Big investors slashing exposure to early-stage biotech

February 28, 2022

COVID saw the biggest IPO boom in biotech history. But the investors who funded that boom have slashed the amount of capital they allocate to the riskiest biotech stocks, calling into question the "IPO trade" that saw preclinical companies going public at $1B+ valuations 2-3 years after launch.

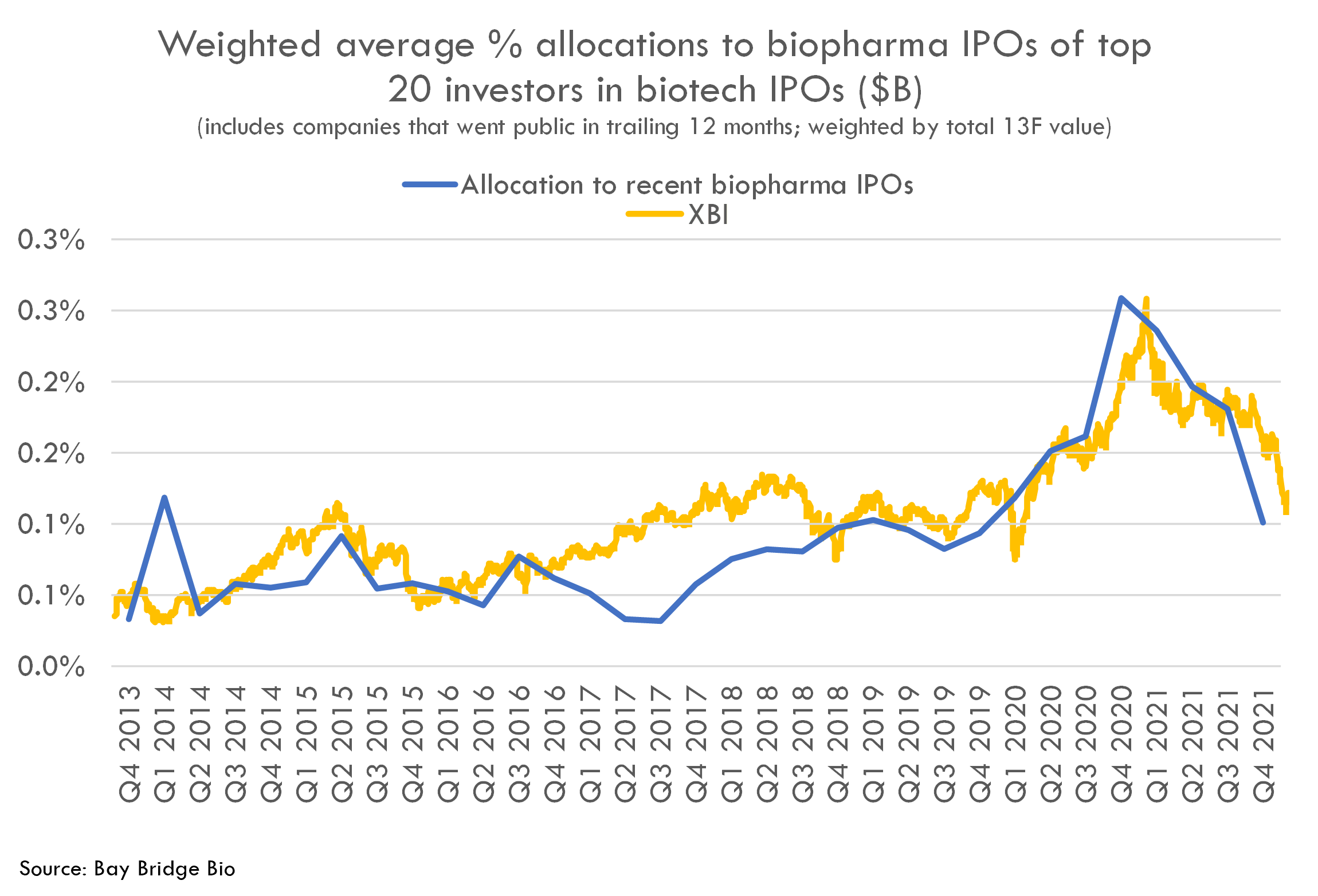

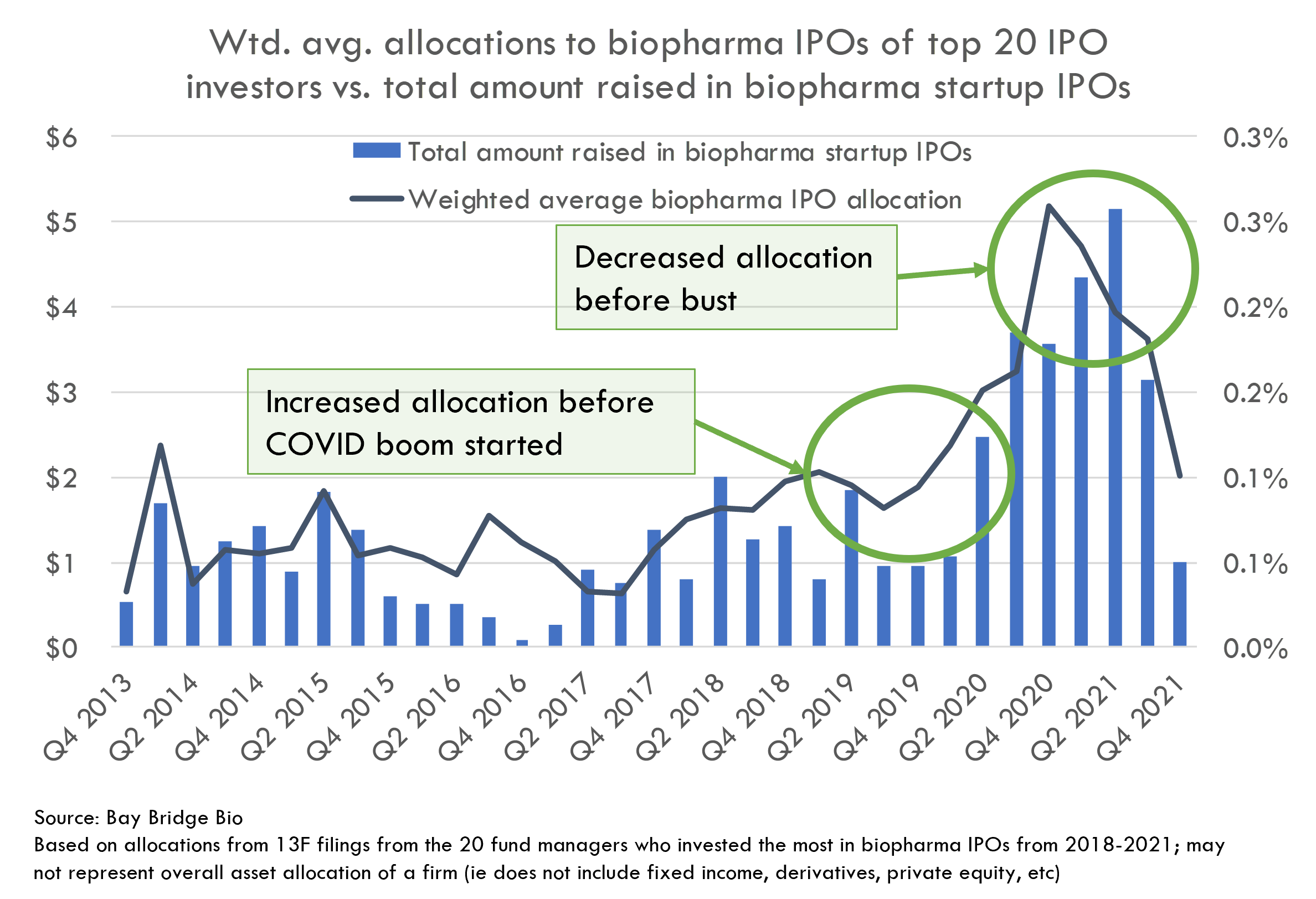

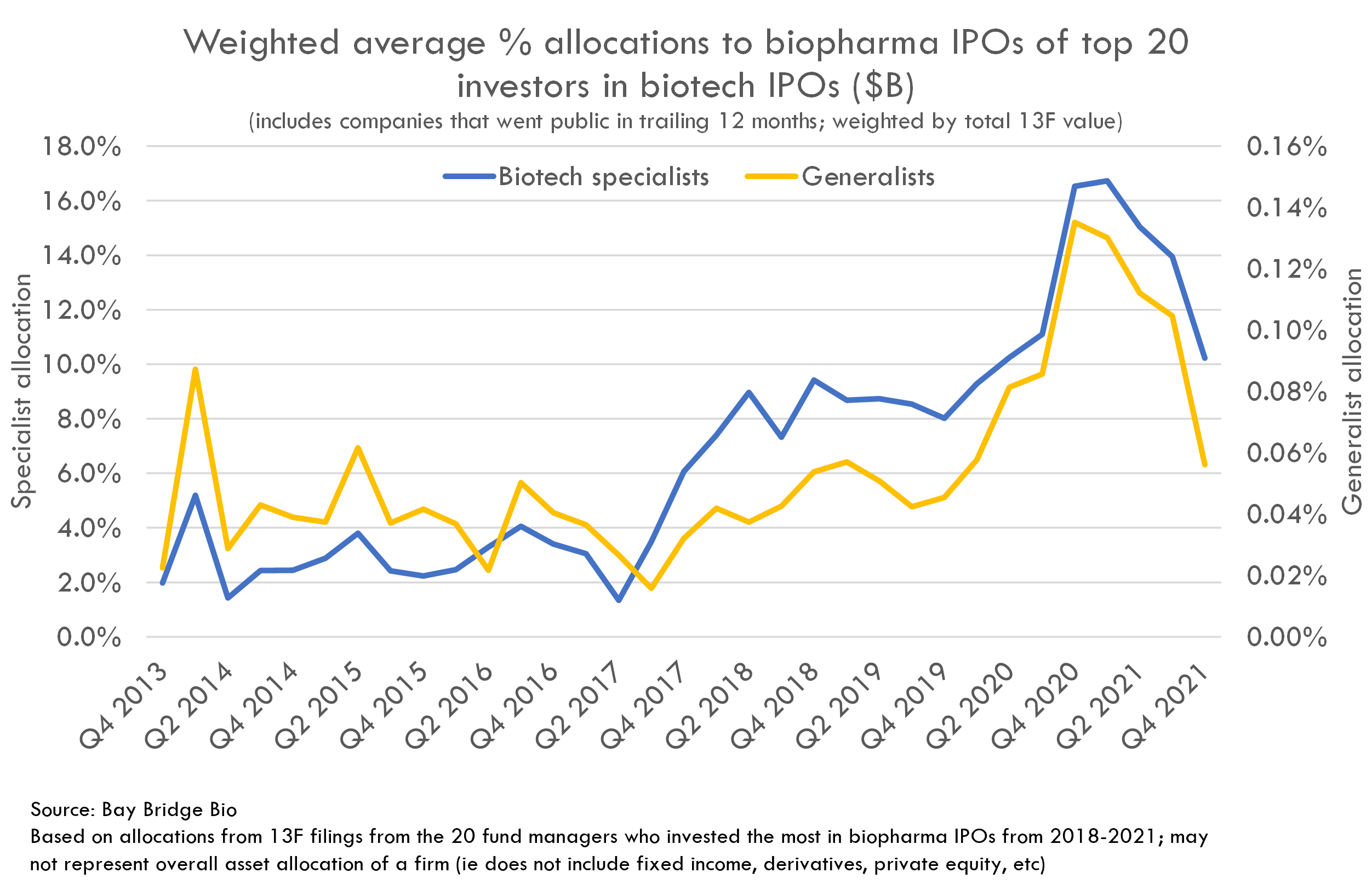

We analyzed the 13F filings of the top 20 most active investors in biopharma IPOs from 2018-2021. These funds have slashed their allocations to early-stage biopharma (biopharma companies that went public in the year prior to the 13F) on both a percentage and absolute basis.

These investors, who collectively manage trillions of dollars, increased their exposure to biopharma IPOs before the COVID IPO boom started, and decreased their exposure before the peak. They tripled their allocations to recent biopharma IPOs from Q4 2019 (the quarter before COVID) to their peak allocation in Q4 2020. Over the next year, they cut their allocations back to pre-COVID levels.

As the XBI has declined a further 20%+ since then, it is likely that these investors have further decreased their IPO allocations to levels not seen since at least 2018 (when the recent IPO boom picked up steam).

Low-risk biotech is in, high-risk is out

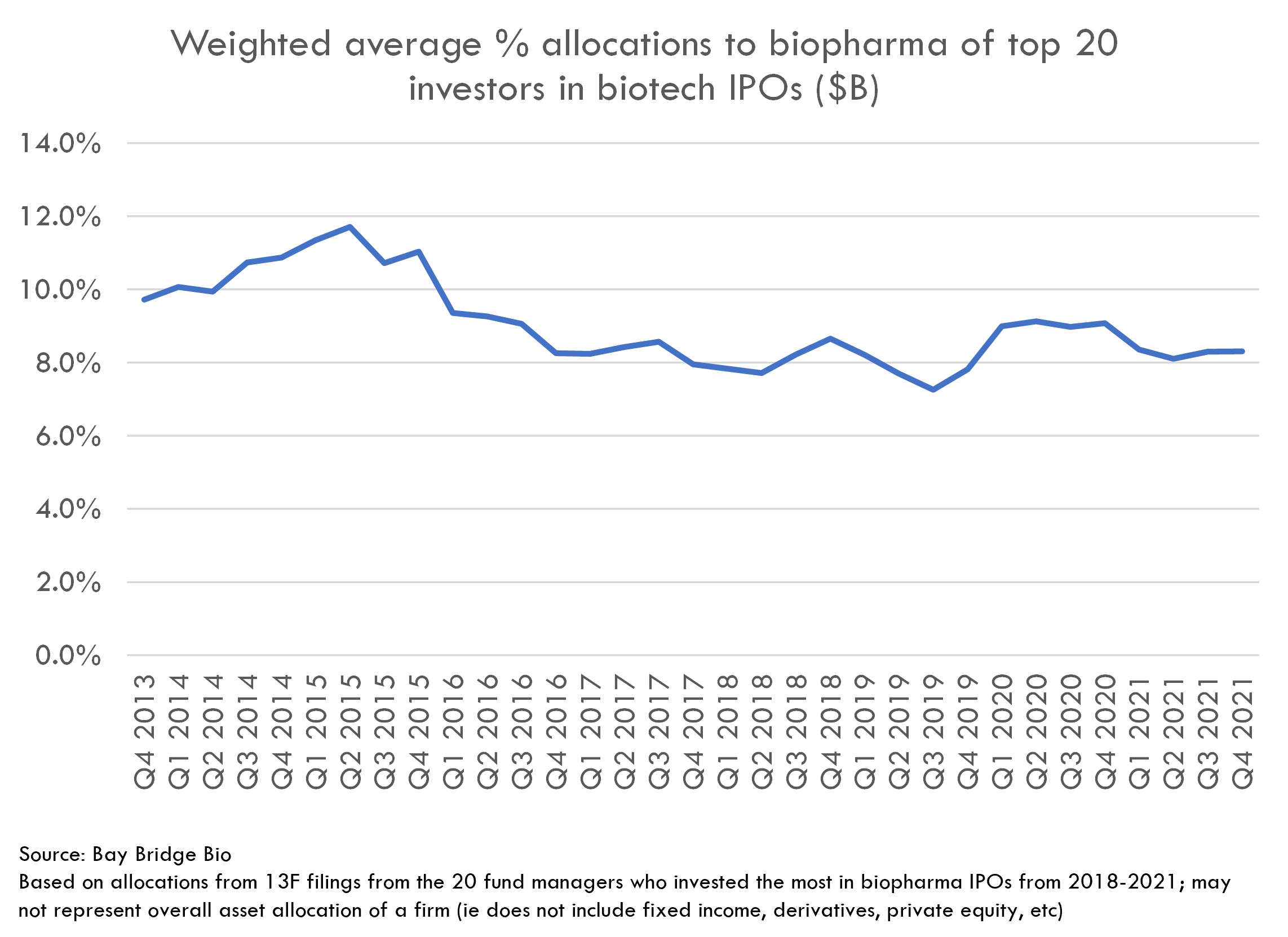

These investors still like biopharma as a sector -- just not the riskiest companies. These investors have modestly decreased their allocations to biopharma as a whole (as opposed to just recent biopharma IPOs) after a slight increase during COVID. These funds have steadily reduced their exposure to biopharma after a peak in 2015, although as we saw in a previous chart, they have changed their risk tolerance within biopharma (increasing risky IPOs as a percentage of their total biopharma investments).

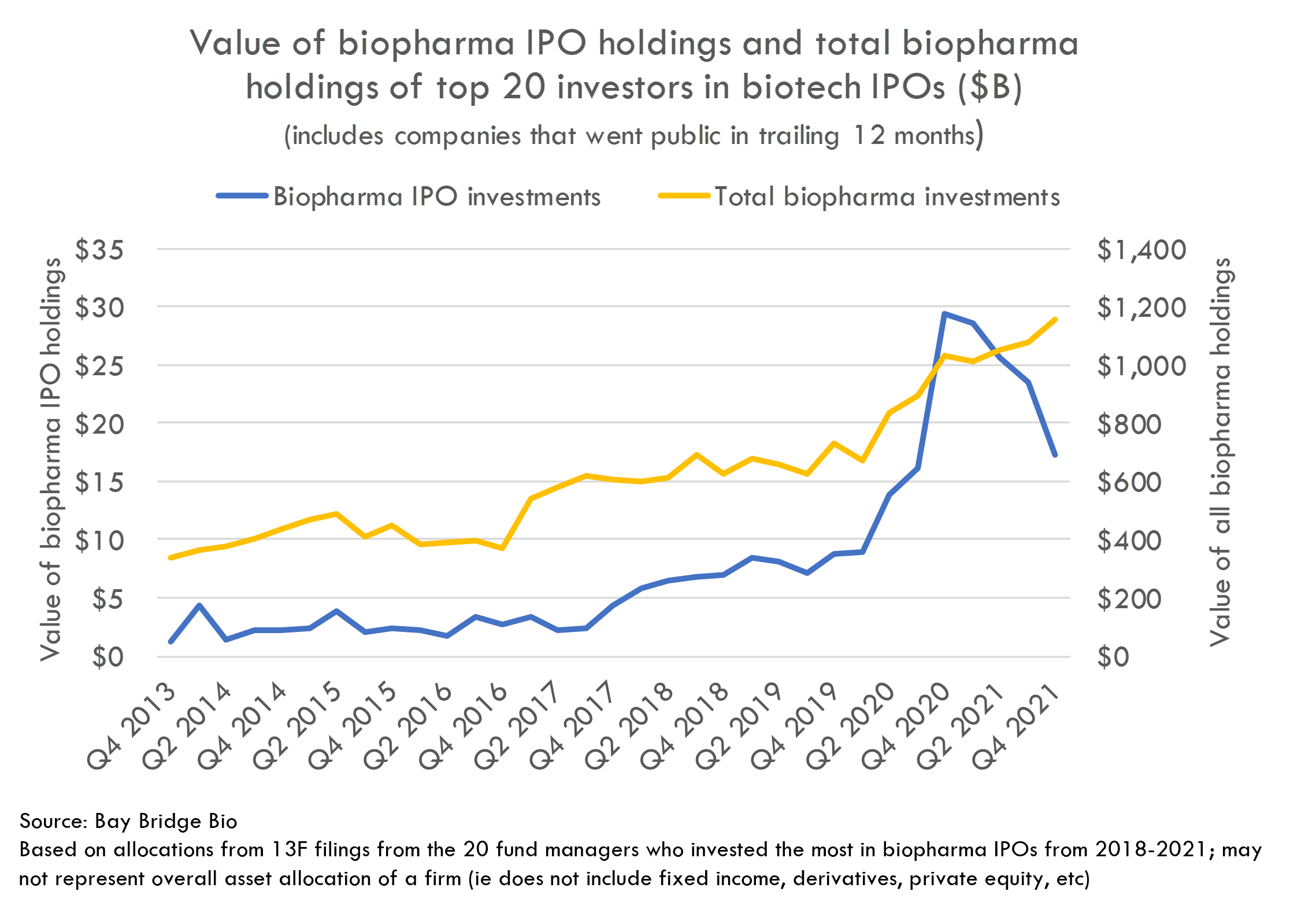

So high-risk biopharma allocations are down on a percentage basis. What about in absolute dollars?

Notably, the value of total biopharma investments held by these funds has increased despite lower allocations, as the overall rise in asset values has offset a decrease in allocation. However, total value of biopharma IPO investments has decreased.

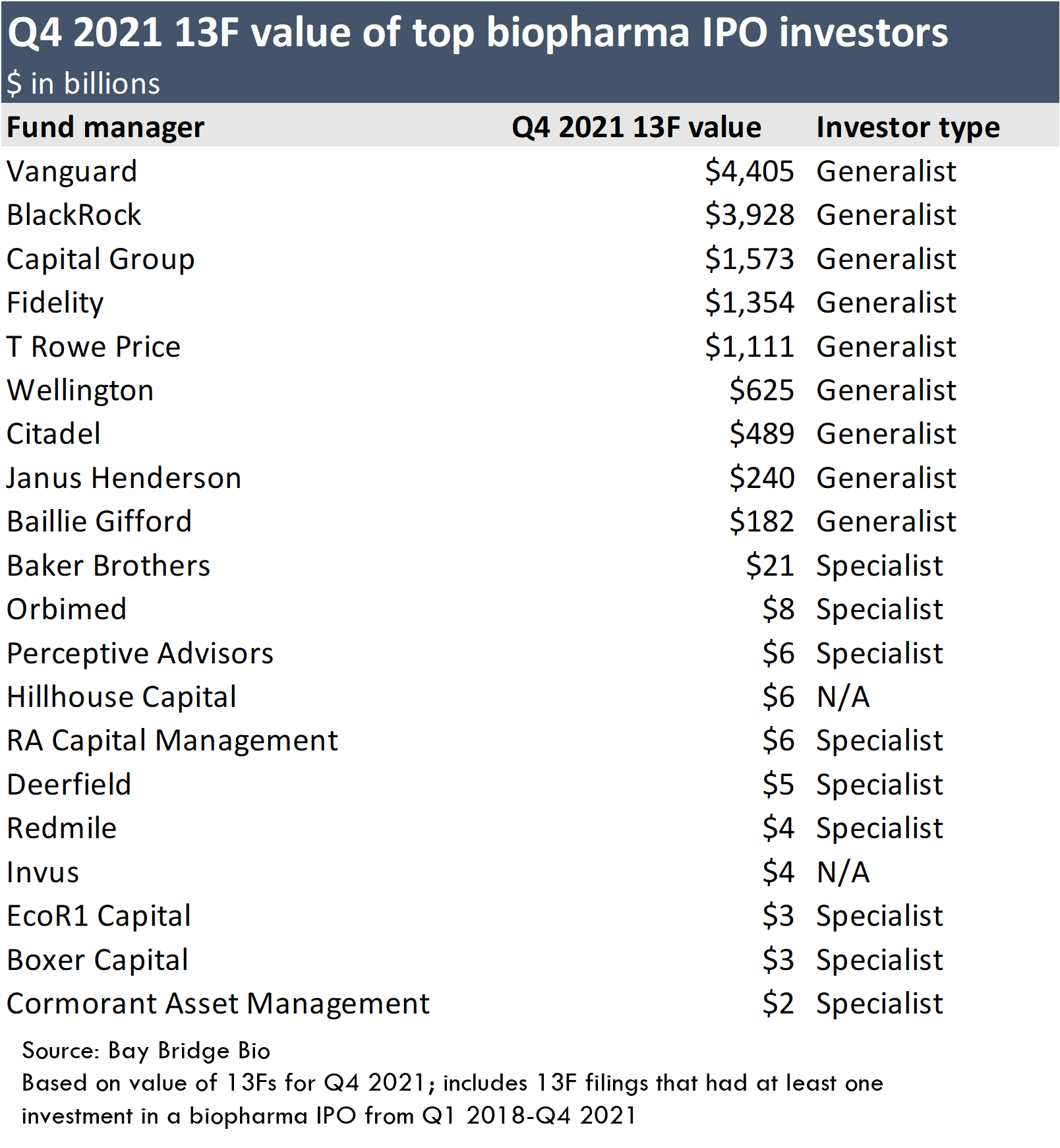

Who are these investors?

These investors generally fall into two categories: specialist biotech investors and generalist mega-investors. The generalist investors are huge fund managers that invest across sectors and asset classes, and include biopharma investments as part of their overall investment strategy. These investors manage trillions of dollars, so biopharma IPO investments barely represent a drop in the bucket for them. Thus small changes in their commitments to risky biopharma IPOs can drastically change the IPO market.

How have these generalist investors changed their allocations to biopharma IPOs over time?

Both generalist and specialist investors have cut their exposure to biopharma IPOs, though generalists cut earlier and more drastically. Specialist investors gradually been decreasing their exposure to biopharma as a whole since 2015, allocating more to med tech, diagnostics, health tech, agtech and other life science and healthcare sectors.

Not all specialists have decreased their exposure so drastically. The allocation figure above is weighted by total 13F asset value, so specialist funds with higher 13F AUM (like Baker Brothers) will impact the metric more.

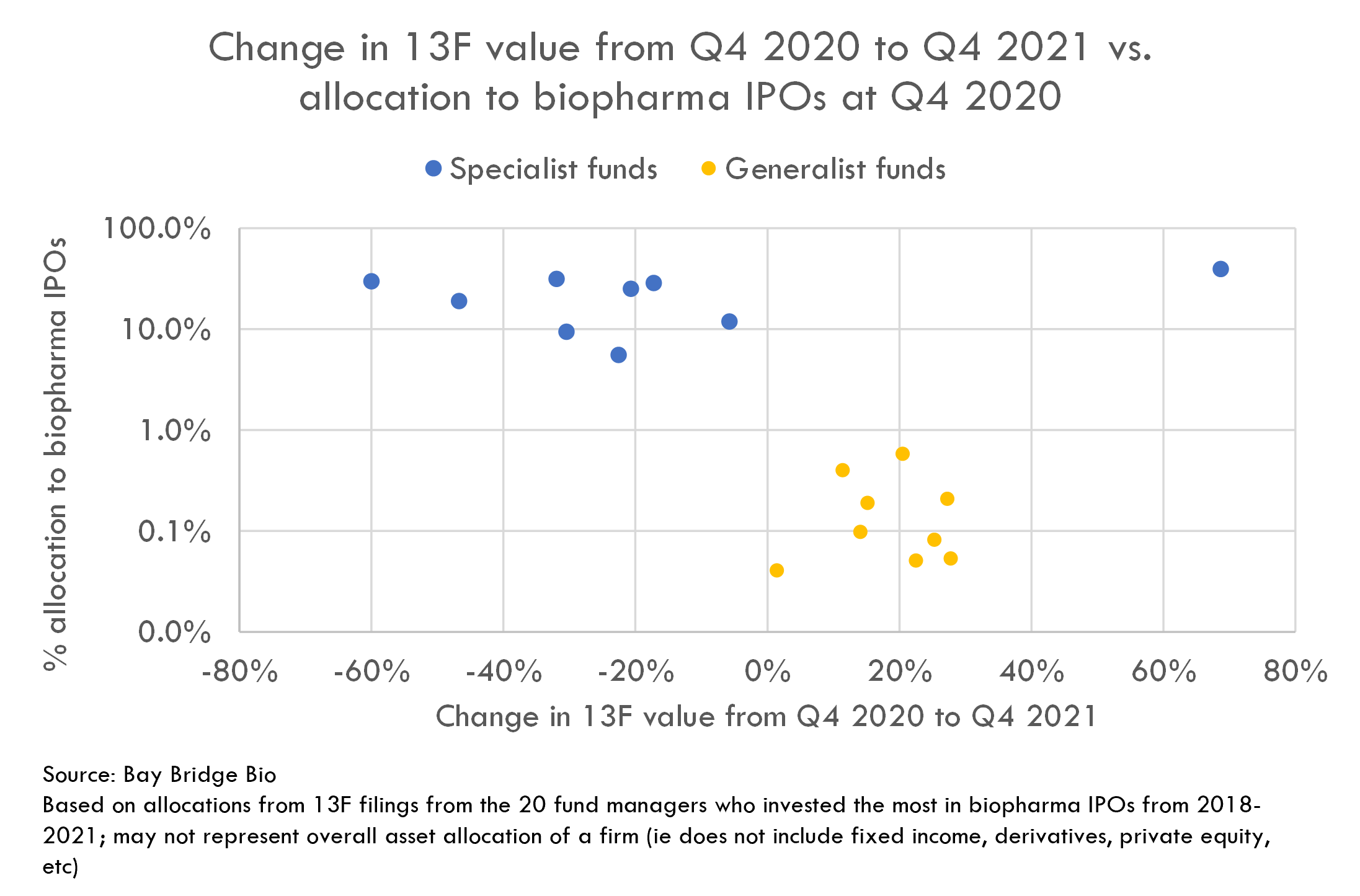

How did exposure to biopharma IPOs impact fund performance during 2021?

One of the benefits of being a generalist fund is that you can diversify. Because the broader stock market has performed well while biotech stocks have dropped, these generalist investors have increased the value of assets reported in their 13Fs by around 20% during 2021. The NASDAQ index was up 21% during 2021 and the S&P 500 was up 27%, while the XBI biotech index was down 20%.

While generalist funds have held up well over the last year, biotech specialist funds have suffered. Some biotech specialist funds lost nearly half of their 13F value in 2021, with further declines in 2022 YTD (the XBI is down 22% in 2022 through March 1).

This illustrates one of the existential challenges of biotech investment firms: they live and die by the biotech market cycle. Without the ability to diversify, and with a limited ability to execute market-neutral strategies due to high volatility and low liquidity of many biotech stocks, it is challenging for biotech specialist funds to manage the downside of the cycle. Funds that are more flexible in their strategies have an advantage, as they can shift capital to more promising sectors of the market: for example, to company creation and early-stage VC when markets are booming, or to PIPEs when public markets are struggling.

IPO market outlook

The IPO market in 2022 will almost certainly be down from record 2021 levels. But how far will it drop?

The 2022 biopharma IPO market started strong: there were 4 biopharma startup IPOs early in the year. In 2020, there were only 6 biopharma startup IPOs in Q1 (although this quarter included initial market disruption from COVID). In Q1 2019, there were 6 biopharma startup IPOs, and there were 7 in Q1 2018. With a month left in Q1 2022, we are not too far off from the number of IPOs seen in 2018-2020.

However, most of the 2022 IPOs came in January. Since January, the XBI has continued to decline amid the prospect of interest rate increases, and the invasion of Ukraine has brought the overall IPO market to a standstill, with the IPO market heading for its worst period since the financial crisis.

It is possible that 2022 could see fewer biopharma IPOs than 2019, which would represent a 70%+ decline from 2021 levels. The "IPO machine" relies on mega-investors like Fidelity and BlackRock to survive, and it looks like these funds have soured on biopharma IPOs. With a European war, the prospect of rising rates, and a biopharma market that is still quite speculative compared to historical levels, it is unclear what could rejuvenate the IPO market back to 2021 levels other than the Fed coming to the rescue or a flurry of M&A.

The good news is that venture funds have plenty of capital. A significant drop in the IPO market could leave $10B+ of slack in the market, and VCs could have to direct a lot of their dry powder to plugging this gap. While many private companies are still raising big rounds at healthy valuations, it wouldn't hurt for private biopharma companies to monitor their burn and prepare for the possibility of more challenging funding markets ahead.

Benchmark VC performance

Deal-level cash-on-cash returns, proceeds from exits, check sizes, and more for thousands of biopharma investors covering $80B+ in global venture investment.