Analying the performance of Series A biotech VCs

Updated December 9, 2021

Biotech VC is on pace for its biggest year ever (by far), while public biotech indices are declining. To better understand how biotech VCs are performing in this environment, we analyzed a few metrics of VC performance: interim deal-level returns, number of investments and exits, and percentage of investments that fail to raise the next round.

In this post, we focus on investors who lead Series A deals (as opposed to those who follow-on in rounds but don't lead as often) and have done at least new 7 deals since January 2018. A Series A is generally the first big round a company raises from institutional VCs. The data include investments and exits of venture-backed biopharma startups from January 2018 through June 2021. The data comes from our biotech investor database.

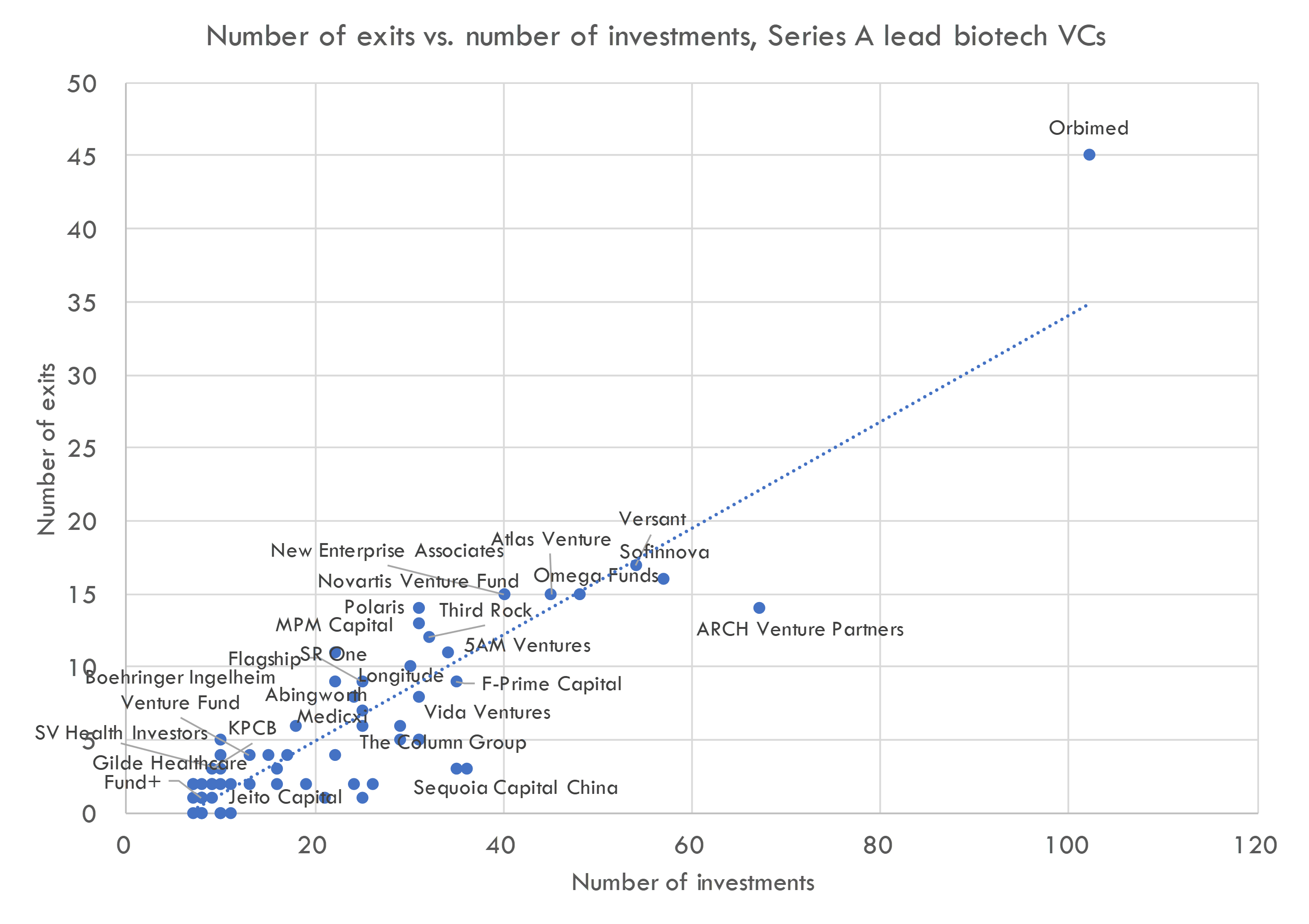

Number of investments and exits

Above we show the number of investments and exits for each investor since January 2018. Exits include IPOs as well as M&A (although private investors typically hold shares for several years post-IPO). This only includes publicly disclosed investments, so firms that don't publicize all of their investments (like Flagship) will show up further to the left side of the chart than they perhaps should.

Investors above the dashed line have more exits per investment than the typical investor; those below the line have fewer exits / investment. Investors that generate more exits / investment don't necessarily perform better than those that generate fewer exits / investor, as we also must account for the returns generated by each exit.

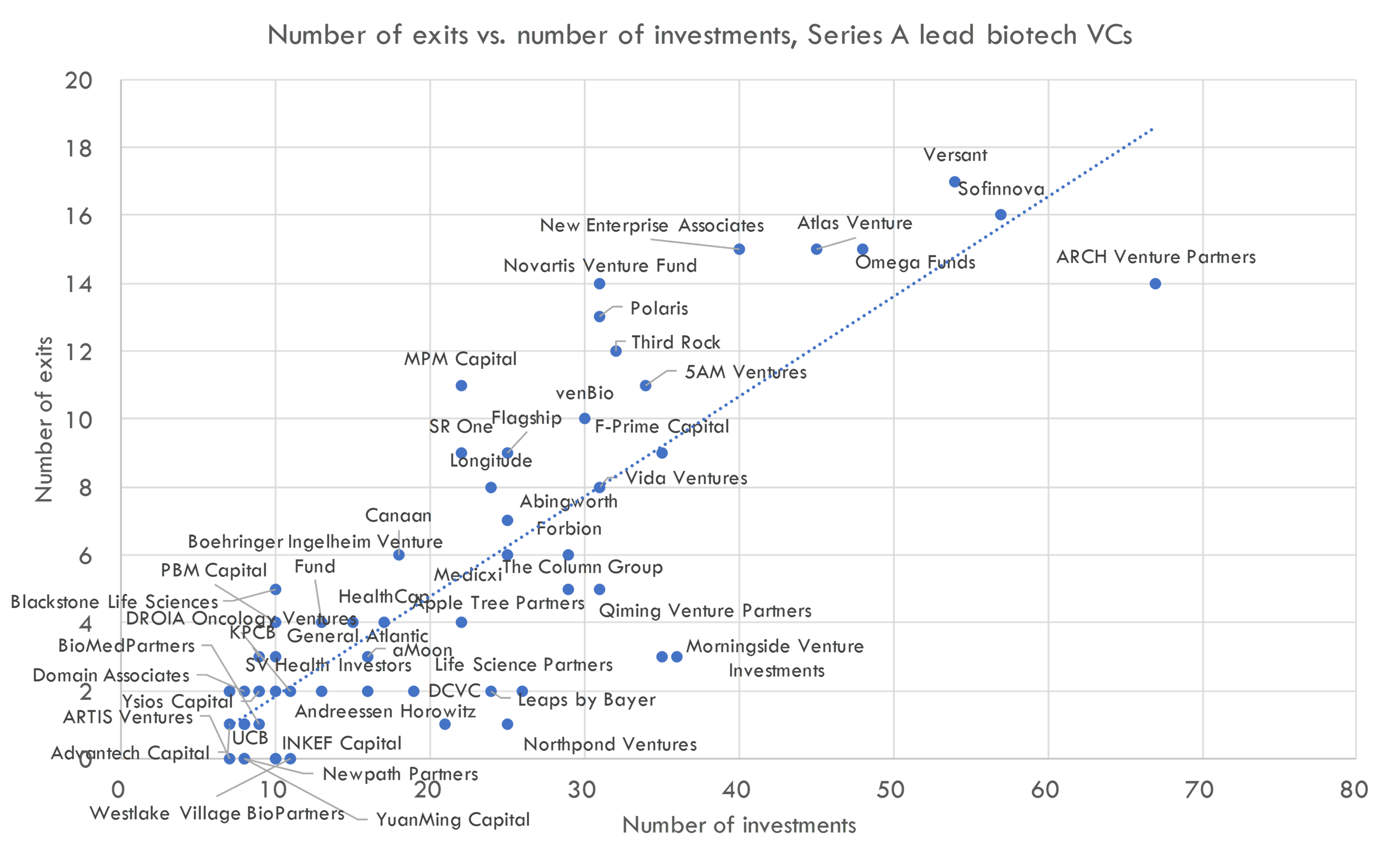

Orbimed is far and away the most active investor, and also generates more exits / investment than most investors. The below chart excludes Orbimed so we can see other investors more clearly.

It is important to emphasize that we can't draw conclusions about performance from this chart. Some funds that are below the trendline are simply newer to biotech investing, so their investments haven't had time to "mature" and generate exits. Funds can also be below the trendline because of fund strategy: investors who take more risks will show up below the trendline. For example, ARCH is the only one of the most active investors that is below the trendline, but ARCH's average returns / exit are higher than most of its peers, suggesting they take a higher risk/reward approach.

Returns and loss rates

To evaluate how fund performance is tracking, it also helps to know the returns of each exit (in addition to the number and rate of exits we saw above) and the percentage of exits that fail.

We use two metrics to estimate these: "weighted average MOIC" of exits and "zombie rate". "Weighted average MOIC" of exits represents the weighted average of cash-on-cash returns: current value of an exited investment / cash invested into an investment, weighted by cash invested. The "zombie rate" reflects the percentage of companies that have gone more than two years without raising more money or doing a cash-generating partnering deal with a larger pharma company.

These are interim figures. Because most exits are via IPO these days, and because most investors hold shares for a while after IPO, these MOIC numbers change with the stock price of the portfolio company (for more on post-IPO performance of biotech startups, see this post). Additionally, some "zombies" may go on to raise money or exit. But these metrics give us a sense of how investors are doing in the current market, which can supplement backward-looking historical IRRs in evaluating fund performance.

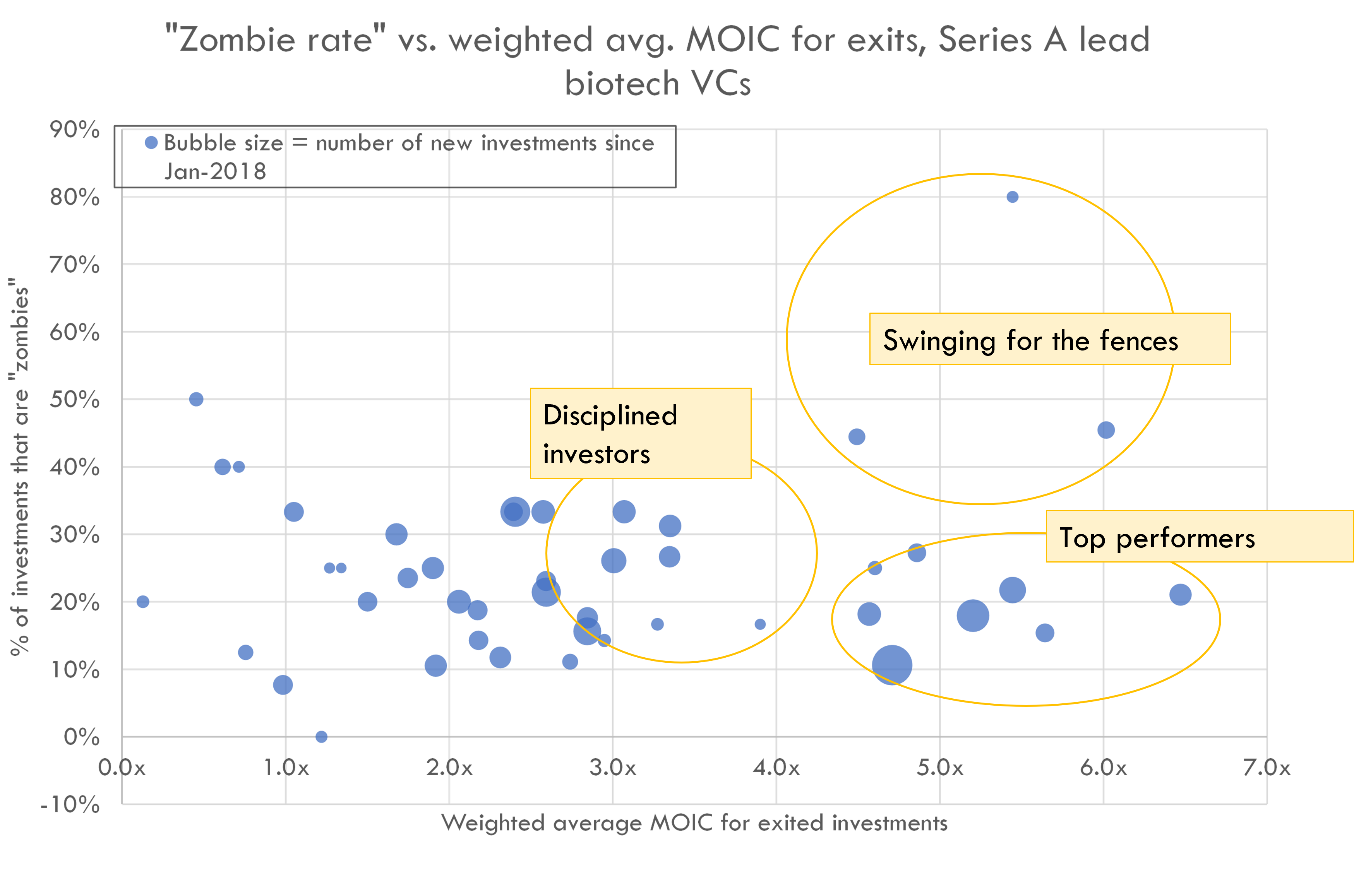

Above, we plot weighted average MOIC and zombie rate, with number of investments since January 2018 reflected as bubble size. This chart excludes funds with no exits, or exits where we don't have MOIC data (private M&A or exits where the investors had a small stake), so there are fewer firms in this chart than in the previous chart. We don't show fund names here -- non-anonymized data are only available to subscribers to our VC database.

This is not an exhaustive list of MOICs for each investor: this just includes deals where we know the amount invested by each investor, as this is weighted average MOIC. We will analyze unweighted average MOIC in another post, using a larger set of MOIC data.

As these are interim performance numbers, we can't conclude anything about a fund's final returns from these data. However, this can help us understand investors' style and compare how they are performing on relevant metrics.

For example, we see there is a subset of investors with low zombie rates and high weighted average MOIC: these are "top performers". Another subset has high zombie rates and high MOIC: these funds seem to take a "swing for the fences" approach with high risk and high reward. Another subset of investors seems to be more disciplined: fewer losses, but fewer big wins.

Note that the percentage of zombies + the percentage of exits does not add up to 100%, as many companies have raised recently (so aren't zombies) but have yet to exit.

Benchmark VC performance

Deal-level cash-on-cash returns, proceeds from exits, check sizes, and more for 1,500+ biopharma investors covering $80B+ in global venture investment.

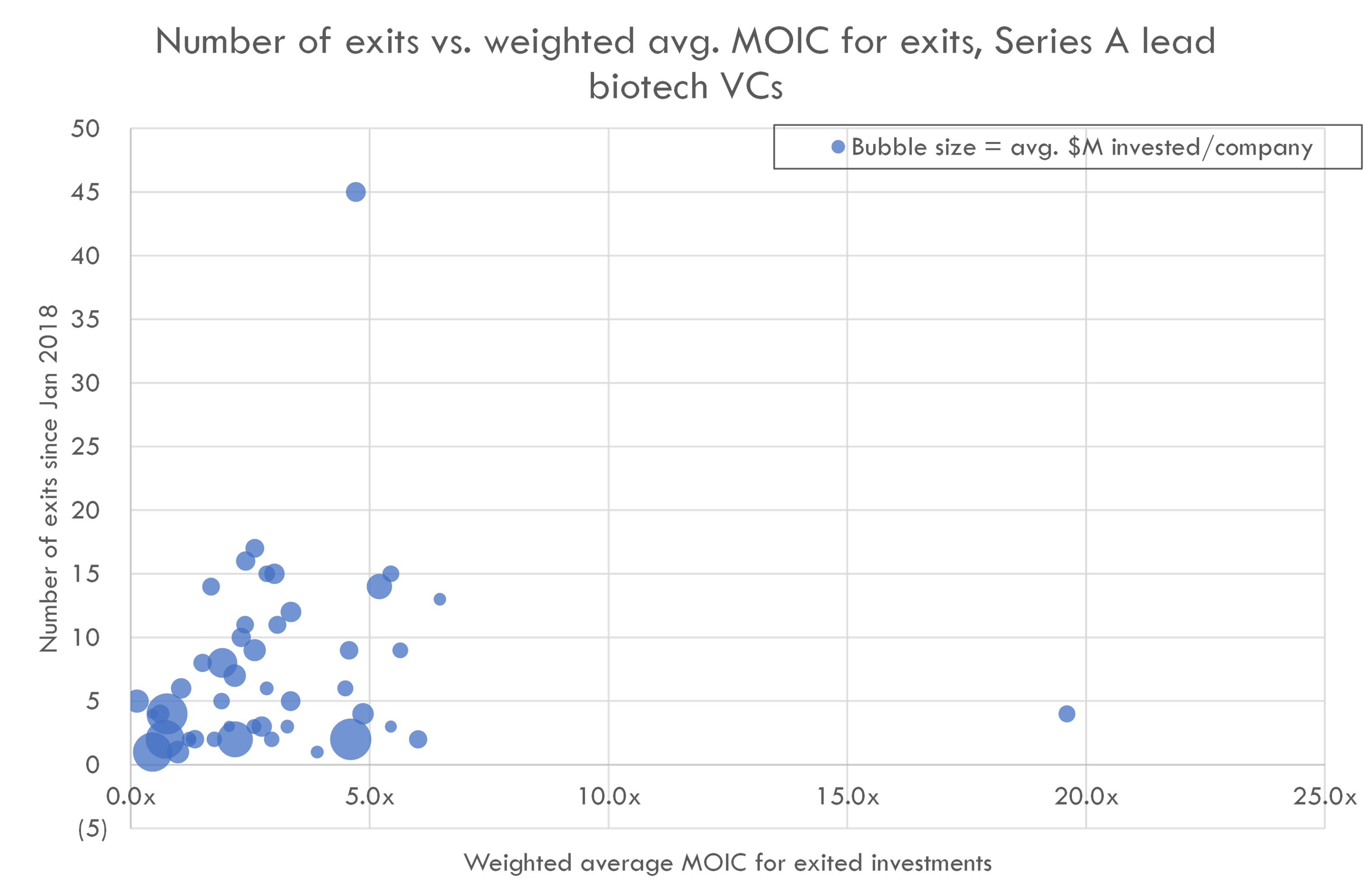

Ability to return capital

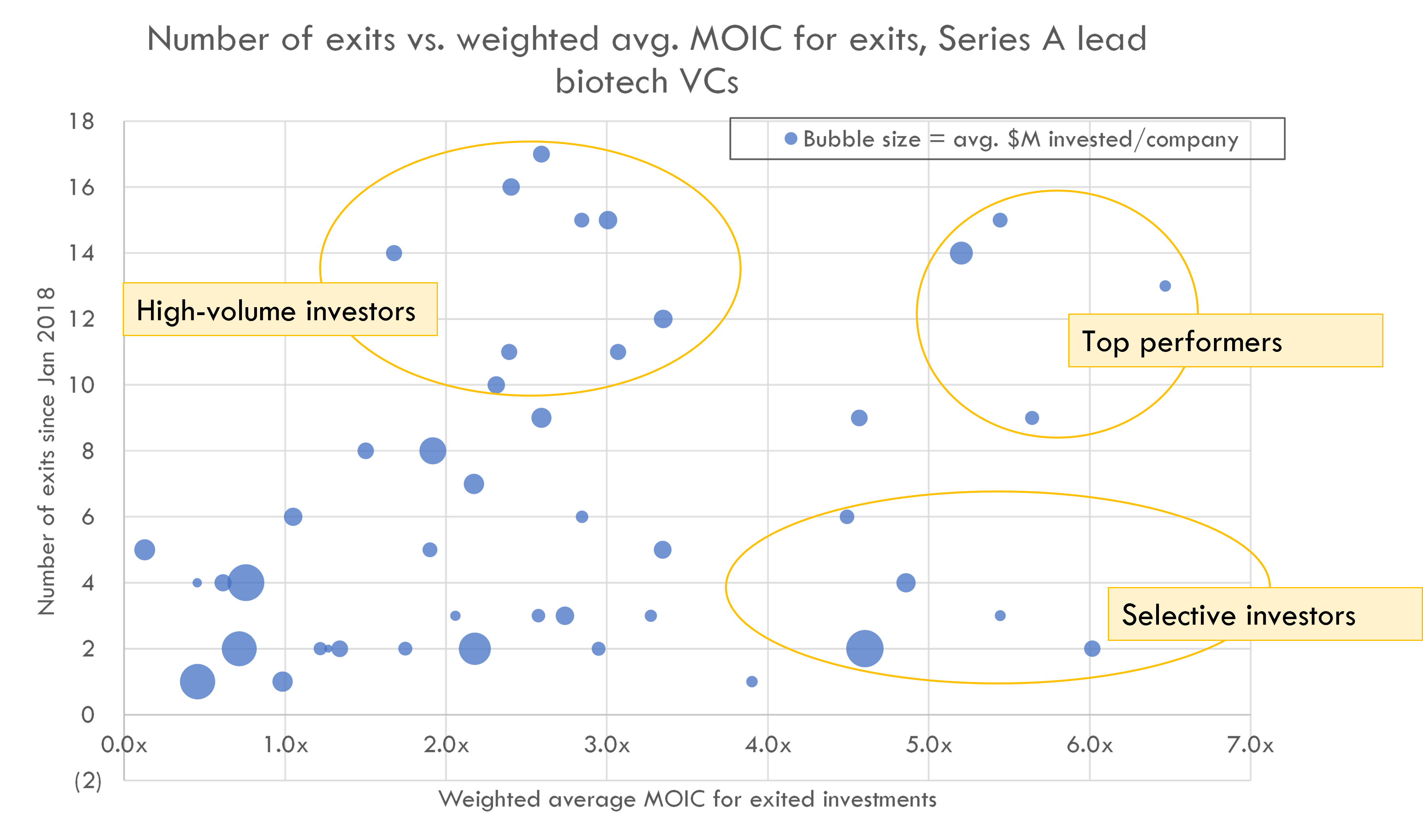

In an environment of ever-increasing funds sizes, another point of interest is ability to effectively deploy large amounts of capital. To better understand this, below we plot number of exits and weighted average MOIC of exits, with bubble size representing average amount invested in companies that exit.

Of course, a better metric here would be fund size vs. interim fund return, but that is a topic we'll explore in another post.

We see that there are two major outliers here. The data without the outliers is below.

We observe a few clusters of investors. We see a group of top performers -- firms that have a lot of exits, and high returns for each investment. We also see a group that has a low number of exits, but strong returns for each investment, and a group that has many exits but more average returns (as well as a group that doesn't perform as well).

Allocators who want to deploy larger amounts of capital but aren't as return-sensitive may find a better fit with the "high-volume" investors, while smaller allocators with a focus on maximizing yields may prefer "selective investors". Of course, we also need to consider fund size in addition to capital returned, which will be explored in another post. For access to our full investor database including non-anonymized performance metrics, fund size data, deal-by-deal returns, and more, check out our private biotech investor database.