Top investment banks for biotech IPOs

by Richard Murphey

The biotech IPO market has been very active since 2013. In the last 18 months, there have been 68 major VC-backed biopharma IPOs (which I define as IPOs with proceeds of over $50M), which is 25% of all US IPOs.

These IPOs have generated $547M in fees for banks in the last 18 months. The average IPO generated $8M in fees.

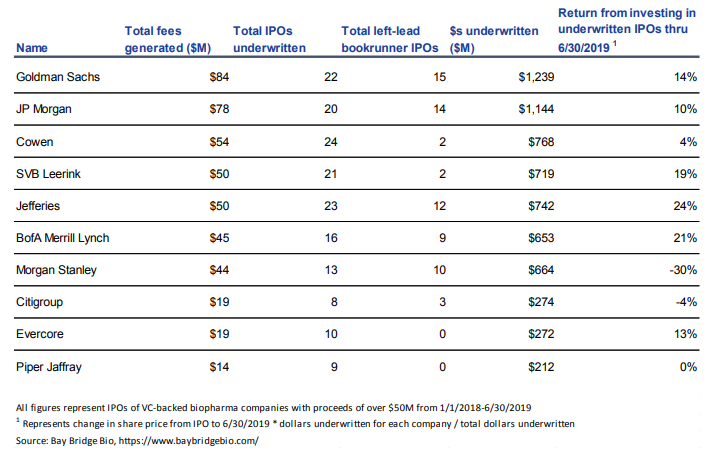

The leading banks by total fees from VC-backed biopharma IPOs of over $50M in proceeds in FY 2018 and 1H 2019 are:

It isn't surprising that Goldman Sachs and JP Morgan, two of the top investment banks in the world, are at the top of the list for biotech. They lead in both total fees and number of deals led.

Cowen and SVB Leerink take the third and fourth spots. Cowen is a boutique bank that is very strong in healthcare, particularly life sciences, and SVB Leerink is focused specifically on healthcare and life sciences. Both groups have top-tier equity research groups in life sciences (Leerink was originally founded as a sell-side research group). Cowen and SVB Leerink rarely take lead bookrunner roles.

In fifth place is Jefferies. Jefferies leads the third-most deals after GS and JPM, and has been involved in the second most IPOs after Cowen. BofA Merrill Lynch has a similar profile to Jefferies but is just behind in terms of lead bookrunner roles, total IPOs, fees and performance of IPOs.

Defensible clinical trial cost estimates

Get transparent cost estimates for any trial in minutes. Input an NCT ID or upload a protocol, then see a full cost analysis report.

Morgan Stanley is something of an outlier and appears to be the most "company-friendly" biotech investment bank for IPOs. They have the highest ratio of deals led to deals they've been involved in, but they generated almost 50% fewer fees than GS and JPM. Their IPOs also performed significantly worse, returning an aggregate -30% on a dollar-weighted basis. Of the 13 major VC-backed biopharma IPOs that MS underwrote in 2018 and 1H 2019, only one, Kodiak Sciences (which priced below the expected range), was up through 6/30/2019.

Companies that select Morgan Stanley as left-lead bookrunner leave less money on the table during their IPO. Theoretically, these companies would have a stronger negotiating position with investors to command a higher valuation. Notably, Morgan Stanley was left-lead for Moderna's IPO.

As an interesting side note, SVB Leerink became so named after Leerink Partners was acquired in November 2018 by Silicon Valley Bank, a corporate bank focused on lending to startups with a large life sciences practice. SVB paid $280M upfront with a retention pool of $60M to be paid to employees over 5 years. Leerink has additional lines of business than IPO underwriting, but I'd imagine most of their revenue comes from underwriting equity raises (they have a small M&A practice). If Leerink did $50M in IPO underwriting fees in FY 2018-1H 2019, we can assume an annual run-rate of $33M in IPO fee revenue, then maybe round up to $40-50M for advisory and follow-on equity underwriting, and you get a 7-8.5x LTM revenue multiple.

You may also like...

Valuations of biotech startups from Series A to IPO

Venture returns from biopharma IPOs, 2018-Q1 2019

List of recently funded biotech startups

Bay Bridge Bio Startup Database

Biopharma VC Basics 2: How do VCs work?

The world's most expensive drug? A case study of Zolgensma

Did you enjoy this article?

Then consider joining our mailing list. I periodically publish data-driven articles on the biotech startup and VC world.