Biotech's "dark ages" made investors risk-averse, and experienced CEOs reduced execution risk

Richard Murphey, 4/18/2019

“Probably only at the very beginning of an industry do you have the kind of work that some of us did at Genentech early on.... The entire industry is at a different stage now. It's more mature.... You don't get these breakthroughs by one or two people working 120 hours a week. A whole team has to be integrated and working well together….

In the early days at Genentech one or two or three people could do the major amount of work to take an idea to the compound that was a drug.”

- David Goeddel, 2001, as interviewed by Sally Smith Hughes 1

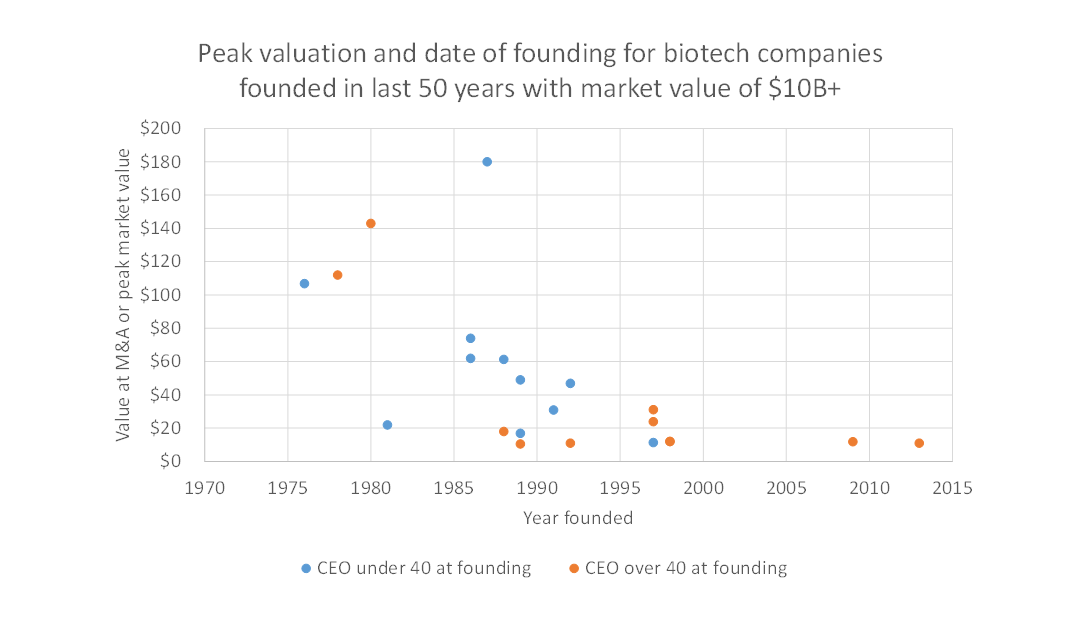

A previous post showed that, historically, young CEOs are capable of building very successful biotech 2 companies. If that’s the case, why do so few young biotech CEOs get funded today?

There are many valid reasons for preferring experienced CEOs: they are used to the level of rigor of industrial science, have experience managing drug discovery programs, understand the drug discovery and development process, have extensive networks, have experience with FDA, and have a nose for commercially viable science.

There are also many valid reasons for preferring younger CEOs: they are closer to the latest science and technology, they are less constrained by conventional ways of thinking, and they bring fresh perspectives, optimism and ambition.

Some companies, like asset-centric virtual startups, are probably best run by experienced CEOs. But young, technical CEOs are probably well suited to build the next gene editing or synthetic biology platform.

Both experienced and inexperienced entrepreneurs have strengths and weaknesses. But the industry today seems to disproportionately emphasize the virtues of experience and undervalue the virtues of youth. The industry is structured to turbocharge the strengths of experienced entrepreneurs and build support systems to complement their weaknesses. But there don't seem to be as many groups that put young technical founders front-and-center, and build support systems to compensate for their lack of experience and networks.

Why is this? I hypothesize that the industry’s current preference for experienced CEOs is a rational response to the “dark ages” of the late 1990s and 2000s, one of the most challenging environments ever for biotech VC and pharma R&D (the industry seems to have emerged from this period, and that's the topic of the next post):

- Eroom's Law put the cost of developing a drug out of reach of cash-strapped startups.

- A conservative FDA was approving fewer new drugs, and big companies were better able to absorb regulatory risk than were startups.

- The breakthrough technologies of the turn of the century – gene and cell therapy 1.0, antisense therapy, the sequencing of the human genome – that could have fueled the next wave of startups proved to be more hype than reality 3.

- The exit environment was challenging, so it was hard for biotech venture investors to make money.

- The "low-hanging fruit" of drug discovery was picked, and as discovery projects became more complex, skilled managers increased in importance relative to highly productive individual contributors.

- Investors became more risk-averse in response to these challenges. Investors reduced “management risk” by not funding young CEOs.

Another unfortunate side effect of this challenging time was that an entire generation of would-be entrepreneurs, investors and industry scientists never got training in industrial biotech or exposure to how science-based companies were built. Pharma was cutting R&D, biotech companies weren’t taking big science risk, and investors were abandoning biotech. This depleted the stock of promising young scientists with industry training -- the exact kind of person you'd hope to fund as an entrepreneur.

Biotech's "dark age"

The period from the late 1970s to early 1990s was a boom time for biotech startups, with startups like Genentech, Amgen and Biogen using recombinant DNA technology to create a whole new class of medicines. These startups, initially viewed as crazy by established pharma companies, ultimately reshaped the industry. This “golden age of molecular biology” peaked in the 1980s and saw the creation of many large and lasting companies.

The period from 1995 to today was a different story. Only six $10B+ biotherapeutics companies have been started since 1995 (Actelion, BioMarin, Pharmasset, Seattle Genetics, Kite and Juno), and only two have been started since 2000 (Kite and Juno). Of course, it takes time for these companies to grow to such valuations, so there are probably some companies founded recently that will get to that level in time (Alnylam is nearly at a $10B market cap and was founded in 2002; John Maragone, the first CEO, was 38 at the time). But compared to the 1970s and 1980s, the 1990s and 2000s were a challenging time for ambitious biotech startups and their investors.

Why was this period so challenging?

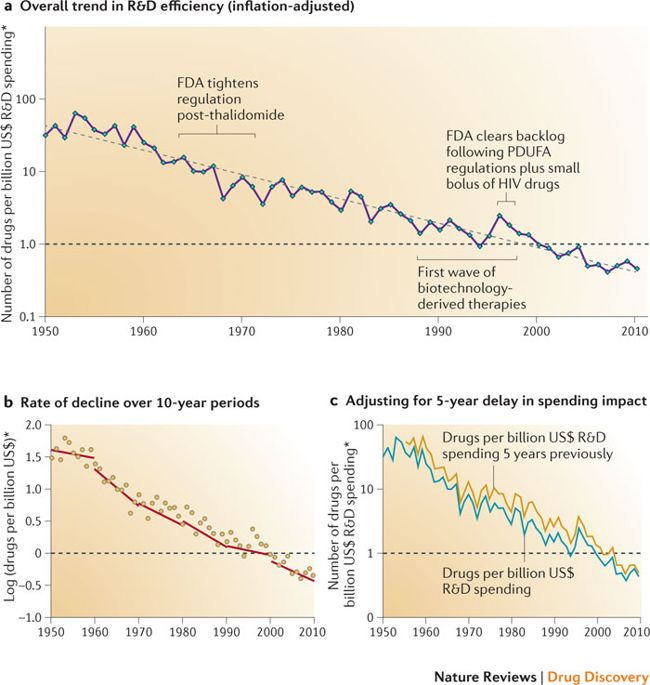

Declining R&D productivity and "Eroom's Law"

A major driver of the struggles of biotech and pharma was, and continues to be, ever-decreasing returns to R&D investment. The number of approved drugs per dollar of R&D spent is on a steady, long-term decline (chart from Scannell et al, Nature Reviews Drug Discovery 2012):

This phenomenon is “Eroom’s Law” (“Moore’s Law” backwards): the cost of developing a drug increases exponentially over time, despite dramatic improvements in efficiency at various steps of the drug development process (some of these efficiency gains approximating Moore’s Law) 4.

This drop in R&D productivity, combined with the “patent cliff” where a huge wave of blockbuster drugs all lost patent protection within a few years, led to the first ever year of declining US revenue for the pharma industry in 2012. Pharma companies responded to these challenges with massive layoffs: some estimated that 150,000 pharma employees were laid off from 2009-2012. These layoffs, combined with a general investor retreat from biotech, made it very difficult for young scientists to get training in the business of building and investing in science-driven companies.

The point of all this is that by the 2000s, drug development had become more expensive than the industry had anticipated, and you couldn’t take a drug from bench to bedside on a startup or academic budget. So startups focused on less expensive, later-stage projects, like reformulations / repurposing, orphan drugs, or lower-risk development plans. These were not the kinds of projects that would become $10B+ companies.

A corollary to this is that as the low-hanging fruit was picked, companies had to work harder for new drugs (as mentioned in the opening quote of this paper). In the early days of biotech, a few smart, dedicated scientists could make a drug. Genentech's first products were recombinant versions of proteins that were already known to be therapeutic, and that were relatively simple to clone. After that, they had to tackle targets with less well-understood biology, or create drugs with more complex structures. As complexity grew, research teams grew in size, and the importance of experienced managers increased in relation to highly productive individual contributors.

Around the turn of the century, new technologies like antisense therapy, gene therapy, cell therapy and genomic medicine promised to create new therapeutic white space that nimble startups were well-suited to explore. Unfortunately, these technologies did not prove ready for prime time. The first gene therapies, engineered cell therapies and antisense therapies were approved by FDA just in the last few years, despite significant hype around these technologies as far back as the 1990s.

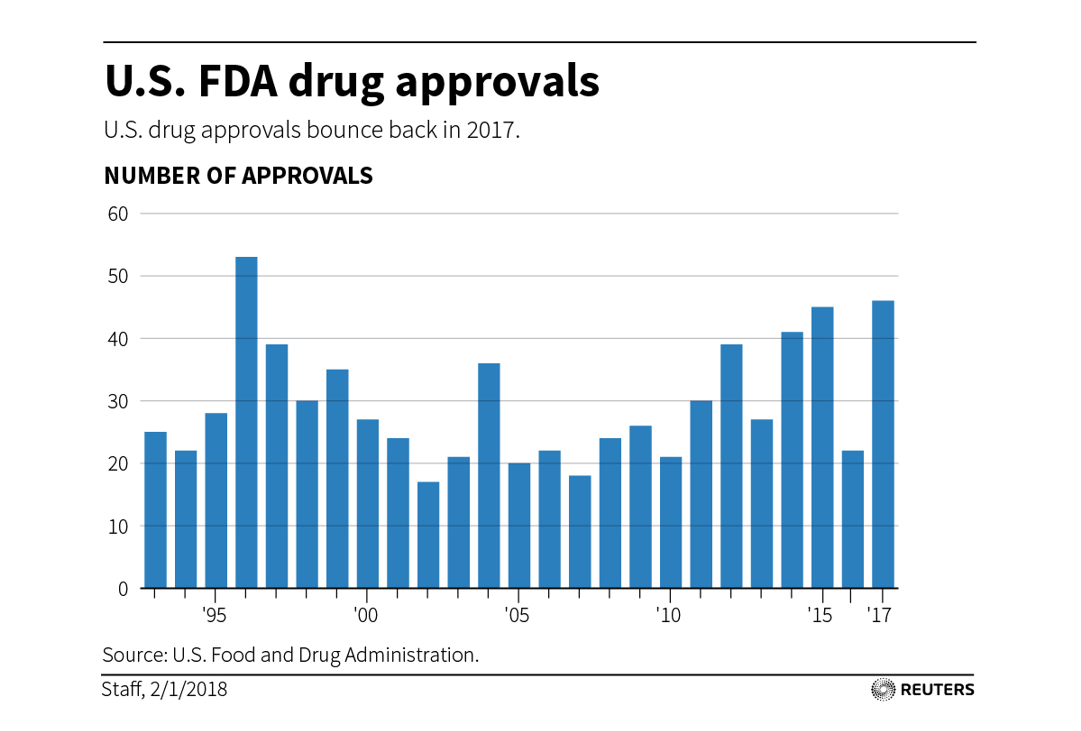

Fewer FDA Approvals

Simultaneously, FDA was approving fewer new drugs (chart from Reuters).

During the 2000s, FDA was approving roughly half the number of drugs per year as it has been since ~2012. While FDA issues certainly affected big pharma as well as startups, an FDA delay could easily kill a startup, while big companies could generally absorb the blow.

Part of this may have been a function of declining R&D productivity (ie pharma was not submitting as many quality drugs for approval, so fewer would be approved; I don’t have data on FDA approval rates going back decades), but FDA anecdotally seemed more conservative during the 2000s than today (understandably, given things like Vioxx’s undisclosed cardiovascular risks and patient deaths).

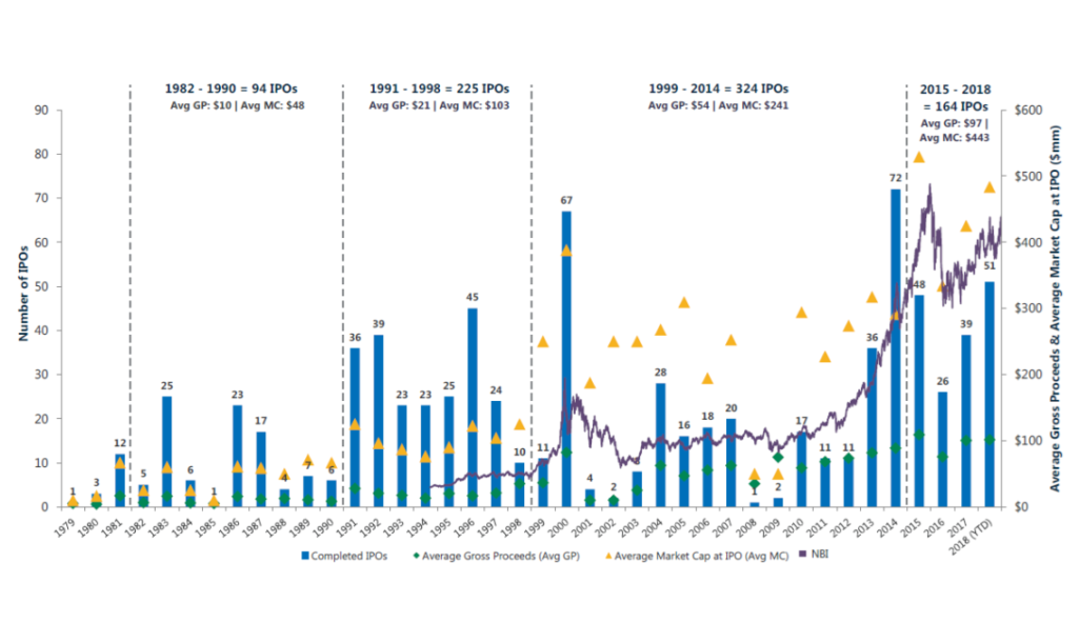

Challenging exit environment compressing VC returns

The 2000s was also a tough decade for IPOs and M&A. In order for investors and entrepreneurs to make money, startups need to “exit”: typically by either selling the startup to a bigger company, or “going public” through an IPO, allowing them to sell stock to the public. If the IPO and M&A markets are not accommodating, it can be very hard for investors to make money.

Biotech IPOs per year (from MTS Partners)

After a booming period from 1991-2000 that saw an average of 30 biotech IPOs a year (including the outlier year 2000), the decade from 2001-2010 saw IPOs fall to a third of that level 5. For most of the 2000s, an IPO was not a realistic possibility for most companies.

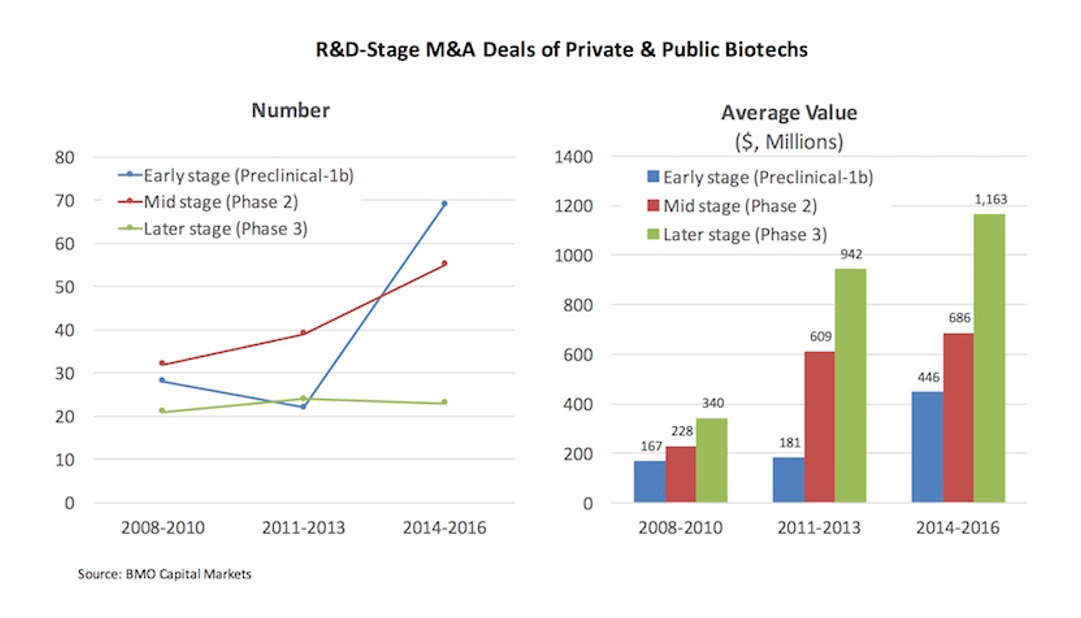

Pharma M&A activity was healthier than the IPO market in the 2000s-2010s, but compared to today, valuations were lower, and pharma typically only spent big money on late stage assets (chart from Bruce Booth / LifeSciVC blog).

In an environment where the average M&A value for a Phase 3 company was only $340M, and the average cost to develop a drug was $1B+, it was challenging to make the math work for investing in biotech startups. A lot of hybrid tech / biotech funds decided to focus on software. A lot of biotech funds went out of business. Many of the investors who remained chose to invest in later-stage companies, where much of the risk had been taken out, and where a venture budget could fund a pivotal study or FDA approval, which could catalyze an acquisition.

Making early-stage biotech VC work

But a few early-stage biotech VCs stuck around despite the tough environment.

These investors were held to the same return thresholds as their tech counterparts. But in tech, you could invest in companies like Facebook and Google that grew so big that investors could get 100x (or even 1,000x) their money. And if you weren’t one of the lucky investors in FAANG startups, there were plenty of “unicorn” $1B+ companies that could generate 20-30x returns. If a tech venture fund got one or two such big exits, the rest of their investments could go to zero, and the fund would still be successful.

But in biotech, you couldn’t rely on one or two big exits to “return the fund”. Your best case was more like a 5-10x on your investment, and a 3-5x was a good outcome. To get a 3x return on your fund (which is generally what venture funds try to achieve) in a world where a good exit is a 3-5x, and maybe one company a year gets a 10x, you couldn’t afford many losing investments. And to squeeze 5-10x returns out of a $300-500M exit, you needed to get to exit on a fairly small amount of capital, and you needed to own a lot of the company at exit.

So surviving as an early-stage biotech VC in the 2000s was all about consistent singles and doubles. VCs developed a playbook for getting these singles and doubles 6:

- Increase probability of success

- Front-load key risks

- In-house company creation: aligns company and investors around truth-seeking and killing things early

- Assess robustness of science and test key hypotheses with seed funding before raising a big Series A

- Minimize translational risk: validated targets, well-understood biology, strong translational science, well-defined, homogenous patient populations

- Reduce cost of clinical proof of concept: orphan drugs, severe unmet needs that allow flexible study design / accelerated approval, homogenous genetically defined patient populations, validated biomarker and other surrogate endpoints

- Extensive technical diligence, including in some cases independent reproduction of academic data

- Minimize commercial risk

- Focus on severe unmet need and large potential clinical benefit

- Partner with potential buyers early on: “build to buy”

- Own more at exit

- Start companies in house to control valuation

- Front-load value creation

- Non-dilutive corporate partnerships

- Fund capital-efficient development plans: orphan drugs, cancer with accelerated approval, indications with high unmet need

- Asset-centric rather than platform companies

- Virtual companies with outsourced R&D

- Experienced managers to minimize operational risk and manage large, cross-disciplinary teams

Many of these startups were not meant to become big, lasting companies, but were essentially vehicles for taking on a few key risks that pharma wasn’t comfortable with and then selling to big pharma once the major risks were taken out. Since many of these startups felt like big pharma carveouts, it made sense for ex-big pharma people to run them.

However, even during this challenging time, there were a handful of funds that focused on ambitious science platforms. Interestingly, most of these funds were run by people who built the last wave of big companies 7. These investors had seen “unicorns” with their own eyes, so perhaps that is why they stayed committed to ambitious early-stage science when the rest of the world thought it was crazy.

Emerging from the "dark ages"

The business model innovations pioneered by these "survivor" VCs have been incredibly effective at increasing R&D productivity. The early-stage VCs who employed these tactics were leaders in creating new medicines for the world at a time when big pharma was retreating from R&D and federal funding for research was declining.

This playbook has been getting amazing results. Today, startups develop more drugs than big pharma. We are seeing big $1B+ (and even $10B+) biotech companies get built again, focused on breakthrough science and transformational medicines. Startups are developing drugs that turn cancer into a chronic illness rather than death sentence and cure fatal genetic disease.

The biotech startup world has changed. And this new world can support a new kind of founder. More on this in the next post.

Sign up to stay updated on future posts

1 David V. Goeddel, Ph.D., "Scientist at Genentech, CEO at Tularik," an oral history conducted in 2001 and 2002 by Sally Smith Hughes for the Oral History Center, The Bancroft Library, University of California, Berkeley, 2003. Accessible at http://www.lib.berkeley.edu/libraries/bancroft-library/oral-history-center. Quoted with permission according to "fair use" standard: http://www.lib.berkeley.edu/libraries/bancroft-library/oral-history-center/rights

2 In this post, as in others, by “biotech” I mean companies developing innovative FDA-regulated medicines. This excludes diagnostics, tools and instruments, medical devices, generics companies, and service providers / contract research and development groups that don’t “own” the drugs they work on.

3 Interestingly, these same technologies have matured over the years and are now supporting the next wave of “decacorns”.

4 I think this point is underappreciated: there have been huge improvements in efficiency at various parts of the drug development process, and many of these improvements approximate Moore’s Law. Despite this, the cost of developing drugs has increased exponentially. One potential explanation for this is that the difficulty of understanding human biology is the “bottleneck” that drives the high failure rate and high cost of R&D. Thus improvements in our understanding of biology, or improvements in our ability to drug well understood biology, may do more to improve R&D productivity than technical efficiency gains.

5 IPOs have since recovered, with the period from 2013-today being the best in history.

6 This information comes from several sources: blogs (Bruce Booth and Michael Gilman's in particular), VC panel discussions, my conversations with VCs, and my experience as a biotech VC. I've collected many of these sources here. It's not a definitive list and just represents some common things VCs look for.

7 David Goeddel at The Column Group was the first and most influential scientist hired at Genentech, Mark Levin and Kevin Starr at Third Rock were formerly CEO and COO / CFO of Millennium (which sold for $8.8B) and early employees at Genentech / Biogen respectively, and Bob Nelson at ARCH was an early investor in Illumina. Flagship and Polaris don’t quite fit this pattern though they have been and continue to be influential and ambitious company builders.