Some highly respected, multi-billion dollar funds saw assets under management cut in half over the course of the year. In addition to AUM contraction at some biotech funds, a large group of investors who flooded the IPO market during COVID have all but disappeared.

The biotech IPO market is supported by a handful of "anchor" investors who allocate significant amounts to investing in biotech IPOs. These investors increased their activity during COVID, with stimulus from the Fed driving increased risk-taking among investors. The market was also flooded with capital from "occassional" biotech IPO investors -- those who invest in biotech IPOs, but not nearly as often and consistently as the "anchor" investors.

These "occassional" investors (that we define as the 20th-50th most active biotech IPO investors, who invest in an average of 5-10 IPOs / year) picked up the pace of their investment at an unfortunate time at a peak in the market. Given the magnitude of their losses ($10B+ of investments down on average 20% 180 days post-IPO) and the continued biotech bear market, it doesn't seem likely that these investors will return to the biotech IPO market unless there is a dramatic rebound in biotech equities.

2022 outlook

The challenges for IPO-seeking companies is not limited to a decrease in the supply of capital from IPO investors. There is also an increase in demand for IPO capital due to the record amount of venture capital invested in private biotech startups in 2021. While the amount of venture capital invested did decrease in the second half of 2021 compared to the first half, Q4 2021 still saw the fourth highest level of quarterly biopharma VC investment on record (the other three quarters of 2021 are in first, second and third place).

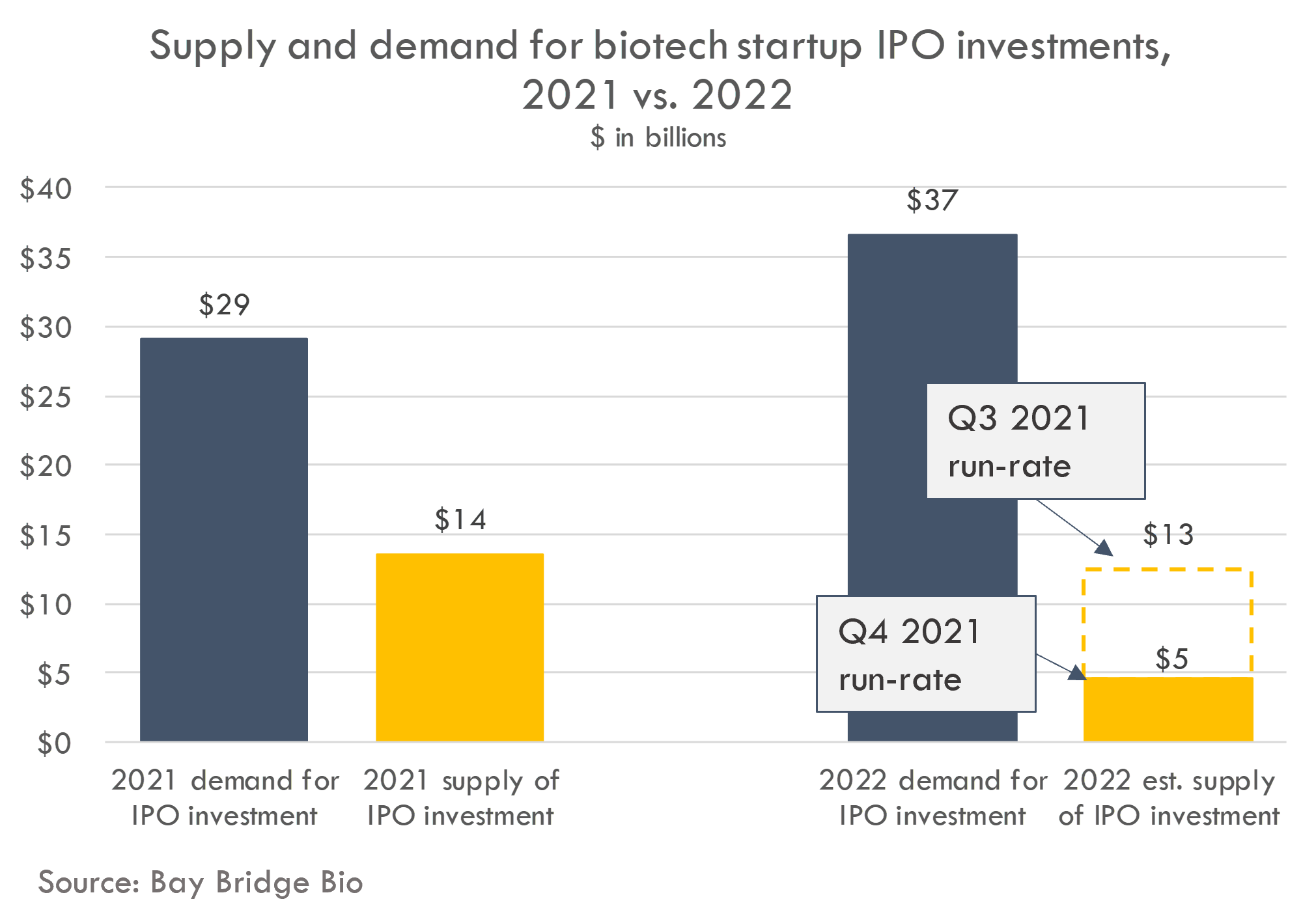

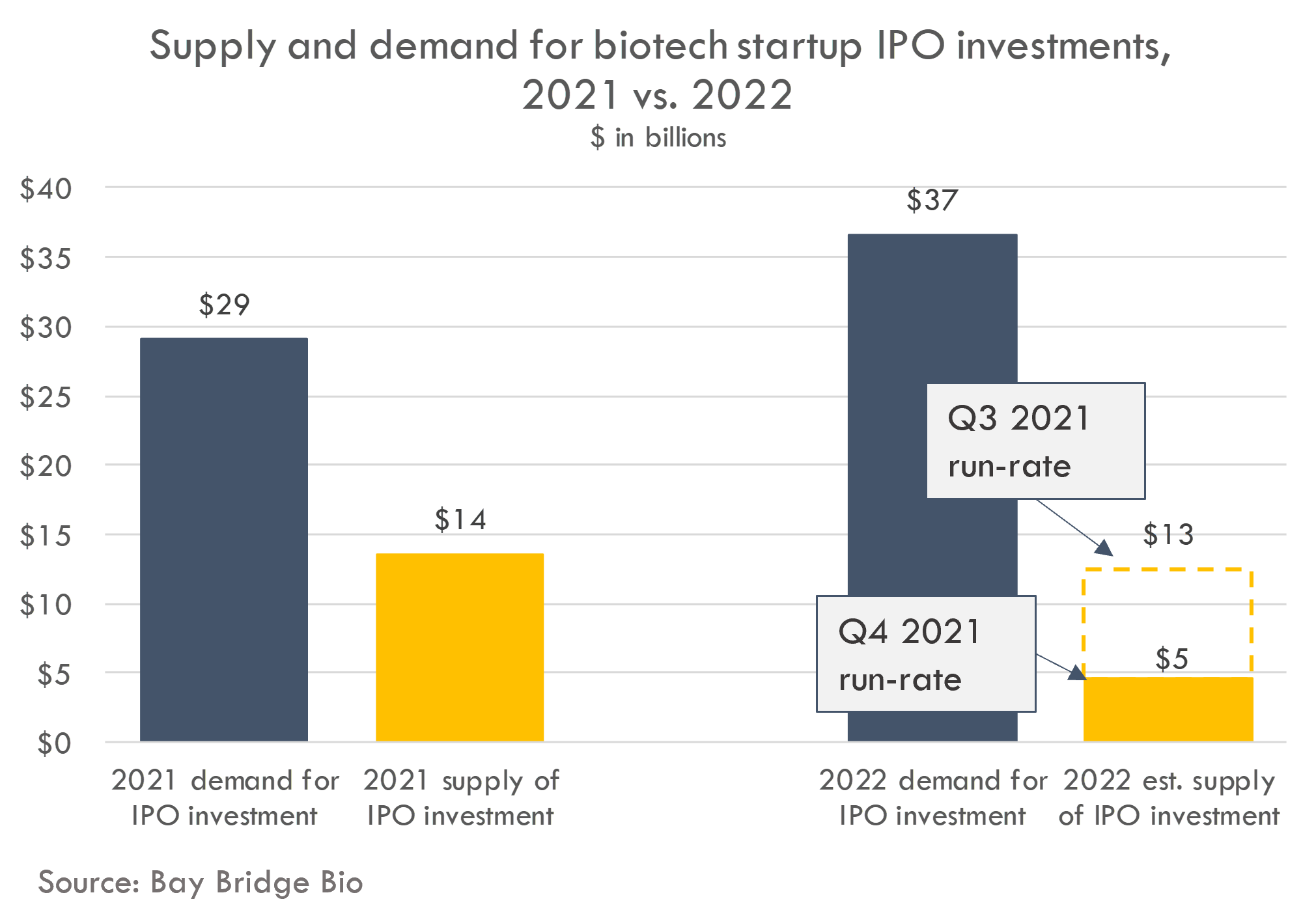

We estimate that demand for IPO investment in 2022 is $37B, up from $29B in 2021. We calculate this based on the number of companies that raised Series B or later-stage venture rounds in 2021 and 2020, multiplied by the average amount raised in US IPOs of VC-backed biopharma startups from 2018-2021.

Calculating supply is a bit trickier: we know the supply of IPO investment in 2021 (the amount invested in IPOs), but it is impossible to predict the amount invested in IPOs in 2022. If we annualize the amount invested in IPOs in Q4 2021, we get $4-5B in IPO investments in 2022, which is in line with pre-COVID levels. If we annualize Q3 2021, we get $12.5B in 2022 biopharma IPO investments (Q3 2021 was still a relatively big quarter for IPOs due to a busy July).

Because amount invested in IPOs generally correlates with the performance of public equities in biotech, the XBI's performance through the first three weeks is not encouraging -- the index is down 17% YTD (as of January 19, 2022). If the market stabilizes, a total IPO investment volume of $5B or so doesn't seem unreasonable, although a lower amount would also be within reason. If the market recovers (due to, for example, the Federal Reserve reversing its position on raising rates), the market could recover closer to 2021 levels -- although this isn't something companies should plan on when budgeting for the new year.

Thus far in 2022, there have been 3 IPOs raising $482M total. This is roughly in-line with the same period last year, altough we can't read too much into this, as IPO activity really only took off in February of 2021.

Implications for companies and investors

On balance, companies should plan for a much more challenging IPO market in 2022. Fortunately, VCs are still flush with cash, so many companies will be able to raise private capital instead of going public. The VCs from whom they raise may look different than they did in 2021, however. Crossover investors, who recently have dominated Series B and later investing, may reduce early-stage venture activity due to 1) poor performance of recent crossover and IPO investments and 2) reduced IPO activity making the crossover trade less feasible. The fact that crossover investing slowed in Q4 2021, while Series A investing increased, provides some support for this.

If crossover investors step back, "traditional" biotech VCs have significant cash reserves and will likely jump at the opportunity to invest in mid- and later-stage private rounds after being priced out of those markets by aggressive crossover VCs and hedge funds in the last few years. While high quality private companies will have plenty of cash available to them, the terms and deal processes may be different (lower valuations and more diligence).

Companies can also pursue funding through pharma partnerships, although if all companies do this, pharma will be in a stronger negotiating position. Nonetheless, pharma has an estimated $1.5T of dry powder to potentially use to invest in or partner with startups.

More good news is that startups have more cash today than ever before, so they can potentially wait out any tough periods in the market. The average Series A in 2021 was $62M, and the average Series B was $100M. Although burn rates have increased, companies have plenty of room to extend their runway while still creating value (focusing investment on the most promising products, more targeted investments in platforms, etc.).

Benchmark VC performance

Deal-level cash-on-cash returns, proceeds from exits, check sizes, and more for thousands of biopharma investors covering $80B+ in global venture investment.