Analyzing the performance of the top biotech IPO investors

January 26, 2022

After the pace of big pharma M&A slowed down several years ago, a red-hot IPO market has supported the biotech startup ecosystem. The current biotech bear market has all but stopped the IPO machine, reducing the total cash available to startups and decreasing investor certainty regarding exits.

To assess the health of the IPO market, we will look at the performance of biotech investments made by the most active investors in US IPOs of VC-backed biopharma companies.

The top IPO investors

The top investors in US IPOs of VC-backed biopharma companies from 2018 through Q3 2021 (by estimated dollars invested) include major asset managers (Fidelity, BlackRock, Vanguard, T. Rowe Price, Wellington), specialist biotech crossover funds (RA Capital, Orbimed, Perceptive, Redmile) as well as large generalist hedge funds that also have a biotech crossover practice (Citadel / Surveyor). About half of the top 10 investors are large asset managers with hundreds of billions under management; the rest are biotech crossover funds.

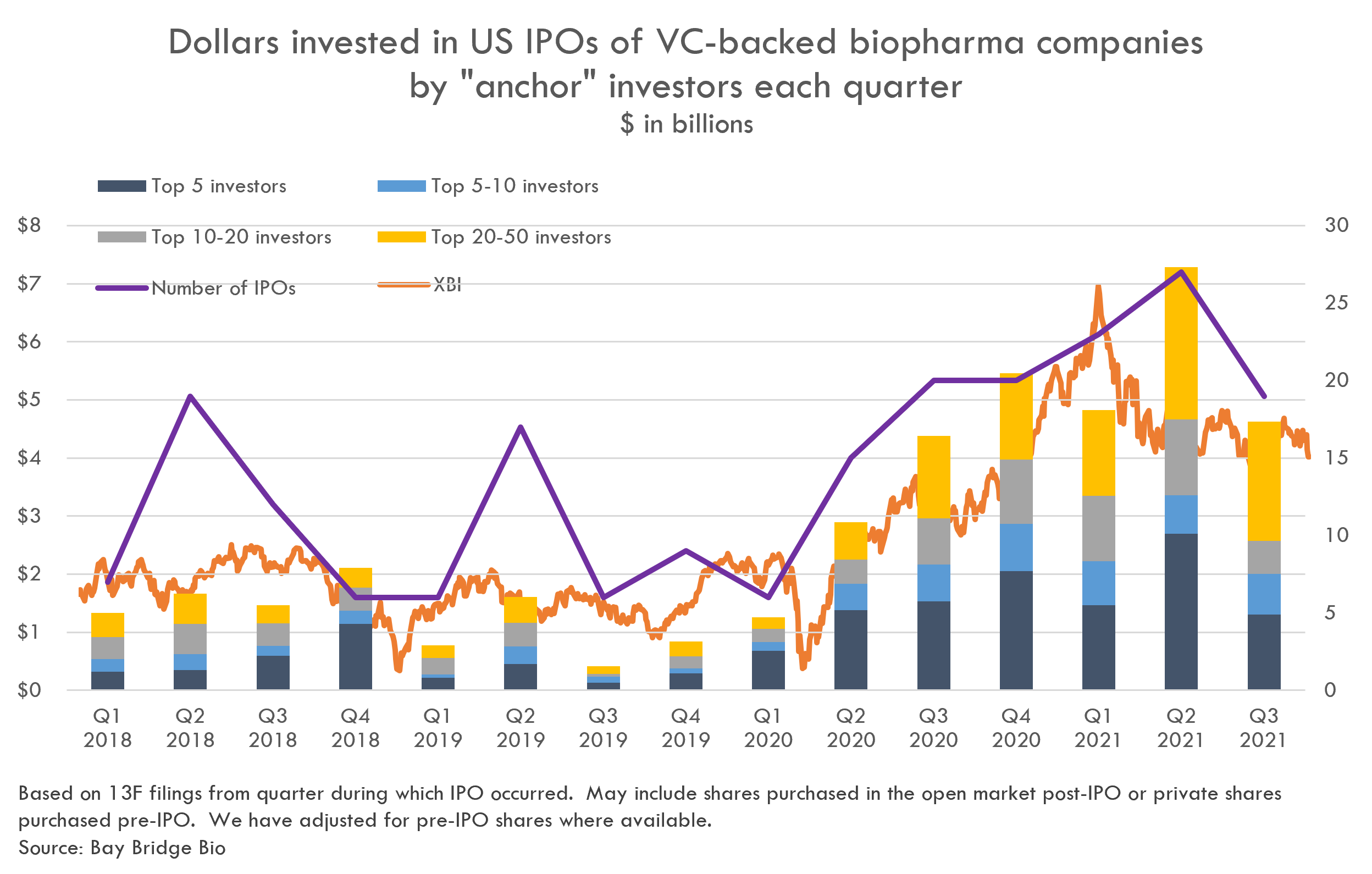

The top 10 investors account for around a third of IPO investments:

The top 5 investors have an outsized share of the market. As most of these investors are massive asset managers with hundreds of billions of assets under management, biotech makes up a small percentage of their total assets, and risky IPO investments make up an even smaller component. Thus the IPO market is very sensitive to the overall asset allocations of these huge money managers. If the broader market decline continues (the NASDAQ index is down 13% YTD and the S&P 500 is flirting with a bear market, down 8% YTD), we can expect these funds to continue to rotate out of riskier assets like biotech.

We also see that these investors' IPO activity generally correlates with public indices: these funds decrease their IPO investing activity after a bad quarter for biotech stocks (and increase activity after good quarters).

Obviously, the last few quarters have been tough for biotech. We don't have 13F data yet for IPOs in Q4 of 2021, but we can assess how these funds' holdings of recent biotech IPOs held up during Q3, and we can calculate how their holdings would have performed through the current date (January 26) assuming they did not sell any shares from Sept 30, 2021 to Jan 26, 2022. Given the market downturn, many of these funds would have sold shares, but some may be restricted from doing so because of IPO lockups or insider restrictions, and for companies whose stock price dropped due to a binary event, funds may not have been able to liquidate before significant negative price movement.

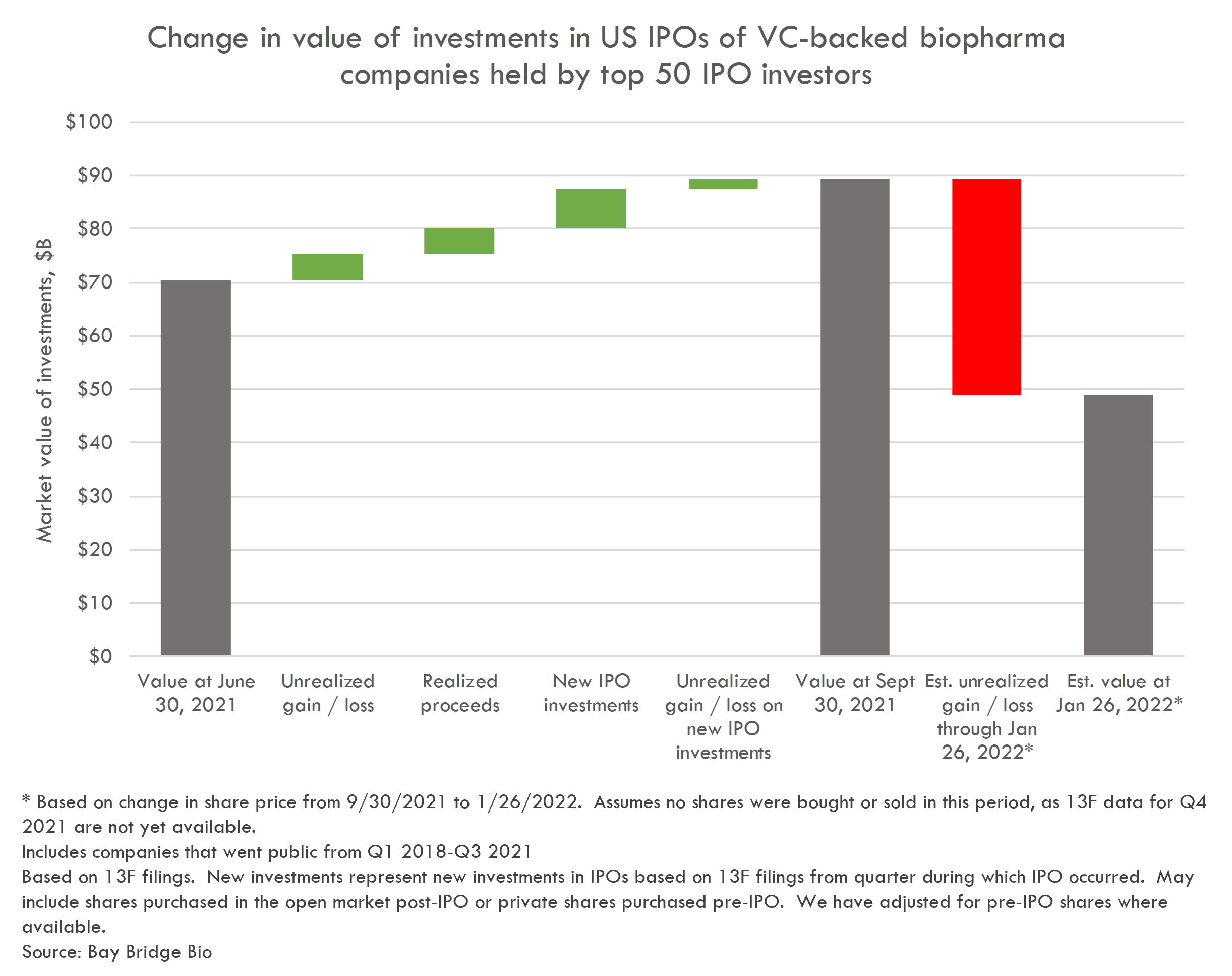

The below chart shows the change in value of investments in recent biopharma IPOs from June 30, 2021 to January 26, 2022. This is calculated based on 13F filings of the top 50 investors in US VC-backed biopharma IPOs. We include the shares held in VC-backed biopharma companies that went public from Q1 2018-Q3 2022.

Q3 was not a bad quarter for these investments, with a return of 14% including realized and unrealized gains on investments in IPOs pre-Q3 (the XBI was down 7% during this period). Additionally, new IPO investments made in Q3 returned 23%.

However, Q4 2021 and the start of 2022 has been bad for these investments, which are down an estimated -45% compared to a return of -29% the same period for the XBI. This -45% likely represents a lower bound to the returns, however, as this assumes that no shares were bought or sold during Q4 (we don't yet have data on shares bought or sold during this period for all investors).

Benchmark VC performance

Deal-level cash-on-cash returns, proceeds from exits, check sizes, and more for thousands of biopharma investors covering $80B+ in global venture investment.

Where is the bottom?

What does this mean for the IPO market? Historically, biotech IPO investors decrease their investment activity during downturns, so we can expect a decline in the IPO market as these investors rotate capital away from high-risk biotech IPOs into other asset classes. During other recent downturns of the last 10 years, IPO volume decreased to 2-4 IPOs per month.

However, during the financial crisis of 2007-2008, there were no biopharma IPOs for nearly two years (and the first IPO, Cumberland Pharma, was not a startup but a spec pharma company with marketed products). It is impossible to predict where the bottom is, but the worst-case scenario is pretty bleak. But if the market picks back up (as it did at the end of this week due to strong earnings from Apple), biotech IPOs could pick back up in a few months (though not likely near the level we saw in 2021).