Who will save biotech?

April 22, 2022

The biotech crash of 2021-2022 is the fourth -- and biggest -- biotech crash in the last 10 years. After the first three crashes, the market quickly bounced back.

In the previous three crashes (2015, 2018 and March 2020), the Federal Reserve (aka the Fed) came to the rescue by stimulating the economy. But the Fed is less likely to save markets this time, as the Fed’s focus has shifted from stimulating the economy to controlling inflation.

After a decade of "easy money", biotech markets depend more on Fed stimulus than on M&A or fundamentals. Unless the Fed reverses course and decides to continue the easy money regime of the last decade, biotech markets will trade down to a “new normal” where Fed policy is not the main influence on financial markets. This “new normal” may bring funding and valuations down to a level not seen for years.

This post will discuss the Fed's role in the biotech market over the last 10 years. If you aren't familiar with the Fed, this post will also give a basic overview of the Fed's function.

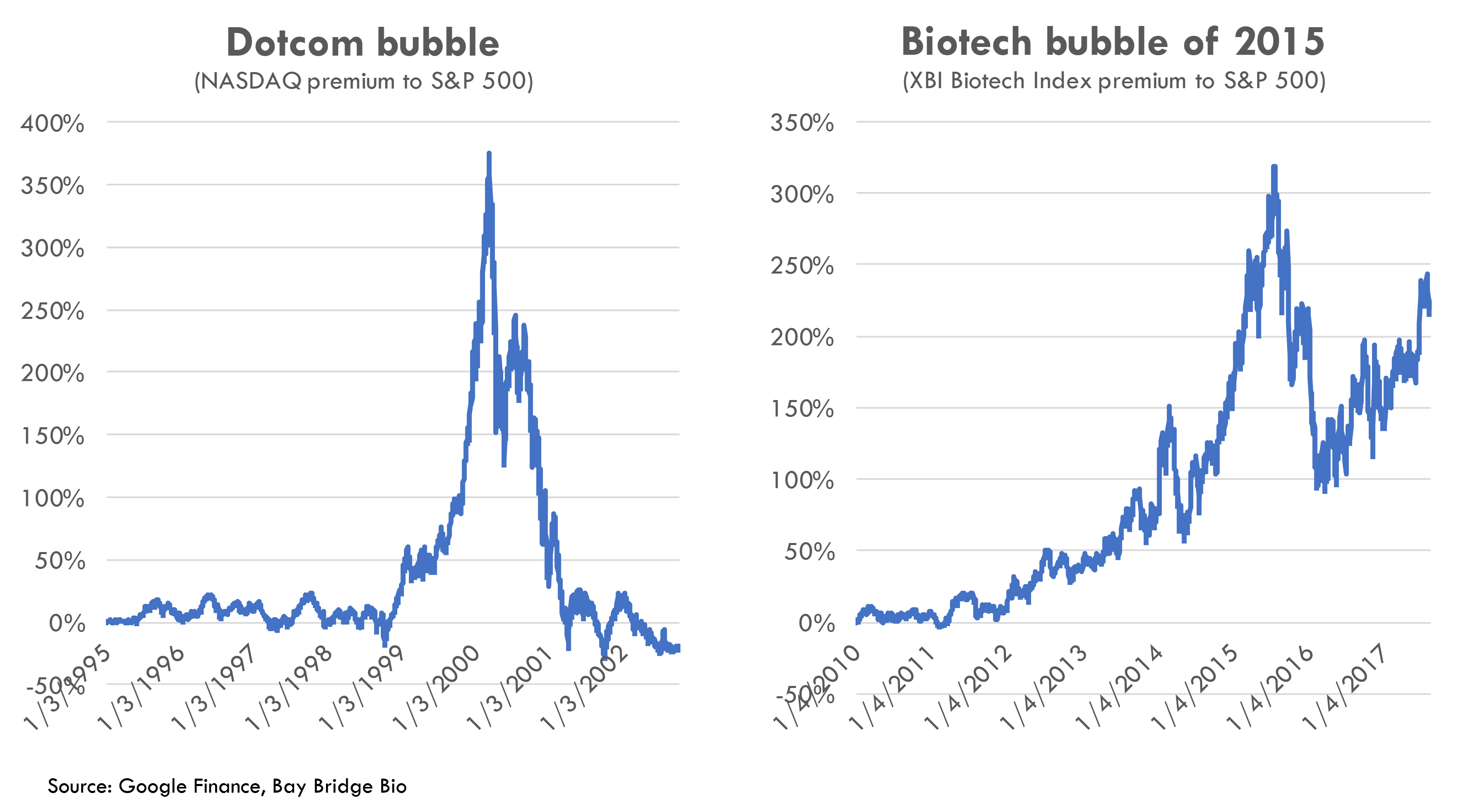

The dotcom bubble vs. the 2015 biotech bubble

To illustrate why biotech founders and VCs should care about the Fed, let’s look at two asset bubbles: the dotcom bubble and the 2015 biotech bubble.

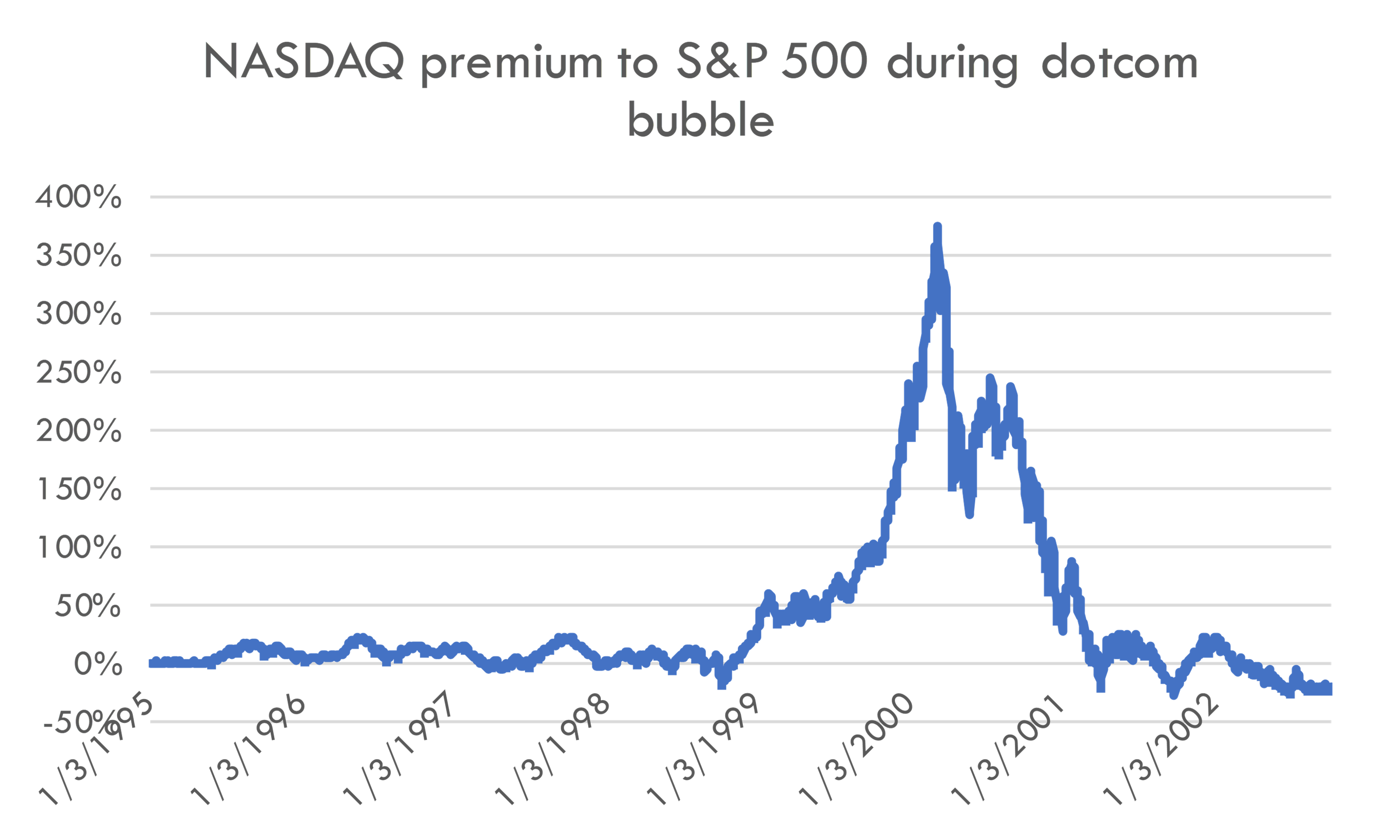

We'll start by looking at the dotcom bubble:

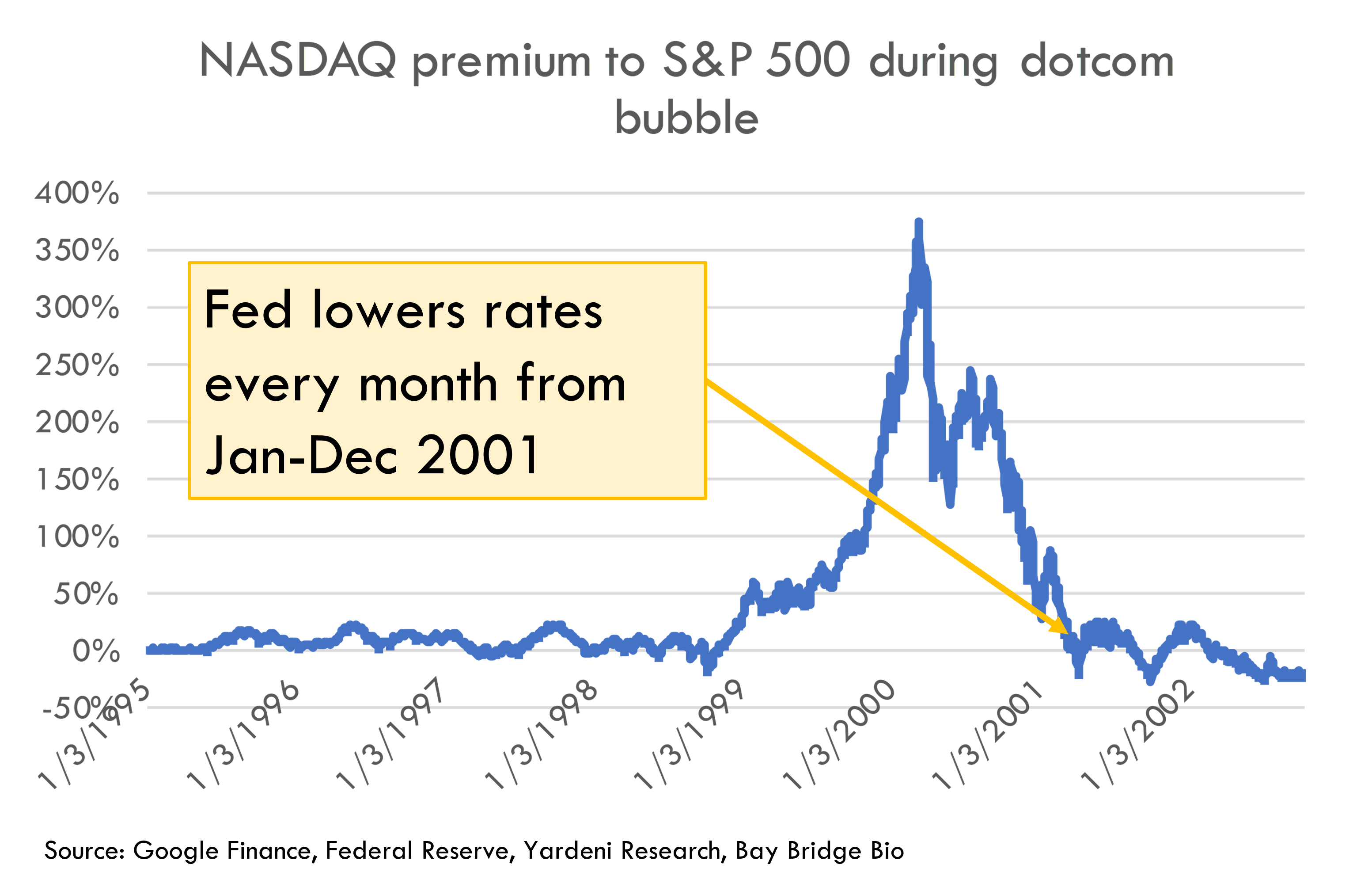

During the dotcom bubble, the NASDAQ (the stock index with the most dotcom stocks) traded in line with the broader markets for several years, then rapidly accelerated, then popped back down to its pre-bubble level.

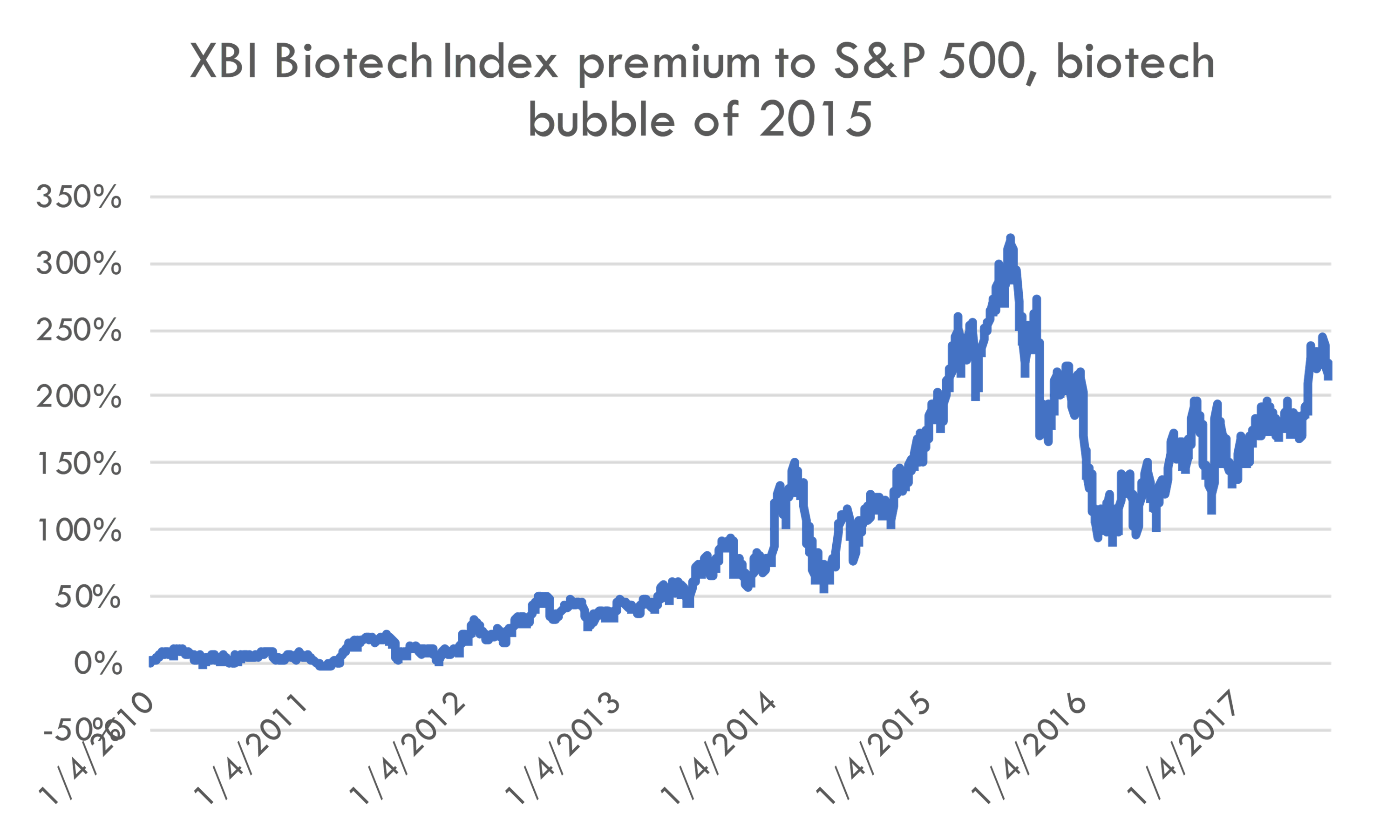

Contrast that to the biotech bubble of 2015:

Both bubbles’ ascents are similar. Both outperformed the S&P 500 by 3-4x during a five-year period leading up to the peak, with a rapid acceleration in the year leading up to the peak and then an equally quick descent.

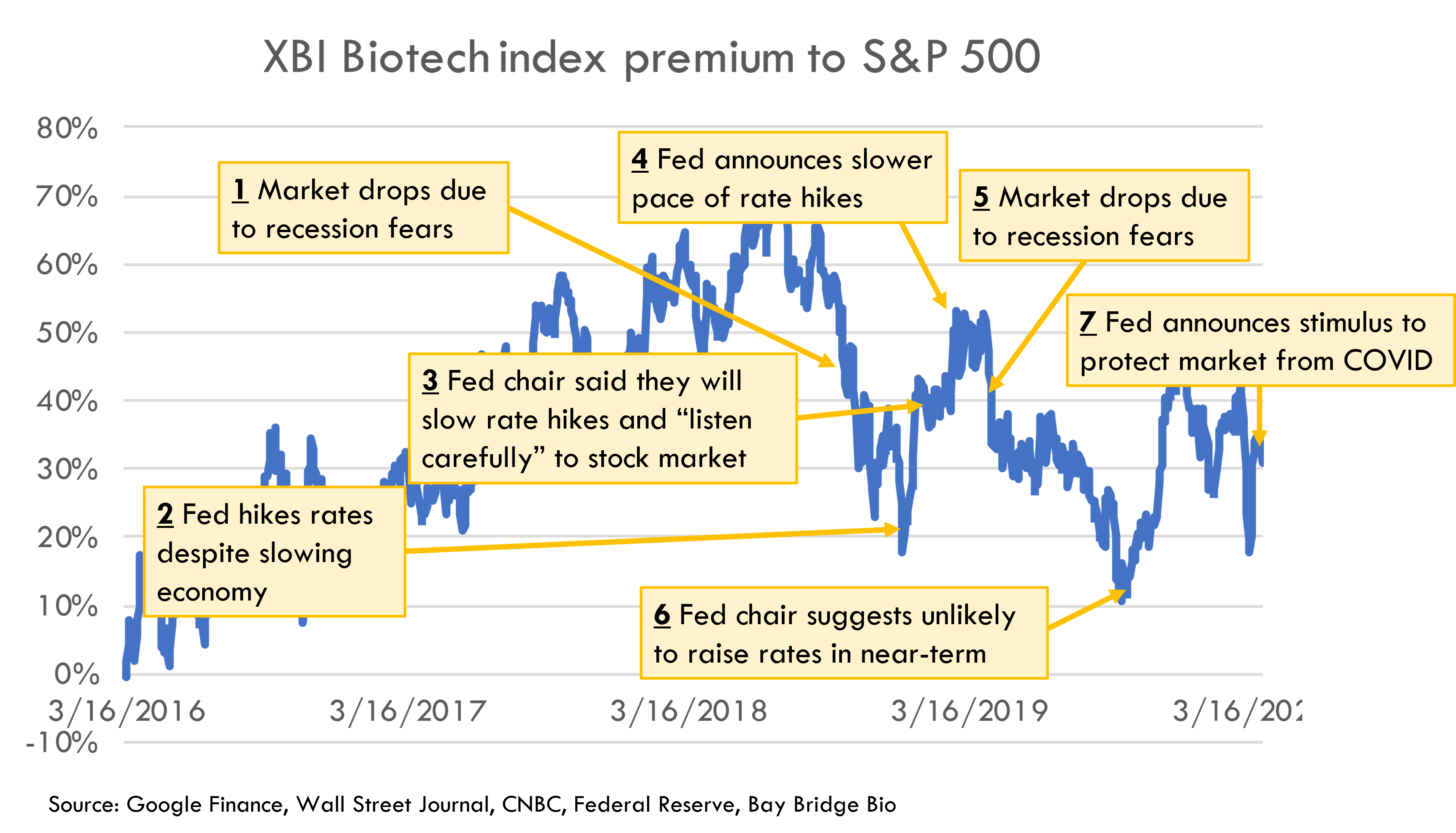

But the 2015 biotech bubble bounced back immediately and was nearly back at its highs in about two years.

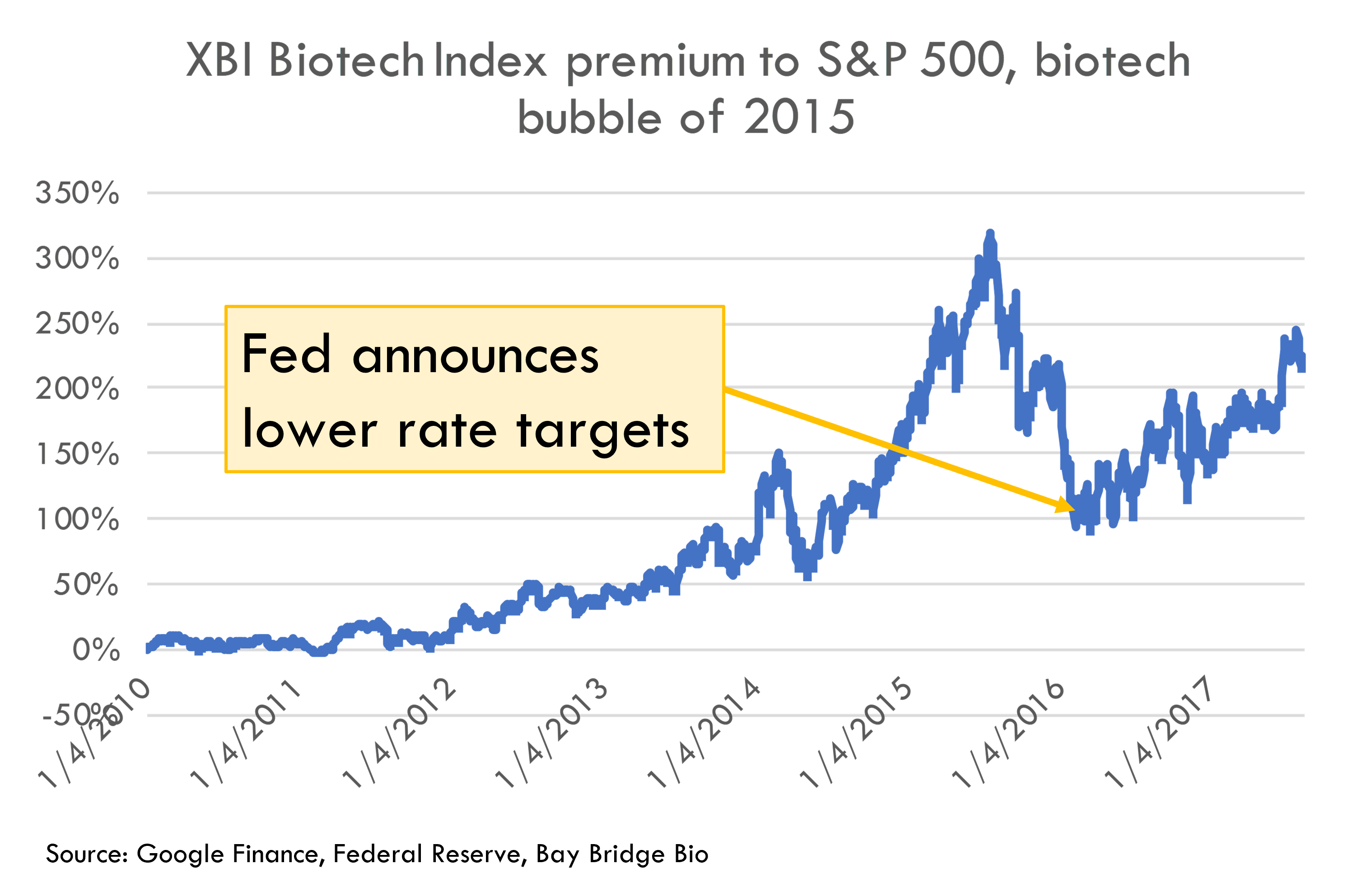

Why did the market rebound so quickly? Because the Fed came to the rescue.

Essentially, in March 2016 the Fed sent a message to markets: take more risk. So investors did, and biotech benefited from this increase in risk tolerance.

We need a bit of context to understand why markets responded with such enthusiasm to this message from the Fed. Leading up to the 2015 biotech bubble, the Fed had supported the economy with unprecedented stimulus. This stimulus started as a way to prop up the financial system in the wake of the 2008 financial crisis. This "easy money" regime saw the lowest interest rates in history (low interest rates stimulate the economy) and never-before-seen levels of asset purchases through Quantitative Easing (or QE, where the Fed supports markets by purchasing a variety of assets to prop up prices).

The stimulus was originally designed as a temporary measure to support the economy after the financial crisis, so the Fed planned to unwind it once markets stabilized. To prepare markets for the unwinding, the Fed had been telling markets for years that it would start unwinding this stimulus in 2015.

The pre-announced unwinding of stimulus in 2015, combined with concerns about drug pricing reform in the wake of Hillary Clinton’s infamous tweet, popped the biotech bubble that had built up in the wake of aggressive big pharma M&A and excitement about immuno-oncology and precision medicine. Investors thought that the easy money era was ending and retreated from risky assets like biotech (more on why easy money leads to higher risk tolerance later).

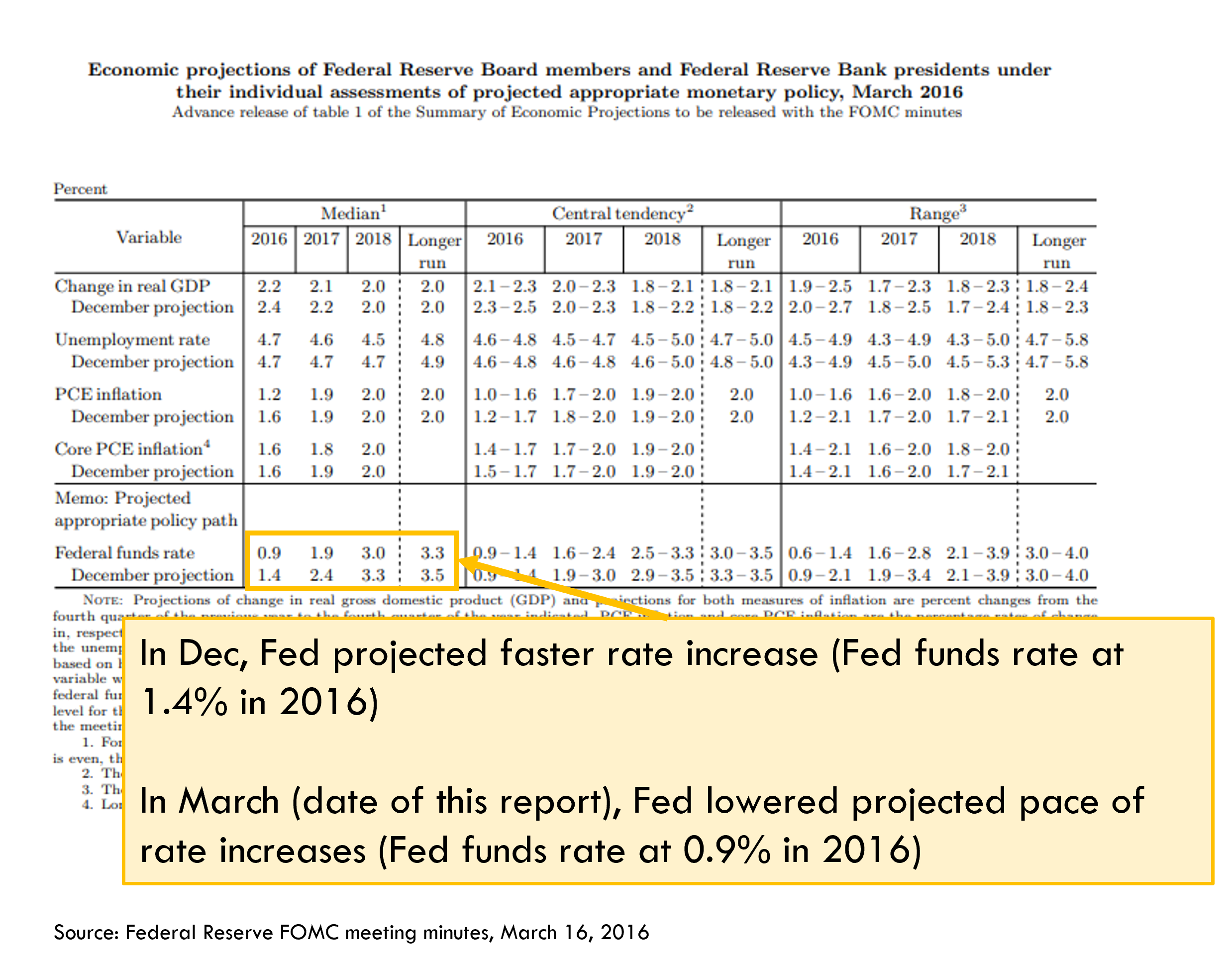

But in March 2016, the Fed assuaged markets by announcing a slower pace of interest rate increases. This meant that easy money would continue.

This seemingly insignificant economic policy detail may not seem like enough to save a bubble from popping. Surely something else must have been responsible for the turnaround -- some breakthrough technological innovation, or amazing clinical data readout, or big pharma M&A?

But there was no fundamental change to the biotech sector that catalyzed the 2016 rebound, nor was there a surge in M&A. M&A actually dropped precipitously in 2016 compared to 2015, while biotech stocks shot up starting in March 2016. This suggests that the Fed’s policies, rather than fundamentals, were driving biotech's rebound.

Interestingly, the Fed also rescued the market during the dotcom bust, but it waited longer to do so:

In both of these examples, the Fed stepped in to support panicking markets. In fact, the Fed was created a hundred years ago largely to act as a “lender of last resort” to support financial markets during crashes. Since 2016, the Fed has continued to step in to support markets in times of stress:

In 2018, markets declined because of fear of a global recession caused by the the US-China trade war. Initially, the Fed did not step in. Even in December 2018 when the economy was slowing, the Fed increased interest rates (which slows the economy), frustrating investors. In response to the market's negative reaction, the Fed quickly changed course, saying that the Fed would “listen carefully” to markets in making its policy decisions. True to their word, a few months later the Fed announced a slower pace of interest rate hikes.

This was only a band-aid for markets, however, as recession fears led to further market declines through 2019. The Fed responded by lowering rates and reassuring investors that it would not raise rates in the near-term.

Then COVID happened. Markets initially panicked, but the Fed quickly stepped in with unprecedented stimulus, and markets took off to new heights.

For the last 15 years, the Fed has protected markets from every setback. The Fed was able to do this because inflation remained low.

Why does low inflation help the Fed protect markets? The Fed has two jobs: reducing unemployment (stimulating the economy) and controlling inflation. Usually, when unemployment goes down, inflation goes up, limiting the Fed's ability to stimulate the economy. But low inflation since 2008, despite low interest rates, allowed the Fed to support markets to an extent never before seen. The current environment of rising inflation means that the Fed's support seems to be going away for the first time since 2008.

The easiest way to build DCF models

Build robust biotech valuation models in the browser. Then download a fully built excel model, customized with your inputs.

What is the Fed?

The US Federal Reserve, aka the Fed, is the central bank of the United States (other countries and regions like the EU have their own central banks). The Fed has two jobs (its “dual mandate”) 1) stimulating the economy to maximize employment (which also stimulates the stock market) and 2) controlling inflation. These goals generally conflict: stimulating the economy stokes inflation, and reducing inflation cools the economy.

The Fed accomplishes these goals by controlling “monetary policy”: essentially, the Fed determines the price of money. If the Fed wants money to be cheap, it enacts “loose” monetary policy, reducing interest rates, which makes it easier to borrow money. Loose monetary policy also increases asset prices, as lower rates means more money in the economy that can be invested in businesses. Increasing asset prices generally drive investors into riskier investments, as the price of safer assets goes up -- and their expected return goes down.

As you might expect, keeping money “cheap” for too long leads to inflation. On the other hand, keeping money expensive for too long leads to a decline in economic activity.

As we saw in the charts above, the Fed has another role: alleviating financial market panics. The Fed was originally created for this purpose, acting as the “lender of last resort”: when money stops flowing through the economy during a panic, threatening economic collapse, the Fed steps in and provides money to banks, that then lend that money to others.

Because of the power of monetary policy to change markets and the economy, the Fed is one of the most important financial and economic forces in the world. The Fed has arguably had a bigger impact on biotech markets over the last 10 years than any technological innovation.

How does the Fed support biotech markets?

Some of the main ways the Fed supports biotech markets are 1) increasing the price (and thus lowering the expected return) of safe investments, which pushes investors to riskier investments like biotech and 2) supporting markets when they crash, which encourages investors to take more risk because they think the Fed will bail them out if their investments go bad.

Specifically, the Fed's decade-long easy money policy has encouraged massive asset managers to allocate more money to high-risk areas like biotech. These asset managers become the "highest bidder" for biotech stocks, pricing out potential big pharma acquirors and more conservative investors. These asset managers -- who manage trillions of dollars -- also deploy huge amounts of capital to biotech, which encourages earlier stage investors like VCs to fund more companies in hopes that big asset managers will invest in later rounds at high valuations. Over the last 10 years, the influence of these big asset managers has become so great that the biotech markets have come to depend on them. Without these funds, the current biotech startup funding model is not sustainable.

Who are these asset managers?

The biggest investors in public biotech stocks and IPOs over the last several years are giant mutual funds and asset managers like Fidelity, BlackRock, Vanguard, Capital Group, and T. Rowe Price. These firms collectively manage trillions of dollars of assets across stocks, bonds, private equity, and other asset classes. Biotech investments – especially high risk investments like biotech IPOs or private company investments – represent a tiny fraction of their portfolios.

The business of these asset managers is creating investment products for their clients. These clients range from huge institutions like government pension funds and sovereign wealth funds all the way to everyday retail investors. To give a sense of what products these firms provide, imagine you're a prospective client:

Are you a billionaire who wants to preserve your wealth in a high-inflation environment? BlackRock can build you a multi-asset portfolio with reduced allocation to fixed income (ie bonds, which do poorly in inflationary environments) and higher allocation to commodities and equities that do well in inflationary environments (like banks and energy companies).

Are you a pension fund that needs to grow assets 15% a year so you can afford to pay your pensioners what you owe them? In your case, even a portfolio of 100% equities will get you just a 10.29% return, so an asset manager can help you get a higher allocation to riskier assets, like venture capital.

Or maybe you are an individual investor who is interested in investing in innovative biotech companies, but doesn’t have the time or expertise to research biotech stocks on your own. Perhaps the Fidelity Select Biotech Portfolio mutual fund, which invests in biotech stocks as well as private companies, is right for you.

For these giant investment firms, investing in biotech startups is just one of thousands of levers they can tweak to adjust the risk-reward profile of an investment product for a specific client. Specifically, biotech startup investing is a way to offer higher returns (and higher risk) to their clients.

These huge asset managers keep their eye on the economy to help them decide what investment products to offer their clients (or to invest in themselves). If they expect strong economic growth, they will take more risk by allocating more money to stocks and private equity. If they expect high inflation, they will allocate less to bonds and more to real estate and commodities. If they expect a recession, they will rotate out of risky stocks into safer assets.

The Fed’s policies are one of the biggest inputs to these firms’ investment equations. When interest rates are low or the Fed buys assets to put more cash into the economy (through Quantitative Easing), these asset managers take more risk. Low interest rates push up bond prices, so bonds don’t offer much of a return. To get yield, asset managers rotate into stocks, and the price of stocks goes up. When the price of stocks goes up, the expected returns goes down.

If the Fed continues stimulus even after asset managers have increased allocations to stocks to the point where expected returns decrease, where do they find return? They turn to riskier growth stocks, like tech or biotech stocks. If the Fed continues stimulus even beyond that, asset managers take even more risk, investing in IPOs or venture capital. If the Fed pumps money into the economy even after the expected returns for those assets decrease, investors turn to more speculative and risky assets, like crypto.

As the Fed puts money into the economy, these asset managers keep getting more money to manage. But the number of good investments doesn’t keep pace with the increase in the amount of money they manage. So these asset managers have no choice but to put more money into the limited pool of increasingly overvalued investments.

At a certain point, the need for these asset managers to offer their clients what they want – high returns – becomes more important than the need for these asset managers to control risk by investing at reasonable valuations. This is when markets become speculative -- when they care mostly about return, and don't worry much about risk. This risk-on mindset drove the IPO boom from 2017-2019, and the bubble of 2020-2021.

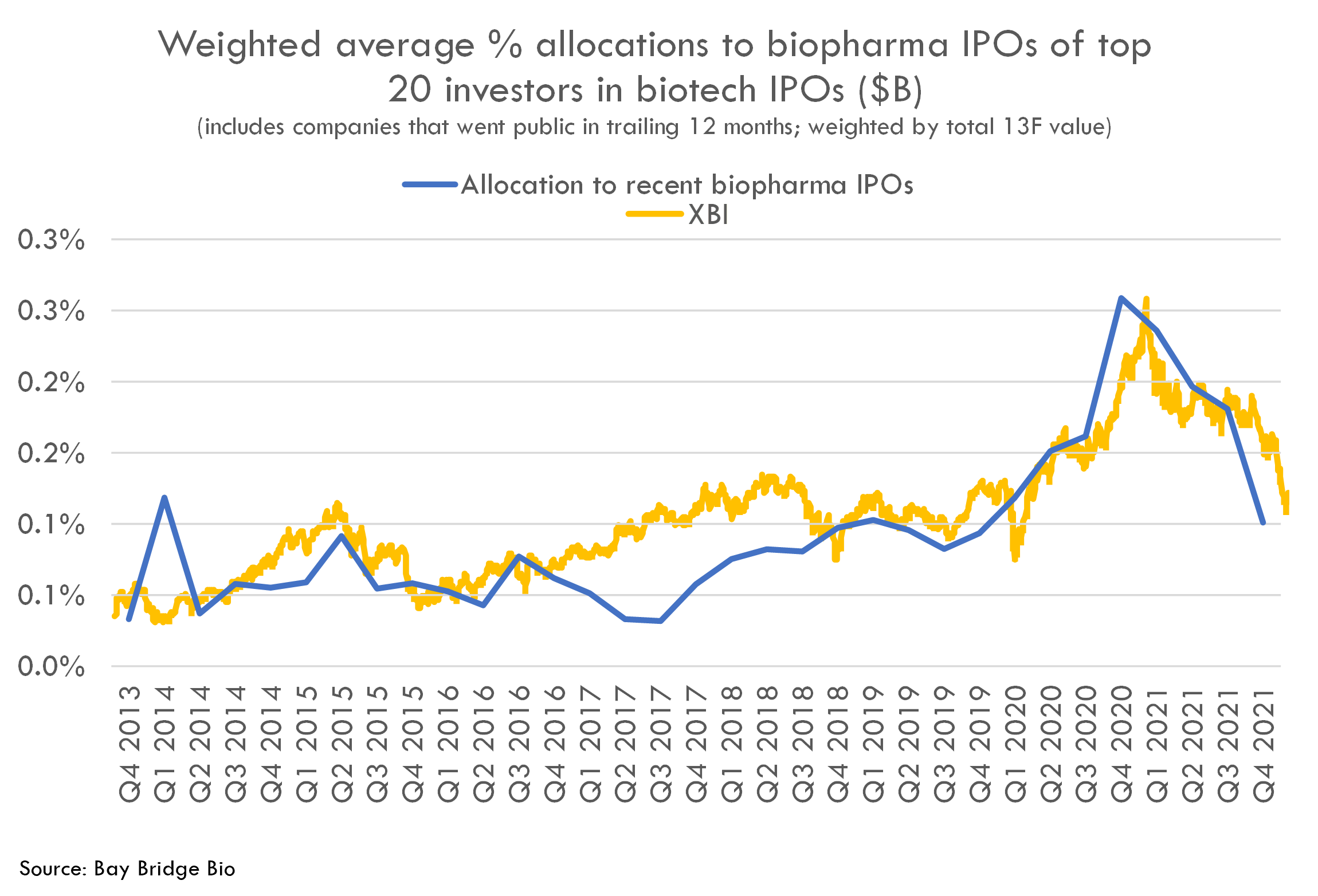

On the other hand, if these asset managers see a slowdown in economic activity, they rotate out of riskier assets. This happened in early 2021, as major asset managers started leaving the biotech IPO market and sold off their high-risk biotech portfolios.

Below we see the allocation to biotech IPOs of these major asset managers over the last ten years:

From 2013 to 2021, these investors have increased their exposure to biotech IPOs. Their demand to invest in early-stage biotech became so great that they became the “highest bidder” for biotech stocks (as opposed to big pharma being the highest bidder via M&A). These asset managers continue to put more money into biotech because they and their clients want return, so they need to take more risk, and investing in biotech startups is one way to take risk to get return. Their willingness to pay for biotech increases as they get more money to manage and need to generate more return. The amount of money they manage, and the amount of return they need to generate, increases as long as the Fed keeps up stimulus.

When stimulus fades, on the other hand, they cut exposure to risky asset classes. These asset managers sharply cut their allocations to biotech and other high risk assets starting in early 2021. Since then, the Fed has signaled even more commitment to fighting inflation. Without these investors in the market, biotech valuations will rely on fundamentals and M&A.

But fundamentals and M&A have been less important to biotech markets than the Fed in recent years: 2014 is arguably the last time that M&A and fundamentals had more influence on biotech markets than the Fed. While we hope the market will recover (and it is certainly possible that it will), we encourage companies and investors to prepare for the possibility of a future that's very different than the last 5 years.

The easiest way to build DCF models

Build robust biotech valuation models in the browser. Then download a fully built excel model, customized with your inputs.